The ALD Partnership shows the following profit and loss ratios and capital balances: Aquino (60%) P252,000; Locsin (30%) P126,000; Dizon (10%) P42,000. The partners decide to sell to Hizon 20 percent of their respective capital and profit and loss interests for a total payment of P90,000. Hizon will pay the money directly to the other par ers. What are the capital balances of the partners after Hizon's admission to the partnership? * Aquino P198,000; Locsin P99,000; Dizon P33,000; Hizon P90,000 Aquino P201,600; Locsin P100,800; Dizon P33,600; Hizon P84,000 Aquino P216,000; Locsin P108,000; Dizon P36,000; Hizon P90,000 Aquino P255,699; Locsin P127,800; Dizon P42,600; Hizon P84,000

The ALD Partnership shows the following profit and loss ratios and capital balances: Aquino (60%) P252,000; Locsin (30%) P126,000; Dizon (10%) P42,000. The partners decide to sell to Hizon 20 percent of their respective capital and profit and loss interests for a total payment of P90,000. Hizon will pay the money directly to the other par ers. What are the capital balances of the partners after Hizon's admission to the partnership? * Aquino P198,000; Locsin P99,000; Dizon P33,000; Hizon P90,000 Aquino P201,600; Locsin P100,800; Dizon P33,600; Hizon P84,000 Aquino P216,000; Locsin P108,000; Dizon P36,000; Hizon P90,000 Aquino P255,699; Locsin P127,800; Dizon P42,600; Hizon P84,000

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.26EX

Related questions

Question

I need correct answer and correct computation. Thank you!

Transcribed Image Text:TNT 6 O

ON 68% 11:15

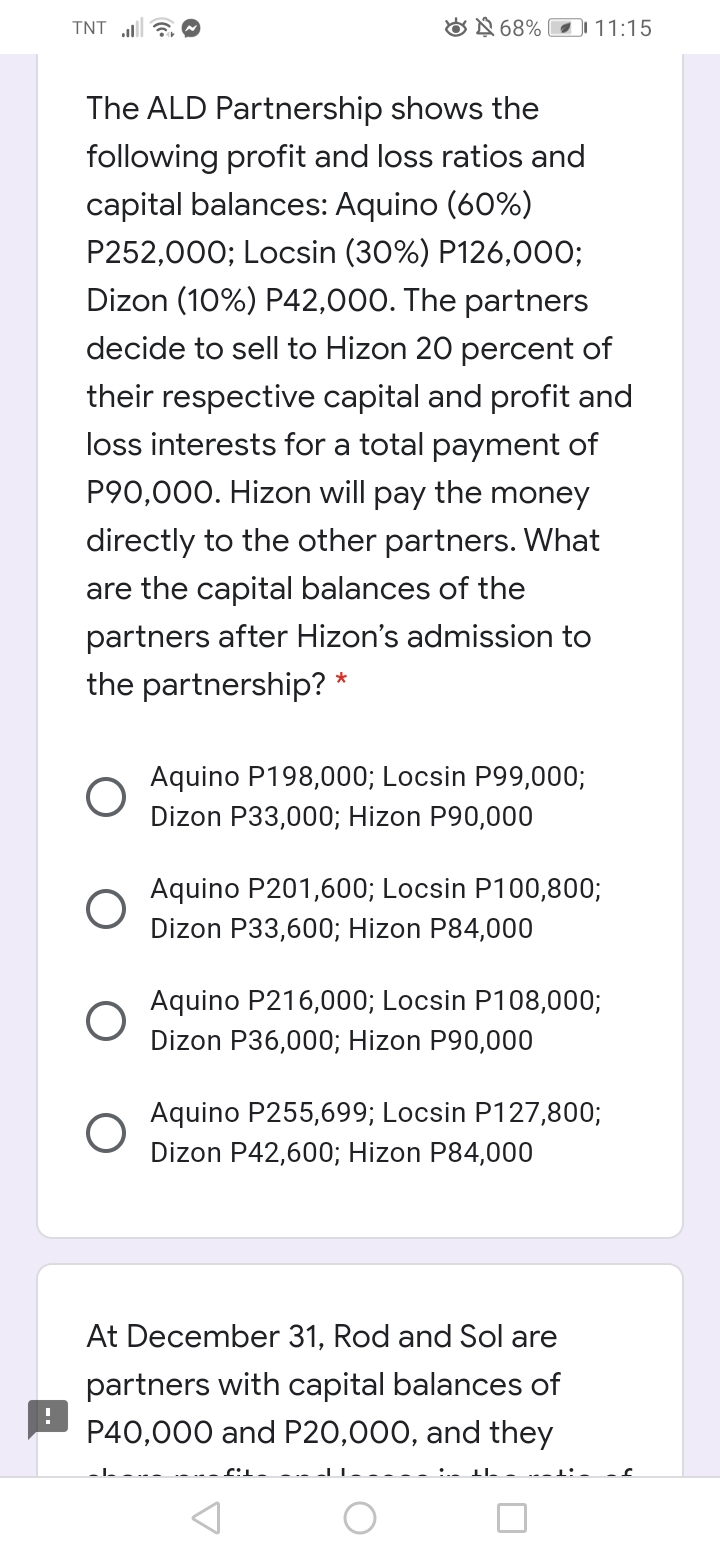

The ALD Partnership shows the

following profit and loss ratios and

capital balances: Aquino (60%)

P252,000; Locsin (30%) P126,000;

Dizon (10%) P42,000. The partners

decide to sell to Hizon 20 percent of

their respective capital and profit and

loss interests for a total payment of

P90,000. Hizon will pay the money

directly to the other partners. What

are the capital balances of the

partners after Hizon's admission to

the partnership? *

Aquino P198,000; Locsin P99,000;

Dizon P33,000; Hizon P90,000

Aquino P201,600; Locsin P100,800;

Dizon P33,600; Hizon P84,000

Aquino P216,000; Locsin P108,000;

Dizon P36,000; Hizon P90,000

Aquino P255,699; Locsin P127,800;

Dizon P42,600; Hizon P84,000

At December 31, Rod and Sol are

partners with capital balances of

P40,000 and P20,000, and they

Transcribed Image Text:TNT 6 O

ON 68%

DI 11:15

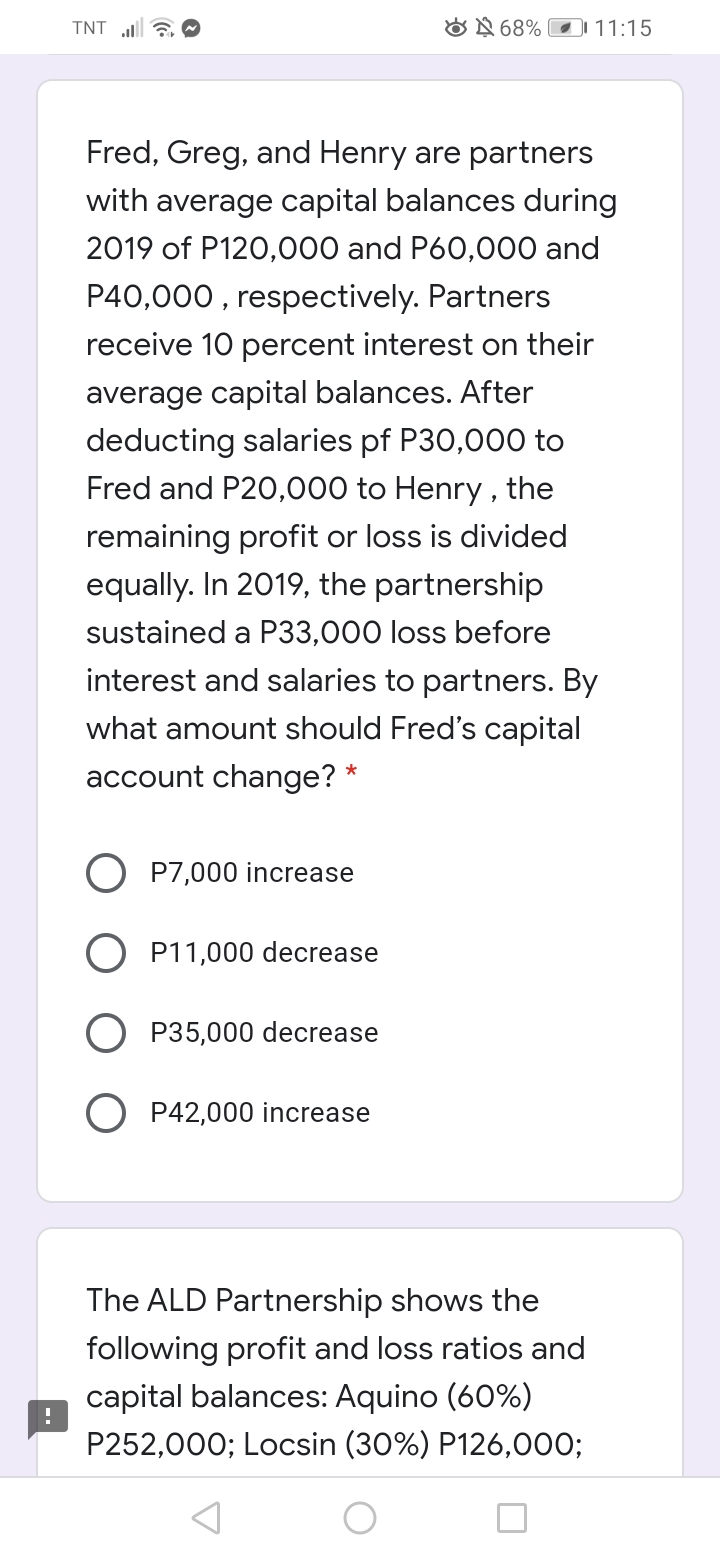

Fred, Greg, and Henry are partners

with average capital balances during

2019 of P120,000 and P60,000 and

P40,000 , respectively. Partners

receive 10 percent interest on their

average capital balances. After

deducting salaries pf P30,000 to

Fred and P20,000 to Henry , the

remaining profit or loss is divided

equally. In 2019, the partnership

sustained a P33,000 loss before

interest and salaries to partners. By

what amount should Fred's capital

account change? *

O P7,000 increase

P11,000 decrease

P35,000 decrease

P42,000 increase

The ALD Partnership shows the

following profit and loss ratios and

capital balances: Aquino (60%)

P252,000; Locsin (30%) P126,000;

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,