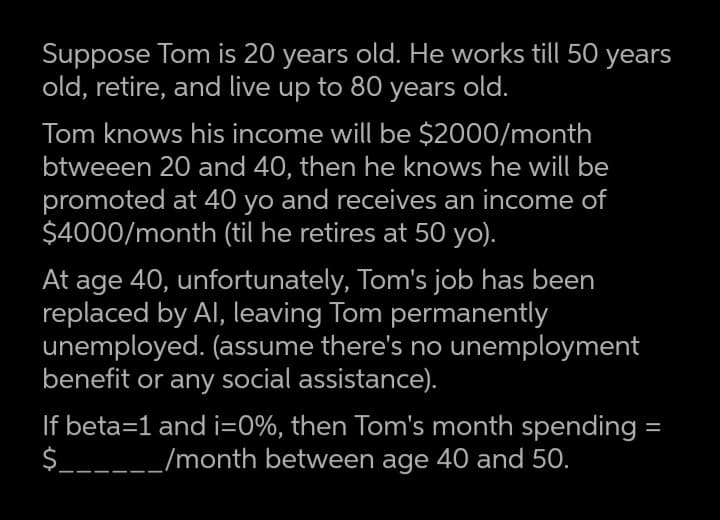

Suppose Tom is 20 years old. He works till 50 years old, retire, and live up to 80 years old. Tom knows his income will be $2000/month btweeen 20 and 40, then he knows he will be promoted at 40 yo and receives an income of $4000/month (til he retires at 50 yo). At age 40, unfortunately, Tom's job has been replaced by Al, leaving Tom permanently unemployed. (assume there's no unemployment benefit or any social assistance). If beta=1 and i=0%, then Tom's month spending = $______/month between age 40 and 50.

Suppose Tom is 20 years old. He works till 50 years old, retire, and live up to 80 years old. Tom knows his income will be $2000/month btweeen 20 and 40, then he knows he will be promoted at 40 yo and receives an income of $4000/month (til he retires at 50 yo). At age 40, unfortunately, Tom's job has been replaced by Al, leaving Tom permanently unemployed. (assume there's no unemployment benefit or any social assistance). If beta=1 and i=0%, then Tom's month spending = $______/month between age 40 and 50.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 32P

Related questions

Question

5

Transcribed Image Text:Suppose Tom is 20 years old. He works till 50 years

old, retire, and live up to 80 years old.

Tom knows his income will be $2000/month

btweeen 20 and 40, then he knows he will be

promoted at 40 yo and receives an income of

$4000/month (til he retires at 50 yo).

age 40, unfortunately, Tom's job has been

replaced by Al, leaving Tom permanently

unemployed. (assume there's no unemployment

benefit or any social assistance).

At

If beta=1 and i=0%, then Tom's month spending =

$______/month between age 40 and 50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT