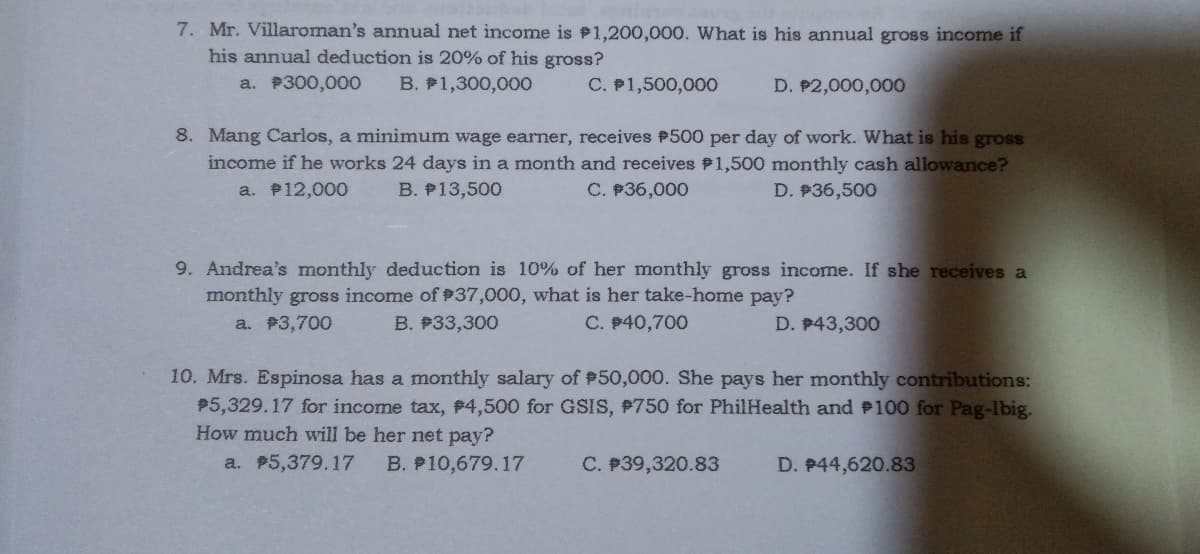

7. Mr. Villaroman's annual net income is P1,200,000. What is his annual gross income if his annual deduction is 20% of his gross? a. P300,000 B. P1,300,000 C. P1,500,000 D. P2,000,000 8. Mang Carlos, a minimum wage earner, receives P500 per day of work. What is his gross income if he works 24 days in a month and receives P1,500 monthly cash allowance? C. P36,000 a. P12,000 B. P13,500 D. P36,500 9. Andrea's monthly deduction is 10% of her monthly gross income. If she receives a monthly gross income of #37,000, what is her take-home pay? a. P3,700 B. P33,300 C. P40,700 D. P43,300 10. Mrs. Espinosa has a monthly salary of P50,000. She pays her monthly contributions: P5,329.17 for income tax, 4,500 for GSIS, P750 for PhilHealth and P100 for Pag-lbig. How much will be her net pay? a. P5,379.17 B. P10,679.17 C. P39,320.83 D. P44,620.83

7. Mr. Villaroman's annual net income is P1,200,000. What is his annual gross income if his annual deduction is 20% of his gross? a. P300,000 B. P1,300,000 C. P1,500,000 D. P2,000,000 8. Mang Carlos, a minimum wage earner, receives P500 per day of work. What is his gross income if he works 24 days in a month and receives P1,500 monthly cash allowance? C. P36,000 a. P12,000 B. P13,500 D. P36,500 9. Andrea's monthly deduction is 10% of her monthly gross income. If she receives a monthly gross income of #37,000, what is her take-home pay? a. P3,700 B. P33,300 C. P40,700 D. P43,300 10. Mrs. Espinosa has a monthly salary of P50,000. She pays her monthly contributions: P5,329.17 for income tax, 4,500 for GSIS, P750 for PhilHealth and P100 for Pag-lbig. How much will be her net pay? a. P5,379.17 B. P10,679.17 C. P39,320.83 D. P44,620.83

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

100%

please show solution

Transcribed Image Text:7. Mr. Villaroman's annual net income is P1,200,000. What is his annual gross income if

his annual deduction is 20% of his gross?

a. P300,000

B. P1,300,000

C. P1,500,000

D. P2,000,000

8. Mang Carlos, a minimum wage earner, receives #500 per day of work. What is his gross

income if he works 24 days in a month and receives 1,500 monthly cash allowance?

C. P36,000

a. P12,000

B. P13,500

D. P36,500

9. Andrea's monthly deduction is 10% of her monthly gross income. If she receives a

monthly gross income of #37,000, what is her take-home pay?

a. P3,700

B. P33,300

C. P40,700

D. P43,300

10. Mrs. Espinosa has a monthly salary of P50,000. She pays her monthly contributions:

P5,329.17 for income tax, #4,500 for GSIS, #750 for PhilHealth and P100 for Pag-Ibig.

How much will be her net pay?

a. P5,379.17

B. P10,679.17

C. P39,320.83

D. P44,620.83

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,