28. Yvonne i s an employee of Goldfish Company which closed its business during the year Yvonne's last paycheck shows the following details: Unpaid salary in the last two months P 30,000 Current month salary Separation pay Total pay 15,000 100,000 P 145,000 Which of the following will be included in the gross income subject to regular income tax a. P 145,000 О Б.Р45,000 О с.Р 100,000 О d.Р30,000

28. Yvonne i s an employee of Goldfish Company which closed its business during the year Yvonne's last paycheck shows the following details: Unpaid salary in the last two months P 30,000 Current month salary Separation pay Total pay 15,000 100,000 P 145,000 Which of the following will be included in the gross income subject to regular income tax a. P 145,000 О Б.Р45,000 О с.Р 100,000 О d.Р30,000

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 33P

Related questions

Question

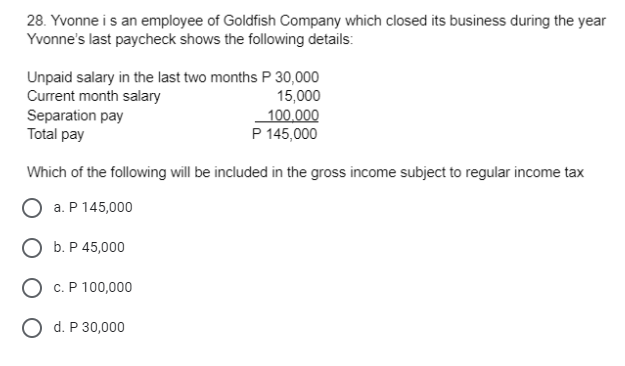

Transcribed Image Text:28. Yvonne i s an employee of Goldfish Company which closed its business during the year

Yvonne's last paycheck shows the following details:

Unpaid salary in the last two months P 30,000

Current month salary

Separation pay

Total pay

15,000

100,000

P 145,000

Which of the following will be included in the gross income subject to regular income tax

a. P 145,000

О Б.Р45,000

О с.Р 100,000

O d. P 30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT