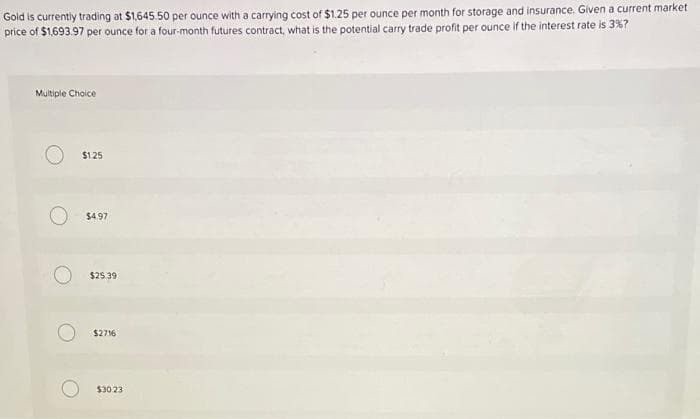

Gold is currently trading at $1,645.50 per ounce with a carrying cost price of $1,693.97 per ounce for a four-month futures contract, what is the potential carry trade profit per ounce if the interest rate is 3%? Multiple Cholce $125 $4.97

Q: In what circumstances can a taxpayer challenge an assessment outside the ordinary appeal process. Di...

A: In matters determined by the Regional Trial Court in the exercise of its original jurisdiction, an a...

Q: Geet Marketing is acquiring Tusk Co. for $565,000 in cash. Tusk has fixed assets with a book value o...

A: Goodwill is the difference of amount paid for acquiring the company and the net assets acquired.

Q: Companies are more apt to choose repurchases over dividends if doing so will enable them to I. take...

A: When a company decides to buy back its own stock from the market, this is known as a share repurchas...

Q: 39. The discount on one unit negotiable substance in one unit of time. rate of interest present wort...

A: Since multiple questions are asked , we will answer 1st question as per prescribed guidelines. T...

Q: 11. Suppose a firm wants to issue long-term debt securities. What are the legal processes that the f...

A: Long-term debt securities Long-term debt securities are those securities that mature in more than on...

Q: Over the last 6 months, Rohan acquired the following assets: an engagement ring which cost $5,000 a...

A: Total purchase value = $5000 + $3000 + $8500 + $15000 + $5000 = $36500 Total selling value = $6000 +...

Q: Adam deposited $1,300 at the end of every month into an RRSP for 8 years. The interest rate earned w...

A: When an investment is made, interest is earned on the deposit so made. The accumulated value of an i...

Q: Shelby purchases a retirement annuity that will pay her $3,000 at the end of every six months for th...

A: Present value of the money would be price that maximum price that can be paid for that kind of annui...

Q: Tell whether the following is a characteristic of stocks and bonds. 1. It can be appropriate for ret...

A: Stocks and bonds are the form of capital where the company issues for raising funds for its operatio...

Q: IBM was trading at $100 when Mrs. Peterson bought a 100 call on IBM at a price of $10. Three months ...

A: The leverage factor for call or put options shows the relative change that occurs in option value be...

Q: The government received a loan of 7 million monetary units at 10% per year (expenditure). These fund...

A: Loan is a situation where the individual or the company or government or any other party borrows mon...

Q: A fixed capital investment of P10 million is required for a proposed manufacturing plant and an esti...

A: Fixed capital investment = 10,000,000 Estimated working capital = 2,000,000 Depreciation rate = 10% ...

Q: PART B.) An engineer who is saving for a new house plans on saving $100 per paycheck towards the dow...

A: The future value is the method of finding out the value of the current deposits at a predetermined t...

Q: Risk return exercise : D2L Assessment #7 DePaul, Inc. You are searching for a stock to add to your c...

A: Given: Year Starting price Ending price 1 $40 $42 2 $42 $47 3 $47 $43 4 $43 $53

Q: YYYYMM Return(Stk1) Return(Stk2) Return(Market) Return(T-bill) 201701 7.75% 3.00% 6.18% 0.20% 201702...

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that explains the relationship betwee...

Q: Suppose that investors are risk-neutral and the linear UIP equation holds. You are given the followi...

A: UK interest rate = 0.07 US interest rate = 0.02 Expected Future Spot Rate in pounds per dollar = 8 ...

Q: For the year ending December 31, 2017, sales for Company Y were $73.91 billion. Beginning January 1,...

A: Compounding is a method of charging interest in which Interest is charged on the amount including or...

Q: Suppose you are provided with the following table of spot rates of different maturity bonds: Year ...

A: Here, Year Spot rate 1 8% 2 9% 3 7% 4 8% 5 10%

Q: Telus kidw orboat toeld0 Activity # 2 Find the future value and present value of the annuity due. Pr...

A: Annuity due is that annuity (perodic equal cash flows) in which payments occure at the start of the ...

Q: B. The target of Co. X is to maintain a financial leverage of 48%. The Co. has deviated negatively f...

A: Financial Leverage and Gearing: Financial leverage refers to the quantum of debt a company employs i...

Q: A company is considering two mutually exclusive projects. Both require an initial cash outlay of Rs...

A: Introduction to the question: Initial Investment = 20,000 each Required Return = 10% Tax Rate = 35% ...

Q: YYYYMM Return(Stk1) Return(Stk2) Return(Market) Return(T-bill) 201701 7.75% 3.00% 6.18% 0.20% 201702...

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that explains the relationship betwee...

Q: The effects of financial choices can be understood by performing which of these? Check two. O Micro ...

A: Financial choices involves the financial, credit, and debt management information required to make f...

Q: A washer-dryer combination can be purchased from a department store by making monthly credit card pa...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Cloud Venture has a line of credit with a local bank of $75,000. The loan agreement calls for intere...

A: Information provided: Line of credit = $75000 Interest “r” = 6% Compensating balance = 3% Amount to...

Q: Calculate the total payment for the FHA Purchase Price: $500k LTV: 96.5% Loan term and type: 3...

A: Working Note #1 Purchase Price = $ 500,000 LTV = 96.5% Down payment = 100% - 96.5% = 3.5% Working ...

Q: Sewing World has an all-equity cost of capital of 11.72 percent, a levered cost of equity of 12.94 p...

A: A firm raises finance from various sources typically debt and Equity. The ratio of debt finance to E...

Q: Bailey, Inc., is considering buying a new gang punch that would allow them to produce circuit boards...

A: MARR is the minimum rate that a company is willing to earn from a project. It is also known as the b...

Q: s the owner of the small business, you are tasked to determine the right price for your product befo...

A: Break-even point: The sales level at which revenues earned by a business are exactly equal to its co...

Q: 4. 1 2 3 4 6. 7 8 9. 10 EOY 20 21 22 23 25 26 27 28 29 30 CF $300 24

A: Annuity An annuity is the series of payments which is received or paid for a certain period of time...

Q: Solve the following problem. 1. Compute for the compound amount and compound interest on 1, 250, 000...

A: We need to use compound interest formula given below to calculate compound amount and compound inter...

Q: it is desired to save $20,000 by depositing $800 every 3 months in an investment that pays 8% coumpo...

A: Annuity means a set of finite number of payments which are the same in size and made in equal interv...

Q: Contrast the differences/similarities of common stocks and bonds. How are they used in the corporate...

A: Common Stock: This security represents the ownership of a company. Common stock is also known as a c...

Q: Given the data and hints, Project Zeta's initial investment is and its NPV is (rounded to the neares...

A: Net Present Value: It is computed by reducing the initial investment from the sum of present-worth c...

Q: Which is TRUE? S1-Only the legislative body can exercise power to levy S2 - Only the executive depar...

A: The power to levy tax is generally exercised by governmental bodies or legislative bodies. In countr...

Q: A firm has a required rate of return (k) of 15 percent and a return on equity (ROE) of 18%. If the p...

A: The expected return is the minimum required rate of return which an investor required from the inves...

Q: Every end of three months, payment of Php 1,300 is made for 5 years, which is deferred for 2 years. ...

A:

Q: Level 1 3 Salary $50,000 $54,000 $60,000 s promoted to salary level 3, receive ost-of-living increas...

A: Apart from Salary employee is also getting cost of living compensation based on salary level and if ...

Q: The Special Drawing Right (SDR): O a. Was created by the International Monetary Fund (IMF) in 1970 a...

A: Special Drawing Rights or S.D.R.s is created by International Monetary Fund or I.M.F. in 1969 and as...

Q: perpetual rate of 3 percent beginning in four years. If you require a return of 15 percent on the st...

A: H Model (Dividend Discount Model): The H model considers that the incomes and dividends of the compa...

Q: Turnbull Co. has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity. ...

A: The capital structure has 45 % of debt 4% of preferred stock and 51% of equity tax rate is 25%.

Q: How are the following used on a stand-alone and a portfolio basis? 1. Standard Deviation 2. Varian...

A: Stand-alone risk: The risks posed by a single asset, division, or project are referred to as standal...

Q: Suppose Tom is 20 years old. He works till 50 years old, retire, and live up to 80 years old. Tom kn...

A: The notion of the time value of money (TVM) is concerned with money's purchasing power capability, w...

Q: Do Ratio Analysis of Allied Food Products. Interpret the answers. (Current ratio, quick ratio, debt ...

A:

Q: Question # 2 show complete mathematical working Given the budget options. Apply the following rules ...

A: The ratio between the cost incurred on a new project with the benefits generated by keeping cost amo...

Q: ABC Residential Investors, LLP, is considering the purchase of a 120 unit apartment complex in steel...

A: Average rental per unit is $550 per month Rent per month Unit project Price $ 550 140 9,000,000...

Q: Which of the following is the correct calculation of project Delta's IRR?

A: Internal Rate of Return (IRR): It is the rate of return at which a project's net present value becom...

Q: BTS Inc. started construction of a building for its own use on January 1, 2021. Upon completion at...

A: Businesses raise money to finance their projects and expansion activities. The financing is made thr...

Q: 2. A second hand car was advertised in the newspaper worth $26,400 if paid in cash, it can also be u...

A: The normal interest rate is the real rate of interest earned by the investor or paid by the borrower...

Q: te

A: Introduction : The given question relates to the capital budgeting techniques which are used to valu...

Quick plz within half an hour give you upvote

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A company enters into 2 long futures contracts on a commodity for 200 cents per unit. Each contract is on 10,000 units of the commodity. The initial margin per contract is $2,500 and the maintenance margin per contract is $2,000. At what futures price will the balance in the margin account equal maintenance margin? a. 205 cents. b. 195 cents. c. 190 cents.Gold currently costs $1,712 per ounce. The yield on T-bills is 0.9%. What should be the futures price for an ounce of Gold to be delivered in 9 months?A company enters into a short futures contract to sell 25,000 units of a commodity for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call? O 76 cents O 66 cents 74 cents O 78 cents

- Gold is trading at a one-year futures price of $2,005 per troy ounce. A futures contract comprises 100 troy ounces. The initial margin is $50,125 and the maintenance margin is $32,080. You are short one futures contract. There is a margin call when the price per troy ounce of gold changes to: Group of answer choices A) $1,967 B) $2,207 C) $1,858 D) $2,120Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. a. What are the initial margin and maintenance margin on your margin account?Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. b. Fill the appropriate numbers in the blank cells in the following table. (Hint: See solution to Q19 in Lesson 2 Learning…

- Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. c. What is your total profit after you closed out your position?A company enters into a short futures contract to sell 8,000 units of a commodity for $0.50 per unit. The initial margin is $5000 and the maintenance margin is $3000. When will there be a margin call? (Round your answer to the nearest cent.) a. $0.63 b. $0.72 c. $0.65 d. $0.75The spot price of silver is $11.00 per ounce and the futures expires in one year trades for $12.20, what is the implied cost of carry?

- The futures price of gold is $800. Futures contracts are for 100 ounces of gold, and the margin requirement is $4,000 a contract. The maintenance market requirement is $1,200. You expect the price of gold to rise and enter into a contract to buy gold. How much must you initially remit? Round your answer to the nearest dollar. $ If the futures price of gold rises to $855, what is the profit and return on your position? Round your answer for profit to the nearest dollar and for return to the nearest whole number. Profit: $ Return: % If the futures price of gold declines to $784, what is the loss on the position? Round your answer to the nearest dollar. Enter the answer as a positive value. $ If the futures price declines to $756, what must you do? Round your answer to the nearest dollar. Enter the answer as a positive value. The investor will have to $ to restore the initial $4,000 margin. If the futures price continues to decline to $740, how much do you have in your…The futures contract for settlement in 4 months is trading at F0 = $6.35 and the cash market is trading at S1 = $6.42. The 4-month interest rate on a continuously compounded basis is 2 percent. What is the arbitrage trade that is available, the transactions and the arbitrage profit? Buy now at S1 with borrowed money and enter a short forward contract at Fo. At time T deliver the underlying, receive F0 and pay back the loan plus interest. Net profit is: $0.4200 Buy now at S1 with borrowed money and enter a short forward contract at Fo. At time T deliver the underlying, receive F0 and pay back the loan plus interest. Net profit is: $0.0280 Sell short S1 and invest proceeds at r and enter long a forward contract at Fo; at time T receive the underlying for F0, cover the short and also collect the principal plus from the bank. Net profit is: 0.1129Suppose a trader opens a short position in two rice futures contracts. Each contract is for 5,000 kilograms. The initial margin is TZS 2,000,000 per contract, and the contract expires in 100 says. Suppose the future price decreases by TZS 500 per Kilogram per day for the first 10 days, then increases by TZS 750 per kilogram per day for the next 5 days. REQUIRED: Estimate the following: The initial margin to be deposited with clearing house The total gain/loss due to price decreases The total gain/loss due to price increase The balance in the trader's margin a/c after 15 day