During the 2020 tax year, Salomie borrowec money to buy an investment property. The property was immediately rented out. She recorded the following expenses: At the time of purchase, the roof was damaged. She spent $100,000 to replace th entire roof. Two months after moving in, tenants revers- into the fence, Salomie paid $500 to repair

During the 2020 tax year, Salomie borrowec money to buy an investment property. The property was immediately rented out. She recorded the following expenses: At the time of purchase, the roof was damaged. She spent $100,000 to replace th entire roof. Two months after moving in, tenants revers- into the fence, Salomie paid $500 to repair

Chapter13: Property Transact Ions: Determination Of Gain Or Loss, Basis Considerations, And Nontaxable Exchanges

Section: Chapter Questions

Problem 87P

Related questions

Question

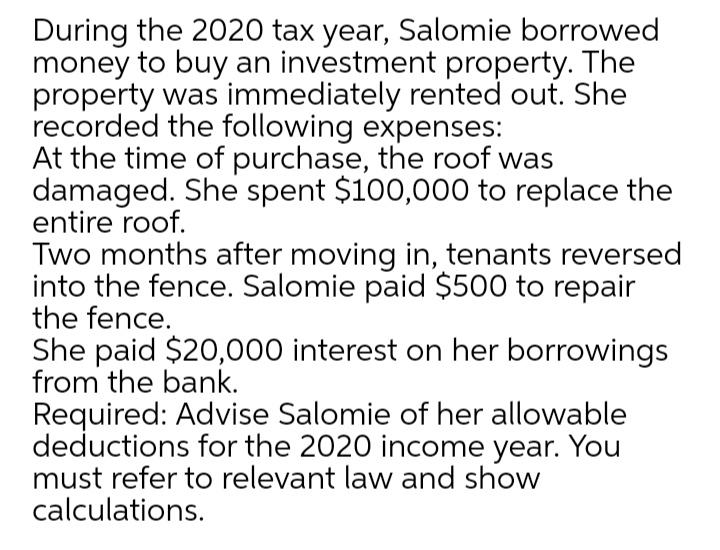

Transcribed Image Text:During the 2020 tax year, Salomie borrowed

money to buy an investment property. The

property was immediately rented out. She

recorded the following expenses:

At the time of purchase, the roof was

damaged. She spent $100,000 to replace the

entire roof.

Two months after moving in, tenants reversed

into the fence. Salomie paid $500 to repair

the fence.

She paid $20,000 interest on her borrowings

from the bank.

Required: Advise Salomie of her allowable

deductions for the 2020 income year. You

must refer to relevant law and show

calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT