840,000 Common stock and APIC, 12/31/20 (*The term "Net income" means Pelican's investment income has been included.) uired: Provide the following figures: onsolidated net income of Pelican and Sun, 2020: 568,000 elican's "Investment in Sun" at 12/31/20 (in Pelican's balance sheet):

840,000 Common stock and APIC, 12/31/20 (*The term "Net income" means Pelican's investment income has been included.) uired: Provide the following figures: onsolidated net income of Pelican and Sun, 2020: 568,000 elican's "Investment in Sun" at 12/31/20 (in Pelican's balance sheet):

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 56BPSB: Problem 1-563 Applying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation...

Related questions

Question

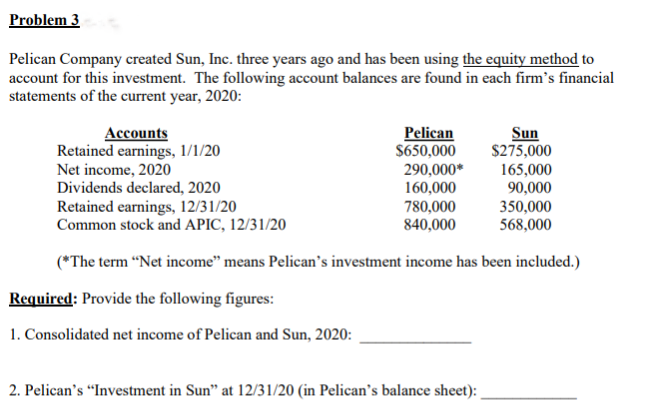

Transcribed Image Text:Problem 3

Pelican Company created Sun, Inc. three years ago and has been using the equity method to

account for this investment. The following account balances are found in each firm's financial

statements of the current year, 2020:

Accounts

Retained earnings, 1/1/20

Net income, 2020

Dividends declared, 2020

Retained earnings, 12/31/20

Common stock and APIC, 12/31/20

Pelican

$650,000

290,000*

160,000

780,000

840,000

Sun

$275,000

165,000

90,000

350,000

568,000

(*The term "Net income" means Pelican's investment income has been included.)

Required: Provide the following figures:

1. Consolidated net income of Pelican and Sun, 2020:

2. Pelican's "Investment in Sun" at 12/31/20 (in Pelican's balance sheet):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning