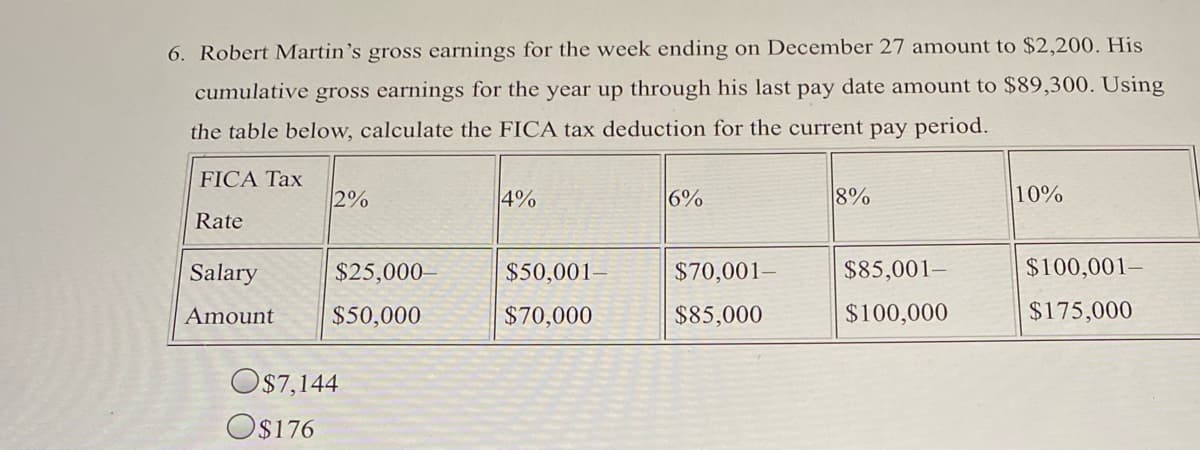

6. Robert Martin's gross earnings for the week ending on December 27 amount to $2,200. His cumulative gross earnings for the year up through his last pay date amount to $89,300. Using the table below, calculate the FICA tax deduction for the current pay period. FICA Tax 2% 4% 6% 8% 10% Rate Salary $25,000– $50,001– $70,001– $85,001– $100,001– Amount $50,000 $70,000 $85,000 $100,000 $175,000

6. Robert Martin's gross earnings for the week ending on December 27 amount to $2,200. His cumulative gross earnings for the year up through his last pay date amount to $89,300. Using the table below, calculate the FICA tax deduction for the current pay period. FICA Tax 2% 4% 6% 8% 10% Rate Salary $25,000– $50,001– $70,001– $85,001– $100,001– Amount $50,000 $70,000 $85,000 $100,000 $175,000

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 15DQ: LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige...

Related questions

Question

Transcribed Image Text:6. Robert Martin's gross earnings for the week ending on December 27 amount to $2,200. His

cumulative gross earnings for the year up through his last pay date amount to $89,300. Using

the table below, calculate the FICA tax deduction for the current pay period.

FICA Tax

2%

4%

6%

8%

10%

Rate

Salary

$25,000–

$50,001–

$70,001–

$85,001–

$100,001–

Amount

$50,000

$70,000

$85,000

$100,000

$175,000

OS7,144

O$176

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning