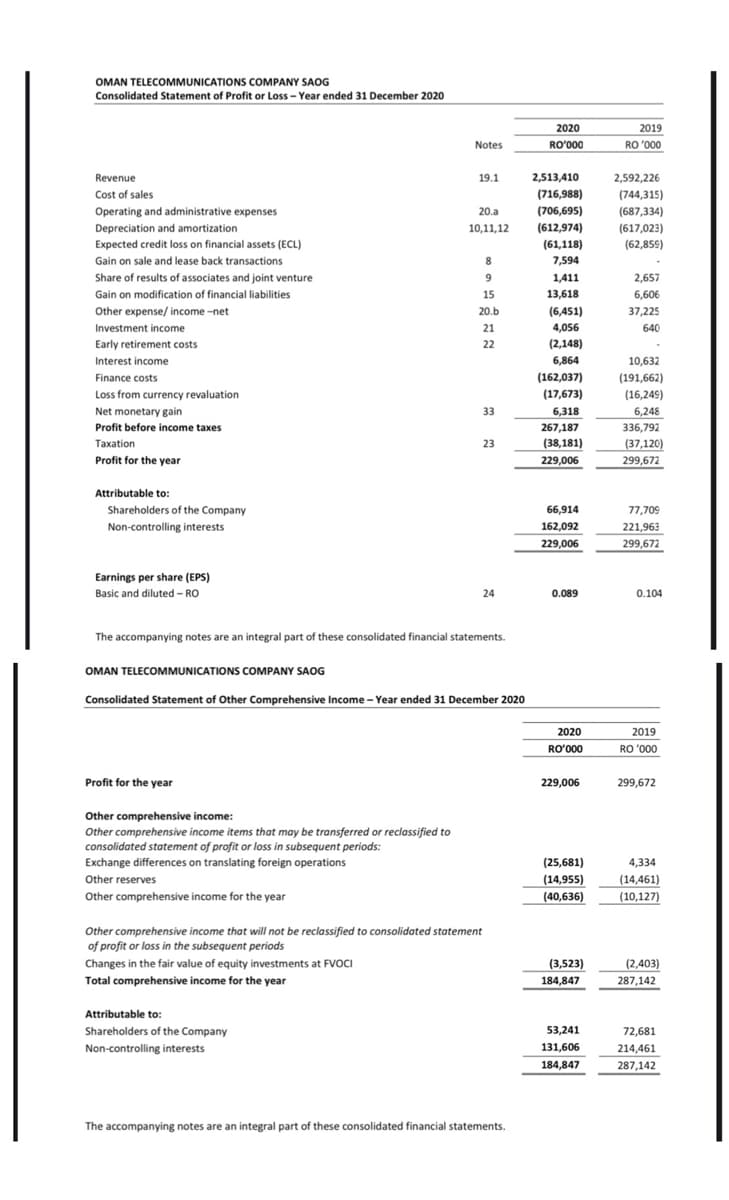

(706,695) (687,334) (617,023) Operating and administrative expenses 20.a Depreciation and amortization 10,11,12 (612,974) Expected credit loss on financial assets (ECL) (61,118) (62,859) Gain on sale and lease back transactions 8 7,594 Share of results of associates and joint venture 9 1,411 2,657 Gain on modification of financial liabilities 15 13,618 6,606 Other expense/ income -net 20.b (6,451) 37,225 Investment income 21 4,056 640 Early retirement costs 22 (2,148) Interest income 6,864 10,632 Finance costs (162,037) (191,662) Loss from currency revaluation (17,673) (16,249) Net monetary gain 33 6,318 6,248 Profit before income taxes 267,187 336,792 Taxation 23 (38,181) (37,120) 299,672 Profit for the year 229,006 Attributable to: Shareholders of the Company 66,914 77,709 Non-controlling interests 162,092 229,006 221,963 299,672 Earnings per share (EPS) Basic and diluted - RO 24 0.089 0.104 The accompanying notes are an integral part of these consolidated financial statements. OMAN TELECOMMUNICATIONS COMPANY SAOG Consolidated Statement of Other Comprehensive Income - Year ended 31 December 2020 2020 2019 RO'000 RO '000 Profit for the year 229,006 299,672 Other comprehensive income: Other comprehensive income items that may be transferred or reclassified to consolidated statement of profit or loss in subsequent periods: Exchange differences on translating foreign operations (25,681) 4,334 (14,461) (10,127) Other reserves (14,955) (40,636) Other comprehensive income for the year Other comprehensive income that will not be reclassified to consolidated statement of profit or loss in the subsequent periods Changes in the fair value of equity investments at FVOCI (3,523) 184,847 (2,403) 287,142 Total comprehensive income for the year Attributable to: Shareholders of the Company 53,241 72,681 131,606 184,847 Non-controlling interests 214,461 287,142 The accompanying notes are an integral part of these consolidated financial statements.

(706,695) (687,334) (617,023) Operating and administrative expenses 20.a Depreciation and amortization 10,11,12 (612,974) Expected credit loss on financial assets (ECL) (61,118) (62,859) Gain on sale and lease back transactions 8 7,594 Share of results of associates and joint venture 9 1,411 2,657 Gain on modification of financial liabilities 15 13,618 6,606 Other expense/ income -net 20.b (6,451) 37,225 Investment income 21 4,056 640 Early retirement costs 22 (2,148) Interest income 6,864 10,632 Finance costs (162,037) (191,662) Loss from currency revaluation (17,673) (16,249) Net monetary gain 33 6,318 6,248 Profit before income taxes 267,187 336,792 Taxation 23 (38,181) (37,120) 299,672 Profit for the year 229,006 Attributable to: Shareholders of the Company 66,914 77,709 Non-controlling interests 162,092 229,006 221,963 299,672 Earnings per share (EPS) Basic and diluted - RO 24 0.089 0.104 The accompanying notes are an integral part of these consolidated financial statements. OMAN TELECOMMUNICATIONS COMPANY SAOG Consolidated Statement of Other Comprehensive Income - Year ended 31 December 2020 2020 2019 RO'000 RO '000 Profit for the year 229,006 299,672 Other comprehensive income: Other comprehensive income items that may be transferred or reclassified to consolidated statement of profit or loss in subsequent periods: Exchange differences on translating foreign operations (25,681) 4,334 (14,461) (10,127) Other reserves (14,955) (40,636) Other comprehensive income for the year Other comprehensive income that will not be reclassified to consolidated statement of profit or loss in the subsequent periods Changes in the fair value of equity investments at FVOCI (3,523) 184,847 (2,403) 287,142 Total comprehensive income for the year Attributable to: Shareholders of the Company 53,241 72,681 131,606 184,847 Non-controlling interests 214,461 287,142 The accompanying notes are an integral part of these consolidated financial statements.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3MC

Related questions

Question

Which format of Income statement is used, single step or multi-step income statement? Briefly discuss the difference between the two type of Income statement.

Transcribed Image Text:OMAN TELECOMMUNICATIONS COMPANY SAOG

Consolidated Statement of Profit or Loss - Year ended 31 December 2020

2020

2019

Notes

RO'000

RO '000

Revenue

19.1

2,513,410

2,592,226

Cost of sales

(716,988)

(744,315)

Operating and administrative expenses

20.a

(706,695)

(687,334)

Depreciation and amortization

10,11,12

(612,974)

(617,023)

Expected credit loss on financial assets (ECL)

(61,118)

(62,859)

Gain on sale and lease back transactions

8.

7,594

Share of results of associates and joint venture

9

1,411

2,657

Gain on modification of financial liabilities

15

13,618

6,606

(6,451)

4,056

Other expense/ income -net

20.b

37,225

Investment income

21

640

(2,148)

6,864

Early retirement costs

22

Interest income

10,632

(191,662)

(16,249)

Finance costs

(162,037)

Loss from currency revaluation

(17,673)

Net monetary gain

33

6,318

6,248

Profit before income taxes

267,187

336,792

Taxation

23

(38,181)

(37,120)

299,672

Profit for the year

229,006

Attributable to:

Shareholders of the Company

66.914

77,709

Non-controlling interests

162,092

229,006

221,963

299,672

Earnings per share (EPS)

Basic and diluted - RO

24

0.089

0.104

The accompanying notes are an integral part of these consolidated financial statements.

OMAN TELECOMMUNICATIONS COMPANY SAOG

Consolidated Statement of Other Comprehensive Income - Year ended 31 December 2020

2020

2019

RO'000

RO '000

Profit for the year

229,006

299,672

Other comprehensive income:

Other comprehensive income items that may be transferred or reclassified to

consolidated statement of profit or loss in subsequent periods:

Exchange differences on translating foreign operations

(25,681)

4,334

(14,955)

(40,636)

(14,461)

(10,127)

Other reserves

Other comprehensive income for the year

Other comprehensive income that will not be reclassified to consolidated statement

of profit or loss in the subsequent periods

Changes in the fair value of equity investments at FVOCI

(3,523)

184,847

(2,403)

287,142

Total comprehensive income for the year

Attributable to:

Shareholders of the Company

53,241

72,681

Non-controlling interests

131,606

184,847

214,461

287,142

The accompanying notes are an integral part of these consolidated financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning