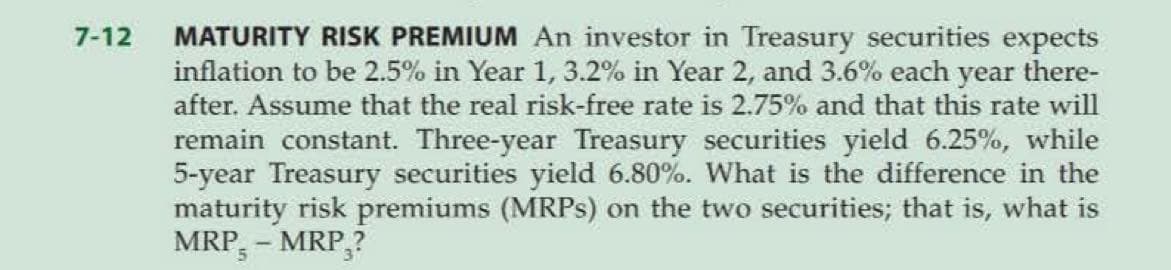

7-12 MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.5% in Year 1, 3.2% in Year 2, and 3.6% each year there- after. Assume that the real risk-free rate is 2.75% and that this rate will remain constant. Three-year Treasury securities yield 6.25%, while 5-year Treasury securities yield 6.80%. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is MRP - MRP,?

7-12 MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.5% in Year 1, 3.2% in Year 2, and 3.6% each year there- after. Assume that the real risk-free rate is 2.75% and that this rate will remain constant. Three-year Treasury securities yield 6.25%, while 5-year Treasury securities yield 6.80%. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is MRP - MRP,?

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 19PROB

Related questions

Question

Answer the problem and explain thoroughly why this is your answer. Also, explain thoroughly your answer step by step.

Transcribed Image Text:7-12

MATURITY RISK PREMIUM An investor in Treasury securities expects

inflation to be 2.5% in Year 1, 3.2% in Year 2, and 3.6% each year there-

after. Assume that the real risk-free rate is 2.75% and that this rate will

remain constant. Three-year Treasury securities yield 6.25%, while

5-year Treasury securities yield 6.80%. What is the difference in the

maturity risk premiums (MRPs) on the two securities; that is, what is

MRP - MRP,?

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you