Q: Economic activity should continue to expand at a similiar rate to 2021's projected rebound, on the b...

A: 1) Three contributors which would result in expansion of economic activity:- a) Accumulation of capi...

Q: QUESTION 3: Refer to the graph below and answers the following questions. All Underling work must be...

A: C. With an effective price celing at $2, total consumer surplus is -CS=[(6-2)(40-0)]+[12(8-6)(40-0)...

Q: Explain how to derive the investment per efficiency unit of labour curve in the Solow growth model.

A: Suppose the production function is given by, Y=F(K,gL) g is the efficiency of labor. The savings ra...

Q: Explain how each of the following work: a green tax, a subsidy, and an emissions trading system.

A: Taxes and subsidies are two important concepts used by the government to influence the production of...

Q: In the long-run framework, budget surpluses: Choose the Correct and Explain why its correct should ...

A: When the income tends to exceed the expenditures of an economy, there is an occurrence of budget sur...

Q: Today, Americans recycle what percentage of their municipal solid waste? 15 percent 28 percent O 33 ...

A: The 292.4 million tonnes of municipal solid waste (MSW) generated in 2018 are classified into two ca...

Q: 1) Elaine wants to keep a good balance of soup and Jujyfruit (a delicious fruit flavored candy) in h...

A: Given information Utility function U=J0.5+S J=Jujyfruit S=soup PJ= Price of Jujyfruit Ps=Price of so...

Q: A Managment instutute can operate for a maxium 12 hours .lectures are the outout of the institute an...

A: A function affirms the connection between one info and one result, or many contributions to yield a ...

Q: Write a money demand function and explain the determinants of money demand.

A: The desired holding of financial assets being in form of money including bank or cash deposits inste...

Q: Which of the following did A. W. Phillips demonstrate in his famous Phillips curve? An inverse relat...

A: An economic theory proposed by A. W. Phillips states that inflation and unemployment have an inverse...

Q: The following graph shows the labor market for research assistants in the fictional country of Acade...

A: Labour economics seeks to comprehend the operation and dynamics of wage labour markets. Labor is a c...

Q: January 26, 2018 U.S. Treasury Secretary Mnuchin said he wants a weak U.S. dollar. then he corrected...

A: Currency is the actual cash in an economy, containing the coins and paper notes available for use. C...

Q: If a bank holding company owns a bank that is chartered by the Office of the Comptroller of the Curr...

A: The answer is - the OCC

Q: Money borrowed today is to be paid in 6 equal payments at the end of 6 quarters. If the interest is ...

A: Given that: i = 0.124 = 0.03n = 6A = 200000to find: P = ? P = A1+in-11+ini

Q: Which of the following did A. W. Phillips demonstrate in his famous Phillips curve? a. An inverse re...

A: The original Phillips curve equation is πt = (μ+z) - αut The modified Phillips curve equation is πt ...

Q: Question 4 4(a) The following equation is associated with the Cobb-Douglas production function: AY/ ...

A: The correct answer is given in the second step.

Q: Price level Potential output SRAS P3 P2 Real GDP Y1 Y3 fer to Exhibit 10.1, which shows the short-ru...

A: The short run supply curve slopes upward signifying the positive relationships between the price and...

Q: 2. Neneh rents a house for which she pays the landlord $25,000 per year. The house can be purchased ...

A: The information given is:- Rent paid by neneh = $25,000 Cost of the house = $250,000 Also the intere...

Q: Compare and contrast the three major approaches to environmental policy: lawsuits, command-and-contr...

A: Environmental economics is the study of the economics of environmental protection and the economic i...

Q: If the daily demand curve for gasoline is as provided in the graph attached, then how much consumer ...

A: Consumer surplus are the monetary benefits that the consumer receives while buying goods and service...

Q: Exchange Rate Determination - Short v. Long Run The nominal money demand for the US is given by the ...

A: Given information Interest rate in US=5.263% Calculated value from part Vi) Demand for Bond Q=100-5P...

Q: . Price discrimination is not possible in case of

A: To find : In which case of price discrimination.

Q: The CDC estimates that cigarette smoking causes more than 480,000 deaths 3. each year in the US. Mar...

A:

Q: Suppose that actual inflation is 4 percent, the Fed's inflation target is 2 percentage points, and u...

A: Given: Actual inflation=4% Inflation target=2% Unemployment rate=2 Full employment rate=4%

Q: Problem 1. (Monopoly and Efficiency) A monopolist faces a market demand Q= 30-P, where P is the mark...

A: Monopolist demand curve: Q=30-P (writing it in quantity terms, we get) P=30-Q Total revenue= P*Q =(3...

Q: Discuss divergent views on population growth

A: Population growth:- The rise in the number of individuals in the population is known as population e...

Q: describe how COVID-19 may differentially affect families across the socioeconomic spectrum. That is,...

A: Concerns of a new recession and financial collapse require strong and resilient leadership in health...

Q: On a graph for a monopolist or monopolistic competitor, which of the following curves coincide? a) T...

A: (2) The demand curve depicts the price at each level of quantity demanded. Average revenue is calcu...

Q: Question 17 If the production function of ideas in the economy is as follows %3D then the function e...

A: 17. If we double both inputs the output is more than doubled, but if we double only the stock of kno...

Q: long-run framework, budget surpluses: Select correct and explain why its correct should be run when...

A: Inside the budgetry cycle, deficiency spending is the sum by which spending surpasses income through...

Q: If the MPC in 2020 was 0.9, a. how much would consumption increase initially as a result of the reco...

A: Given:- MPC=0.9 Recovery rebate=$293 billion in direct payment To calculate:- Rise in consumption=? ...

Q: The following graph shows the market demand for wheat. Use the orange points (square symbol) to plot...

A: Answer: In the short run, the supply curve is the rising part of the marginal cost (MC) curve above ...

Q: 1. Research into how this stories illustrates the impact of foreign influence on Veitnam. A. Post-C...

A: 1. Investigate how these stories depict the impact of foreign influence in Vietnam is

Q: A textile firm in a competitive industry employs a particularly efficient manager to run the operati...

A: Cost Curves show the different level of cost that a firm or individual incurs in producing different...

Q: 1. Consider a two-period model in which you work and save in the initial period (period 0) and live ...

A: Since you have asked a multi-part question and according to the policy, we can only solve the first ...

Q: Which of the following is the best example of a transactions cost? O the price of labor and material...

A: Cost is the expenditure of producing goods and services. It is the cost that is the summation of tot...

Q: QUESTION 3 Consider an OLG economy where each generation has 20 bananas when young, and 0 bananas wh...

A:

Q: Seema is looking at an investment to upgrade an inspection line at her plant. The initial cost would...

A: Given Initial cost (P) = $160,000 Salvage value (F)=$39,000 n=5 years r =14%

Q: Mario and Chris are the only two consumers in a particular market for train tickets. The following t...

A: Market demand is the horizontal sum of all consumers demand for a good in a given period for differe...

Q: Appledale Dairy is considering upgrading an old ice-cream maker. Upgrading is available at two level...

A: Moderate option saving's present value is, 3600+32501.05+......+1500(1.05)6=15907.2 So the present w...

Q: 55. If the income elasticity is greater than one, the commodity is A. O Necessity item B. O Luxury i...

A: "Correct answer is option B."

Q: When the interest rate increases, the opportunity cost of holding money a. decreases, so the quantit...

A: In the mentioned question, we have been asked about the relationship between interest rate and the o...

Q: Write on growth and fluctuation in national income of Ghana and theories of cycles

A: In the short to medium term, the economy looks promising, assuming increased export demand, greater ...

Q: Suppose that for a particular economy, nominal GDP in 2015 falls, compared to its previous level in ...

A:

Q: The actual unemployment rate is composed of three types. Identify each type and explain whether the ...

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new que...

Q: 3. How much will you have in 40 years if you save $3,000 each year and your account earns 8% interes...

A: Future value is the value of a current resource at a future date in light of an accepted pace of dev...

Q: ADVANTAGES AND DISADVANTAGES OF LEARNING THE CONCEPT OF DEMAND AND CONCEPT OF SUPPLY. Give 5 each

A: Concept of Demand : The amount of a commodity that a household wishes to purchase is called the quan...

Q: will be the market price? If both firms collude and share the output equally, what is the revenue to...

A: Assuming two firms are there X and Y , production happens only with fixed cost and both the firm pro...

Q: Abhishek's utility function is: U = min {2x- y, 2y–x} %3D Which letter resembles Abhishek’s indiffer...

A: Utility: - Utility is the satisfaction derived by any consumer from consuming a good or service.

Step by step

Solved in 2 steps

- 1. Which of the situations is an example of the crowding-out effect on investment as it pertains to macroeconomics? - The government of Walla Walla spent $4.3 billion dollars and collected $2.2 billion dollars in tax revenue. - Candex, an eyeglass frame company, decides to cut the price on all of its frames to $10, which successfully drives out all other firms from the market. - The government deficit is at an all-time high in the United States. As such, people begin to save more money in fear that taxes will increase in the future. - Jack wants to borrow money to create a cowboy-themed inflatable bounce house for kids called "Wild Wild West." However, the government is running a deficit which has increased interest rates so much that Jack can no longer afford to borrow the money.Suppose actual real GDP is $7.91 trillion, potential real GDP is $13.33 trillion, the marginal propensity to consume is 0.68, and that the government has a balanced budget. If we ignore price effects, by how many trillions of dollars should the government change its spending to fix the gap while keeping the federal budget balanced? (Round this to two digits after the decimal and enter this value as either a positive value or a negative value without the dollar sign.)Suppose a closed economy with no government spending which in equilibrium is producing an output and income of 2500. Suppose also that the marginal propensity to consume is 0.80, and that, if at full employment, the economy would produce an output and income of 3900 By how much would the government need to cut taxes (T) to bring the economy to full employment?

- The program has provoked a lot of political discussions. Which of the following statementsare correct (assuming a closed economy)? 1. The higher the marginal propensity to consume, the lower will be investment multiplier.2. A reduction of the tax rate lowers the fiscal policy multiplier.3. The higher the marginal propensity to consume, the more consumption can be induced bymore government spending, and this will lead to a higher fiscal policy multiplier.4. When fiscal policy is not able to compensate fully for other demand reductions, anexpansionary monetary policy can be helpful to overcome a recession more quickly.5. An expansionary monetary policy by the ECB in combination with a fiscal expansion willalways lead to inflation.6. Only a consequent fiscal consolidation will help the economy out of a recession.7. In the liquidity trap there is no crowding-out effect to be expected.8. It is best to conduct fiscal consolidation when the economy is in a boom.A. Calculate the levels of consumption and savings that occurs when the economy is in equilibrium. B. Computer the government budget deficit in this economy. C. If government spending in banana land increases by $1000 what is the amount of the increase in equilibrium output? D. If taxes in banana land decrease by $1000 what is the new equilibrium output in this economy? E. To keep the government budget balanced, of both government spending and taxes in banana land increase by $1000 what is the change in equilibrium income level?4) Suppose an economy is producing real GDP of $600 billion. Potential GDP is equal to $540 billion, and the MPC is equal to 0.6. i)What kind of a gap (or problem) is this country experiencing? ii) What policy action do you suggest the government to take to eliminate the gap? State both the specific type of policy action and its size. Show your work for partial credit.

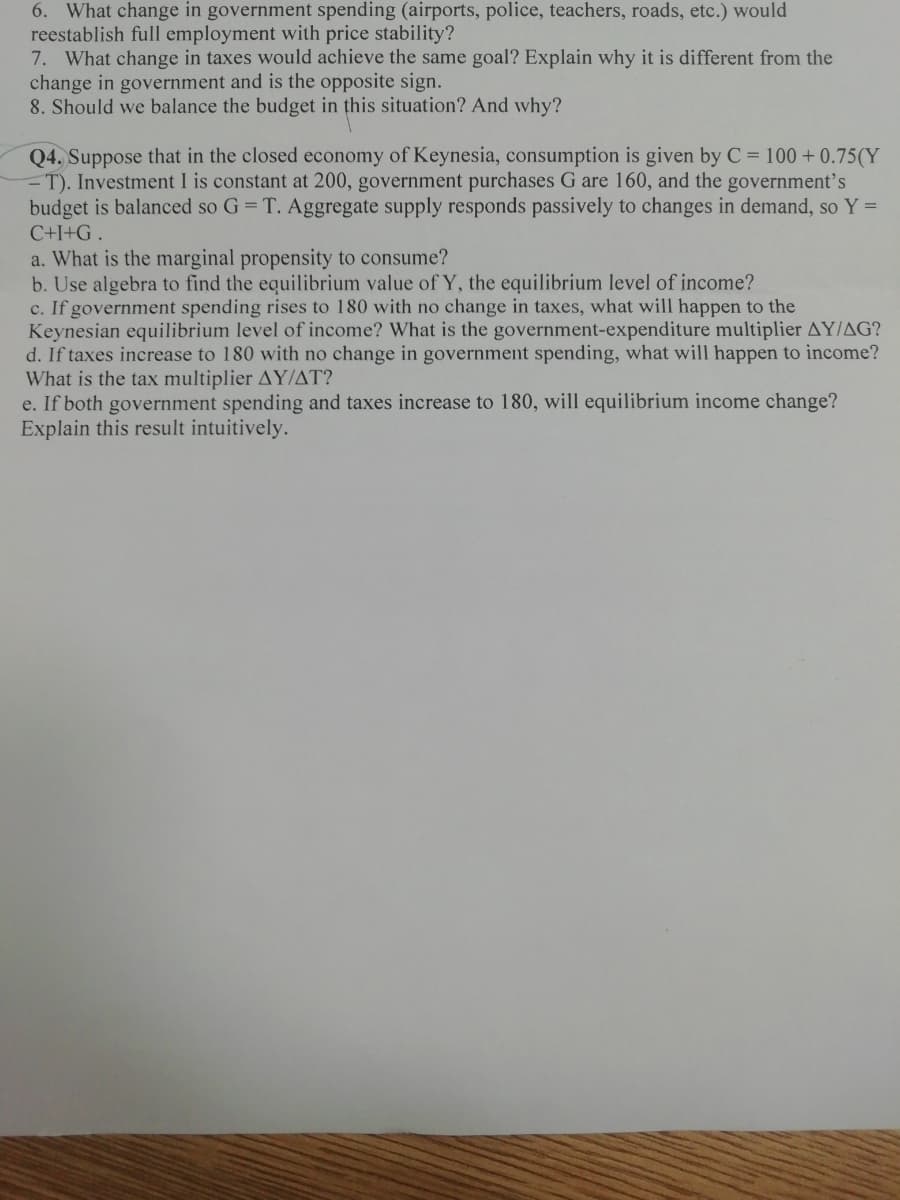

- 1. In the Keynesian model, suppose that the economy has the following values : C = 100 + 0.75*Y G = 300 I = 200 NX = 0 (remember Y = GDP = C + I + G + NX) a) Solve for the level of equilibrium output in this economy. b) What is the MPC in this economy? What is the multiplier on government spending? (I want a specific number here, not a definition) c) Household savings is defined as income minus consumption (S = Y – C). What is the level of household savings in this economy? d) Suppose that households become nervous about the future of the economy and decide that they will consume less and save more money, so their new consumption function becomes C = 100 + 0.6*Y Solve for the new equilibrium level of output and calculate how much households end up saving. How has it changed from the level of savings in part c? e) How much does the government needs to increase its spending by to counteract the fall in economic output in this model?Let's say that our country's Gross Domestic Product is at $15 billion (this year). We also know that we currently have unemployment and that we would have full employment if our Gross Domestic Product were to reach $18.5 billion. If the Keynesian multiplier is 7, then what would Keynesian economists recommend regarding changes in government spending and taxation?22. Consider a Keynesian model but where both investment and consumption are increasing in aggregate income, e.g., because investment depends on business cash flow. Now that investment depends positively on aggregate income, fiscal stimulus has less effect on equilibrium output. True/False. Remember to include your explanation.

- 11. Assuming a Marginal Propensity to Save (MPS) of 20% or 0.20, use the Keynesian Multiplier to determine the additional amount of government spending required.(a) Suppose in a simple Keynesian economy, planned consumption function is given by C=250+0.65(Y-T). Planned investment, government purchases, taxes are $100 million, $100 million and $150 million respectively. What is MPC, MPS and autonomous consumption Derive the saving function. What is the equilibrium level of income? Y= AD=C+I+G If government purchases increase to $150 million, what is the new equilibrium level of income? What level of government purchases is needed to achieve an income of $2000 million? From question e) you get the newly government purchase. Now find out the multiplier value What is the amount of shift in AD curve? [Use the multiplier value from e)] (b) In a self-regulating economy “X”, labor supply is 40 million but labor demand is 10 million. What will happen in goods and service market simultaneously? Explain this situation with relevant graph. Based on your findings in a) is it denoting long run equilibrium? If not, will the economy be able to restore…1. Suppose the MPC is .90 and the MPI is .10. if government expenditure goes up $100 billion while taxes fall $10 billion, what happen to the equilibrium level of real GDP? Use following equations for exercise 2-4 C= $100 + .8Y I=$200 G= $250 X = $100 - .2Y 2. What is the equilibrium level of real GDP? 3. What is the new equilibrium level of real GDP if government spending increases by $150? 4. What is the new equilibrium level of real GDP if government spending and taxes both increase by $150? 5. Make a graph showing the spending and tax revenue of your state government for as many years as you can find (use the government of your home country if you are not from the United States). What trends do you notice? What spending categories make up the largest share of the state budget? What are the largest sources of revenue?