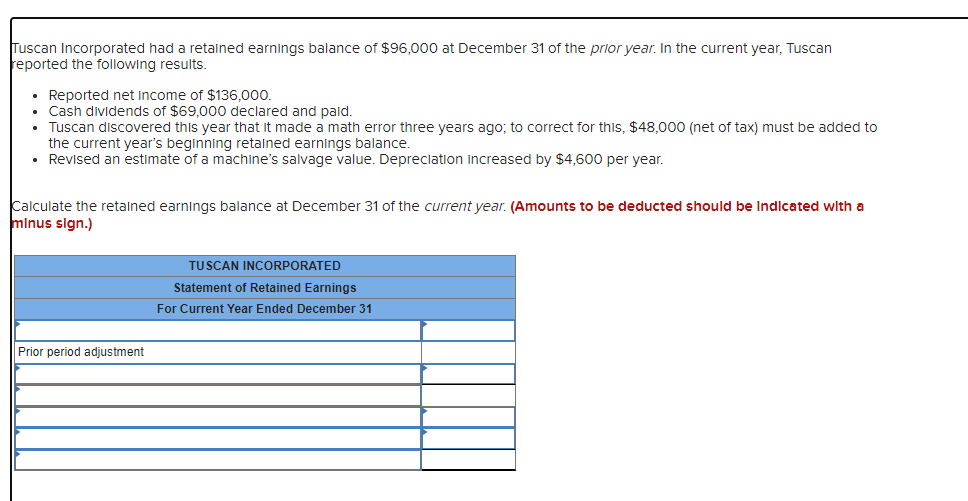

Tuscan Incorporated had a retained earnings balance of $96,000 at December 31 of the prior year. In the current year, Tuscan reported the following results. • Reported net income of $136,000. • Cash dividends of $69,000 declared and paid. • Tuscan discovered this year that it made a math error three years ago; to correct for this, $48,000 (net of tax) must be added to the current year's beginning retained earnings balance. • Revised an estimate of a machine's salvage value. Depreciation Increased by $4,600 per year. Calculate the retained earnings balance at December 31 of the current year. (Amounts to be deducted should be indicated with a minus sign.) Prior period adjustment TUSCAN INCORPORATED Statement of Retained Earnings For Current Year Ended December 31

Tuscan Incorporated had a retained earnings balance of $96,000 at December 31 of the prior year. In the current year, Tuscan reported the following results. • Reported net income of $136,000. • Cash dividends of $69,000 declared and paid. • Tuscan discovered this year that it made a math error three years ago; to correct for this, $48,000 (net of tax) must be added to the current year's beginning retained earnings balance. • Revised an estimate of a machine's salvage value. Depreciation Increased by $4,600 per year. Calculate the retained earnings balance at December 31 of the current year. (Amounts to be deducted should be indicated with a minus sign.) Prior period adjustment TUSCAN INCORPORATED Statement of Retained Earnings For Current Year Ended December 31

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Do not give answer in image

Transcribed Image Text:Tuscan Incorporated had a retained earnings balance of $96,000 at December 31 of the prior year. In the current year, Tuscan

reported the following results.

Reported net income of $136,000.

Cash dividends of $69,000 declared and paid.

• Tuscan discovered this year that it made a math error three years ago; to correct for this, $48,000 (net of tax) must be added to

the current year's beginning retained earnings balance.

• Revised an estimate of a machine's salvage value. Depreciation increased by $4,600 per year.

Calculate the retained earnings balance at December 31 of the current year. (Amounts to be deducted should be indicated with a

minus sign.)

Prior period adjustment

TUSCAN INCORPORATED

Statement of Retained Earnings

For Current Year Ended December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning