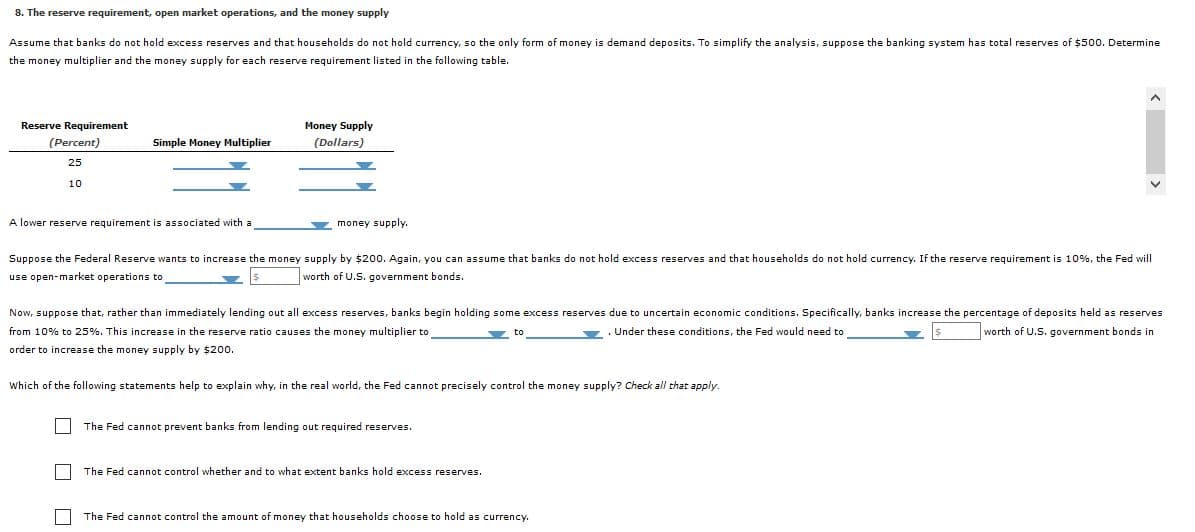

8. The reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Money Supply (Percent) Simple Money Multiplier (Dollars) 25 10 A lower reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to worth of U.S. government bonds. Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions. Specifically, banks increase the percentage of deposits held as reserves from 10% to 25%. This increase in the reserve ratio causes the money multiplier to Under these conditions, the Fed would need to worth of U.S. government bonds in order to increase the money supply by $20o. Which of the following statements help to explain why, in the real world, the Fed cannot precisely control the money supply? Check all that apply. The Fed cannot prevent banks from lending out required reserves. The Fed cannot control whether and to what extent banks hold excess reserves. The Fed cannot control the amount of money that households choose to hold as currency.

8. The reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Money Supply (Percent) Simple Money Multiplier (Dollars) 25 10 A lower reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to worth of U.S. government bonds. Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions. Specifically, banks increase the percentage of deposits held as reserves from 10% to 25%. This increase in the reserve ratio causes the money multiplier to Under these conditions, the Fed would need to worth of U.S. government bonds in order to increase the money supply by $20o. Which of the following statements help to explain why, in the real world, the Fed cannot precisely control the money supply? Check all that apply. The Fed cannot prevent banks from lending out required reserves. The Fed cannot control whether and to what extent banks hold excess reserves. The Fed cannot control the amount of money that households choose to hold as currency.

Chapter14: Banking And The Money Supply

Section: Chapter Questions

Problem 3.4P

Related questions

Question

Transcribed Image Text:8. The reserve requirement, open market operations, and the money supply

Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine

the money multiplier and the money supply for each reserve requirement listed in the following table.

Reserve Requirement

Money Supply

(Percent)

Simple Money Multiplier

(Dollars)

25

10

A lower reserve requirement is associated with a

money supply.

Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will

use open-market operations to

worth of U.S. government bonds.

Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions. Specifically, banks increase the percentage of deposits held as reserves

from 10% to 25%. This increase in the reserve ratio causes the money multiplier to

Under these conditions, the Fed would need to

worth of U.S. government bonds in

order to increase the money supply by $20o.

Which of the following statements help to explain why, in the real world, the Fed cannot precisely control the money supply? Check all that apply.

The Fed cannot prevent banks from lending out required reserves.

The Fed cannot control whether and to what extent banks hold excess reserves.

The Fed cannot control the amount of money that households choose to hold as currency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning