Which of the following is a reason a borrower may want to refinance? O A. The borrower's house value declines O B. Lender's demand lower DTIS O C. Lender's demand lower LTVS O D. The borrower's credit score rises QUESTION 15 Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1,200 and monthly homeowner's insurance of $300. Apple bank has a maximum front end DTI limit of 28%. Considering only the front end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? OA. $82,500.00 O B. $84,000.00 OC. $5,500.00 OD. $7,000.00

Which of the following is a reason a borrower may want to refinance? O A. The borrower's house value declines O B. Lender's demand lower DTIS O C. Lender's demand lower LTVS O D. The borrower's credit score rises QUESTION 15 Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1,200 and monthly homeowner's insurance of $300. Apple bank has a maximum front end DTI limit of 28%. Considering only the front end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? OA. $82,500.00 O B. $84,000.00 OC. $5,500.00 OD. $7,000.00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 5CE

Related questions

Concept explainers

Question

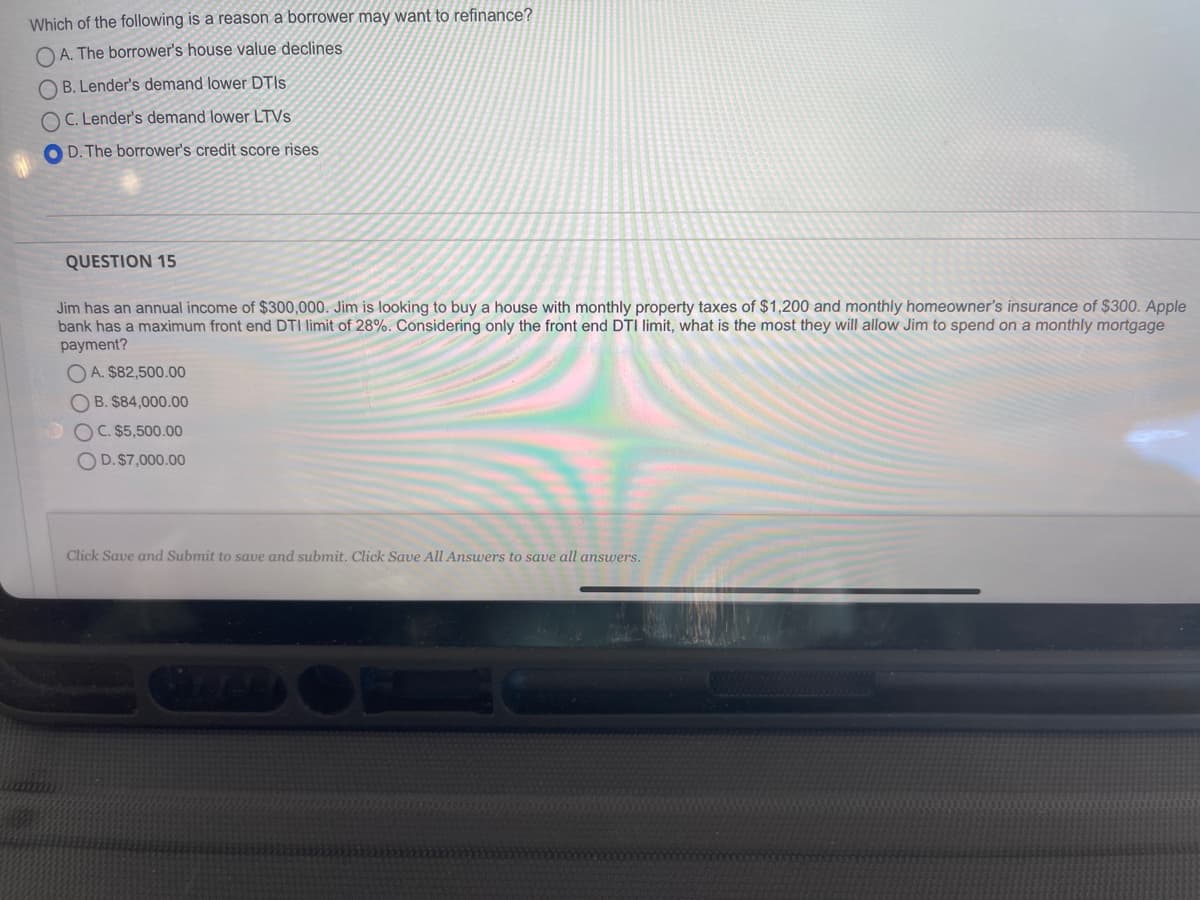

Transcribed Image Text:Which of the following is a reason a borrower may want to refinance?

O A. The borrower's house value declines

O B. Lender's demand lower DTIS

O C. Lender's demand lower LTVS

O D. The borrower's credit score rises

QUESTION 15

Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1,200 and monthly homeowner's insurance of $300. Apple

bank has a maximum front end DTI limit of 28%. Considering only the front end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage

payment?

O A. $82,500.00

O B. $84,000.00

OC. $5,500.00

O D. $7,000.00

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

GZED

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning