8. Generally, the following can exercise the power of taxation, except: a. The local sanggunian b. The members of the House of Representatives c. The president d. The senators

8. Generally, the following can exercise the power of taxation, except: a. The local sanggunian b. The members of the House of Representatives c. The president d. The senators

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 23P

Related questions

Question

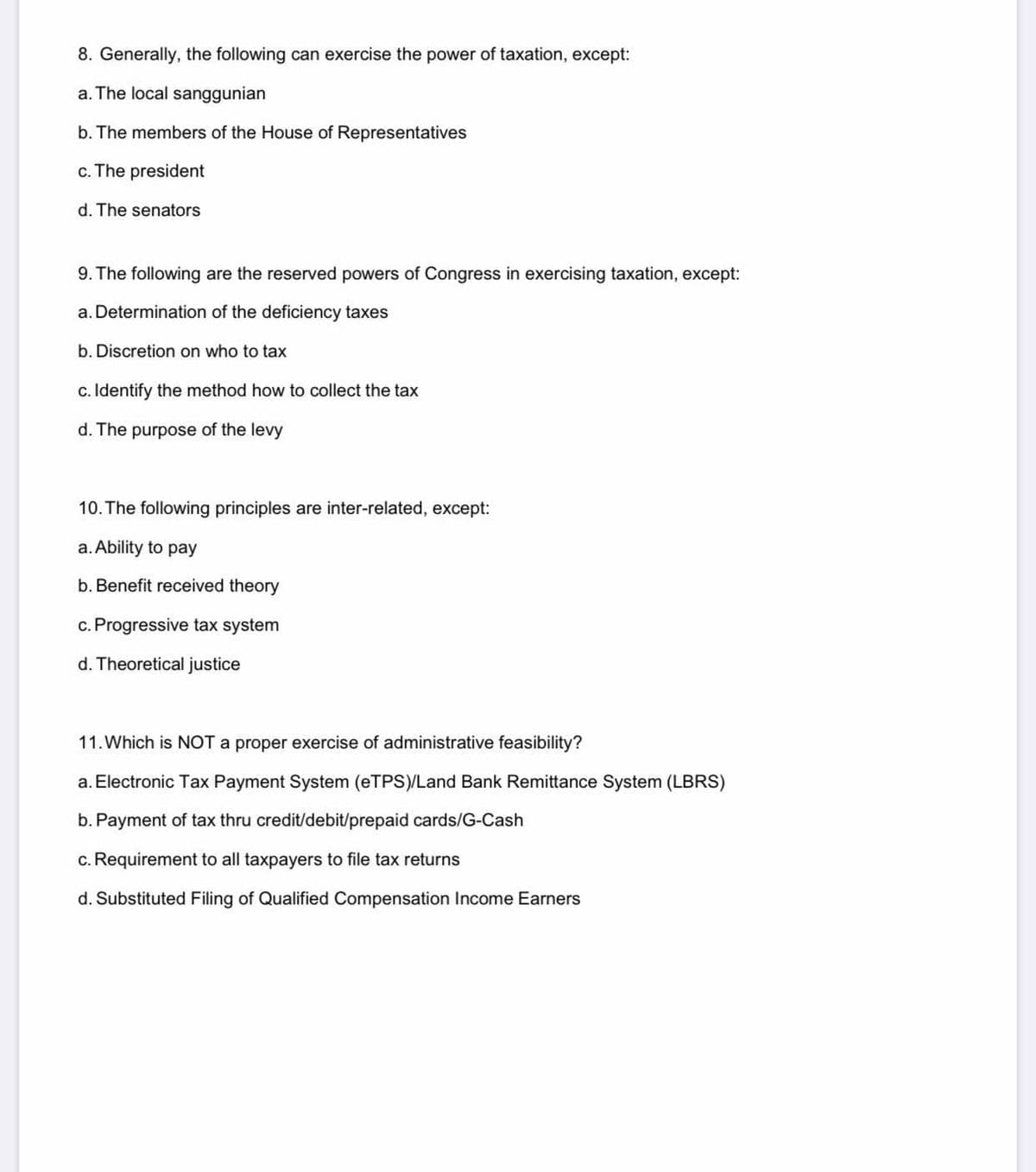

Transcribed Image Text:8. Generally, the following can exercise the power of taxation, except:

a. The local sanggunian

b. The members of the House of Representatives

c. The president

d. The senators

9. The following are the reserved powers of Congress in exercising taxation, except:

a. Determination of the deficiency taxes

b. Discretion on who to tax

c. Identify the method how to collect the tax

d. The purpose of the levy

10. The following principles are inter-related, except:

a. Ability to pay

b. Benefit received theory

c. Progressive tax system

d. Theoretical justice

11. Which is NOT a proper exercise of administrative feasibility?

a. Electronic Tax Payment System (eTPS)/Land Bank Remittance System (LBRS)

b. Payment of tax thru credit/debit/prepaid cards/G-Cash

c. Requirement to all taxpayers to file tax returns

d. Substituted Filing of Qualified Compensation Income Earners

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT