6. The government of Fisclandia is planning its budget for the 2022 financial year. Projected exports are $61 million, and projected imports are $73 million. Expected investment in the economy is $128 million per year. Consumption is given as 70% of income after tax, with the income tax rate currently set at 12%. Government spending is planned to be $117 million. a) i) Calculate the Balance of Trade for the nation. ii) Explain briefly what effect you would expect this to have on the exchange rate with other currencies, assuming a clean float. b) i) Calculate the equilibrium level of income in the economy in the 2022 financial year.

6. The government of Fisclandia is planning its budget for the 2022 financial year. Projected exports are $61 million, and projected imports are $73 million. Expected investment in the economy is $128 million per year. Consumption is given as 70% of income after tax, with the income tax rate currently set at 12%. Government spending is planned to be $117 million. a) i) Calculate the Balance of Trade for the nation. ii) Explain briefly what effect you would expect this to have on the exchange rate with other currencies, assuming a clean float. b) i) Calculate the equilibrium level of income in the economy in the 2022 financial year.

Principles of Economics (MindTap Course List)

8th Edition

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter36: Six Debates Over Macroeconomic Policy

Section: Chapter Questions

Problem 3PA

Related questions

Question

i need it in words not handwritten

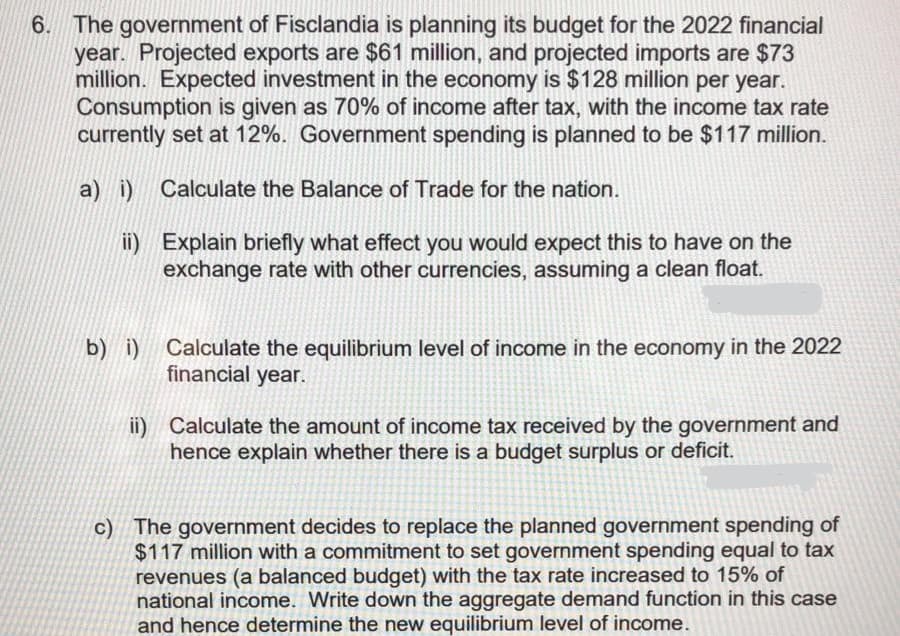

Transcribed Image Text:6. The government of Fisclandia is planning its budget for the 2022 financial

year. Projected exports are $61 million, and projected imports are $73

million. Expected investment in the economy is $128 million per year.

Consumption is given as 70% of income after tax, with the income tax rate

currently set at 12%. Government spending is planned to be $117 million.

a) i) Calculate the Balance of Trade for the nation.

ii) Explain briefly what effect you would expect this to have on the

exchange rate with other currencies, assuming a clean float.

Calculate the equilibrium level of income in the economy in the 2022

financial year.

b) i)

ii) Calculate the amount of income tax received by the government and

hence explain whether there is a budget surplus or deficit.

c) The government decides to replace the planned government spending of

$117 million with a commitment to set government spending equal to tax

revenues (a balanced budget) with the tax rate increased to 15% of

national income. Write down the aggregate demand function in this case

and hence determine the new equilibrium level of income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax