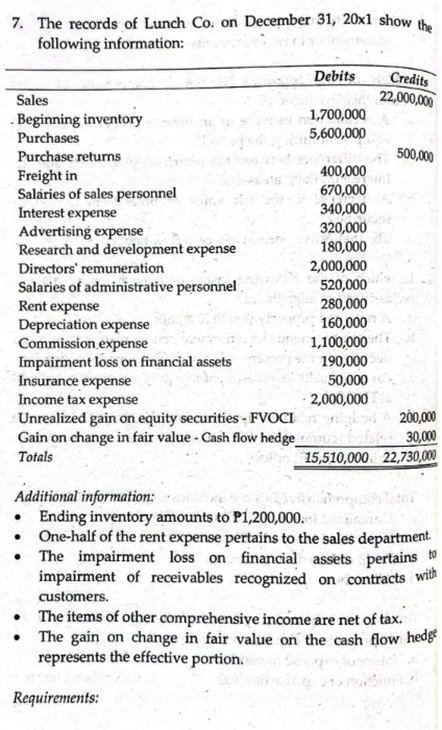

7. The records of Lunch Co. on December 31, 20x1 show following information: Debits Credits 22,000,000 Sales . Beginning inventory Purchases 1,700,000 5,600,000 Purchase returns 500,000 Freight in Saláries of sales personnel Interest expense Advertising expense Research and development expense Directors' remuneration 400,000 670,000 340,000 320,000 180,000 2,000,000 520,000 280,000 160,000 Salaries of administrative personnel Rent expense Depreciation expense Commission.expense Impáirment loss on financial assets Insurance expense Income tax expense Unrealized gain on equity securities - FVOCI Gain on change in fair value - Cash flow hedge Totals 1,100,000 190,000 50,000 · 2,000,000 200,000 30,000 15,510,000 22,730,000 Additional information: Ending inventory amounts to P1,200,000. • One-half of the rent expense pertains to the sales department. The impairment loss on financial assets pertains to impairment of receivables recognized on contracts with customers. The items of other comprehensive income are net of tax. The gain on change in fair value on the cash flow hedge represents the effective portion. Requirements:

7. The records of Lunch Co. on December 31, 20x1 show following information: Debits Credits 22,000,000 Sales . Beginning inventory Purchases 1,700,000 5,600,000 Purchase returns 500,000 Freight in Saláries of sales personnel Interest expense Advertising expense Research and development expense Directors' remuneration 400,000 670,000 340,000 320,000 180,000 2,000,000 520,000 280,000 160,000 Salaries of administrative personnel Rent expense Depreciation expense Commission.expense Impáirment loss on financial assets Insurance expense Income tax expense Unrealized gain on equity securities - FVOCI Gain on change in fair value - Cash flow hedge Totals 1,100,000 190,000 50,000 · 2,000,000 200,000 30,000 15,510,000 22,730,000 Additional information: Ending inventory amounts to P1,200,000. • One-half of the rent expense pertains to the sales department. The impairment loss on financial assets pertains to impairment of receivables recognized on contracts with customers. The items of other comprehensive income are net of tax. The gain on change in fair value on the cash flow hedge represents the effective portion. Requirements:

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.7P

Related questions

Question

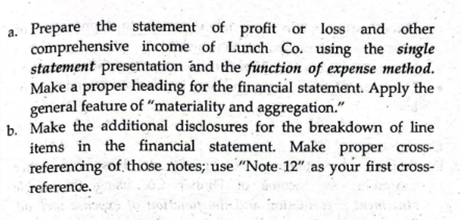

Transcribed Image Text:a. Prepare the statement of profit or loss and other

comprehensive income of Lunch Co. using the single

statement presentation and the function of expense method.

Make a proper heading for the financial statement. Apply the

general feature of "materiality and aggregation."

b. Make the additional disclosures for the breakdown of line

items in the financial statement. Make proper cross-

referencing of those notes; use "Note 12" as your first cross-

reference.

Transcribed Image Text:7. The records of Lunch Co. on December 31, 20x1 show the

following information:

Credits

22,000,000

Debits

Sales

Beginning inventory

1,700,000

Purchases

5,600,000

Purchase returns

500,000

400,000

Freight in

Saláries of sales personnel

670,000

340,000

Interest expense

Advertising expense

Research and development expense

320,000

180,000

2,000,000

520,000

Directors' remuneration

Salaries of administrative personnel

Rent expense

Depreciation expense

Commission.expense

Impáirment loss on financial assets

Insurance expense

Income tax expense

Unrealized gain on equity securities - FVOCI

Gain on change in fair value - Cash flow hedge

280,000

160,000

1,100,000

190,000

50,000

- 2,000,000

200,000

30,000

15,510,000 22,730,000

Totals

Additional information:

Ending inventory amounts to P1,200,000.-

• One-half of the rent expense pertains to the sales department.

• The impairment loss on financial assets pertains

impairment of receivables recognized on contracts 'with

customers.

• The items of other comprehensive income are net of tax.

• The gain on change in fair value on the cash flow hedge

represents the effective portion.

Requirements:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning