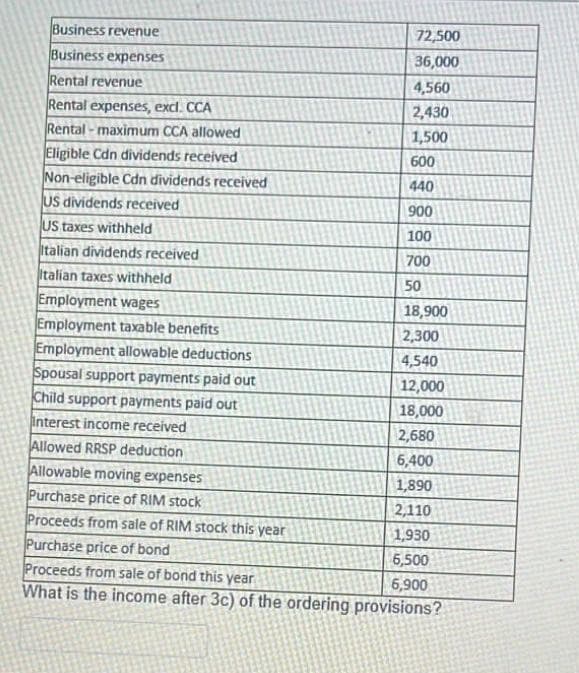

Business revenue Business expenses Rental revenue Rental expenses, excl. CCA Rental-maximum CCA allowed Eligible Cdn dividends received Non-eligible Cdn dividends received US dividends received US taxes withheld Italian dividends received Italian taxes withheld Employment wages Employment taxable benefits Employment allowable deductions Spousal support payments paid out Child support payments paid out Interest income received Allowed RRSP deduction 72,500 36,000 4,560 2,430 1,500 600 440 900 100 700 50 18,900 2,300 4,540 12,000 18,000 2,680 6,400 Allowable moving expenses 1,890 Purchase price of RIM stock 2,110 Proceeds from sale of RIM stock this year 1,930 Purchase price of bond 5,500 Proceeds from sale of bond this year 6,900 What is the income after 3c) of the ordering provisions?

Business revenue Business expenses Rental revenue Rental expenses, excl. CCA Rental-maximum CCA allowed Eligible Cdn dividends received Non-eligible Cdn dividends received US dividends received US taxes withheld Italian dividends received Italian taxes withheld Employment wages Employment taxable benefits Employment allowable deductions Spousal support payments paid out Child support payments paid out Interest income received Allowed RRSP deduction 72,500 36,000 4,560 2,430 1,500 600 440 900 100 700 50 18,900 2,300 4,540 12,000 18,000 2,680 6,400 Allowable moving expenses 1,890 Purchase price of RIM stock 2,110 Proceeds from sale of RIM stock this year 1,930 Purchase price of bond 5,500 Proceeds from sale of bond this year 6,900 What is the income after 3c) of the ordering provisions?

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 8MCQ: The purpose of Schedule M-1 on the corporate tax return is to: Reconcile accounting (book) income to...

Related questions

Question

2

Transcribed Image Text:Business revenue

Business expenses

Rental revenue

Rental expenses, excl. CCA

Rental-maximum CCA allowed

Eligible Cdn dividends received

Non-eligible Cdn dividends received

US dividends received

US taxes withheld

Italian dividends received

Italian taxes withheld

72,500

36,000

4,560

2,430

1,500

600

440

900

100

700

50

18,900

Employment wages

Employment taxable benefits

2,300

Employment allowable deductions

4,540

Spousal support payments paid out

12,000

Child support payments paid out

18,000

2,680

Interest income received

Allowed RRSP deduction

6,400

Allowable moving expenses

1,890

Purchase price of RIM stock

2,110

Proceeds from sale of RIM stock this year

1,930

Purchase price of bond

5,500

Proceeds from sale of bond this year

6,900

What is the income after 3c) of the ordering provisions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning