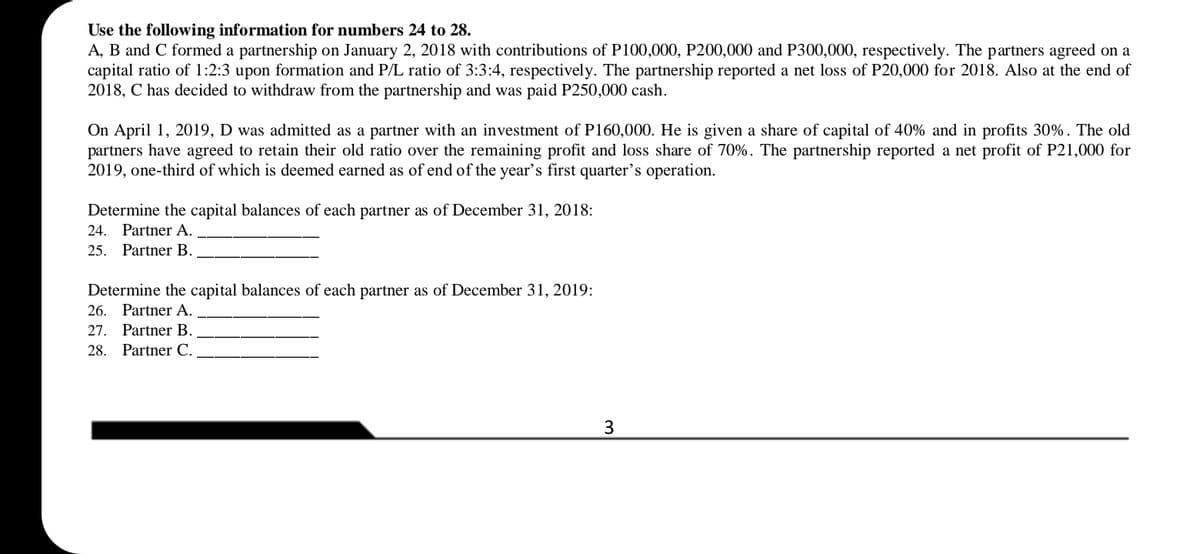

Use the following information for numbers 24 to 28. A, B and C formed a partnership on January 2, 2018 with contributions of P100,000, P200,000 and P300,000, respectively. The partners agreed on a capital ratio of 1:2:3 upon formation and P/L ratio of 3:3:4, respectively. The partnership reported a net loss of P20,000 for 2018. Also at the end of 2018, C has decided to withdraw from the partnership and was paid P250,000 cash. On April 1, 2019, D was admitted as a partner with an investment of P160,000. He is given a share of capital of 40% and in profits 30%. The old partners have agreed to retain their old ratio over the remaining profit and loss share of 70%. The partnership reported a net profit of P21,000 for 2019, one-third of which is deemed earned as of end of the year's first quarter's operation. Determine the capital balances of each partner as of December 31, 2018: 24. Partner A. 25. Partner B. Determine the capital balances of each partner as of December 31, 2019: 26. Partner A. 27. Partner B. 28. Partner C.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps