Questions: Based on the above data, answer the following: (Round off present value factors to four decimal places) 1. Which one of the following is a correct adjusting entry for the accounts

Questions: Based on the above data, answer the following: (Round off present value factors to four decimal places) 1. Which one of the following is a correct adjusting entry for the accounts

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6P

Related questions

Question

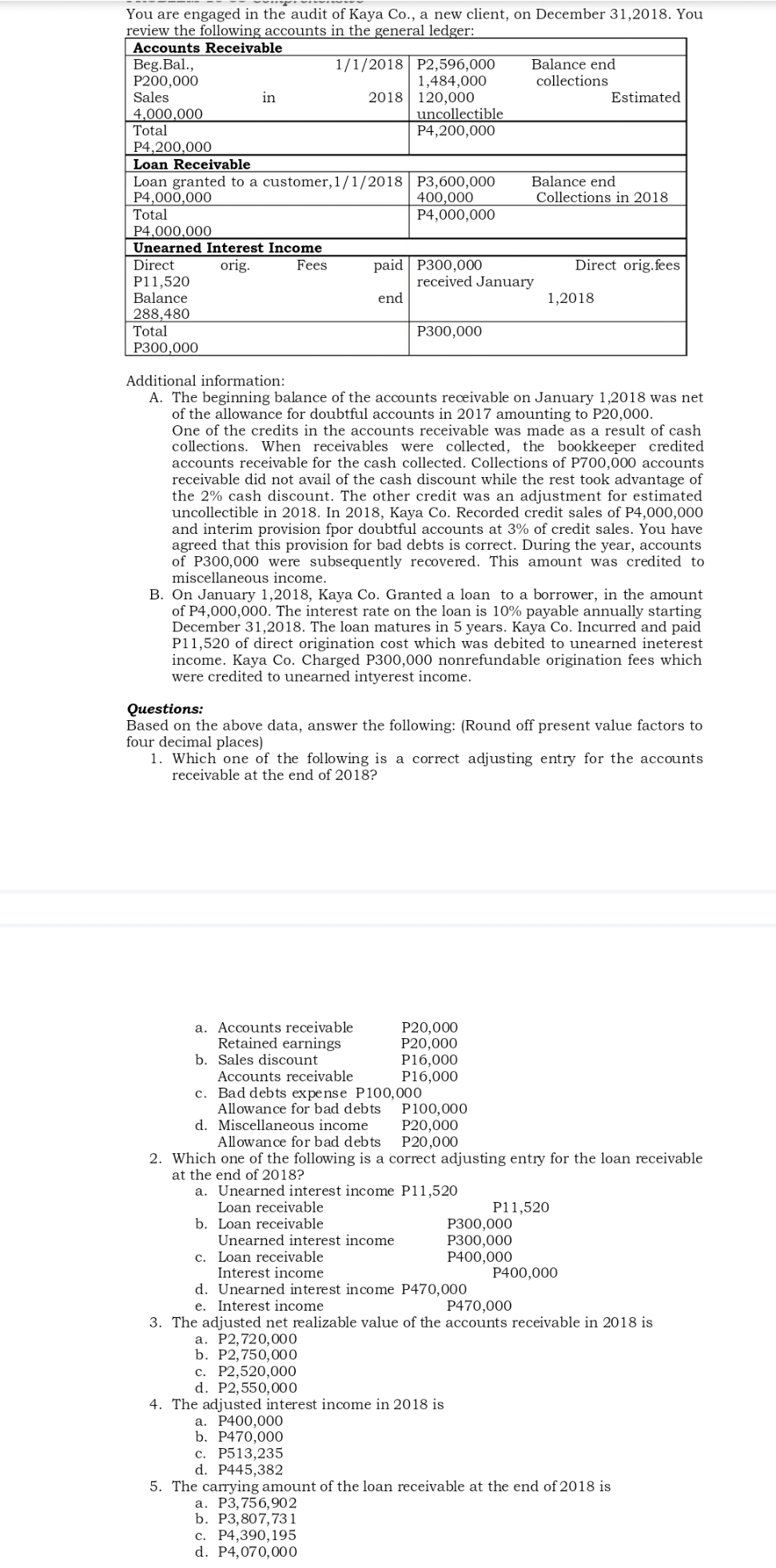

Transcribed Image Text:You are engaged in the audit of Kaya Co., a new client, on December 31,2018. You

review the following accounts in the general ledger:

Accounts Receivable

Beg.Bal.,

P200,000

Sales

4,000,000

Total

P4,200,000

Loan Receivable

Loan granted to a customer, 1/1/2018 P3,600,000

P4,000,000

400,000

Total

P4,000,000

P4,000,000

Unearned Interest Income

orig.

Fees

Direct

P11,520

Balance

288,480

Total

P300,000

in

1/1/2018 P2,596,000

1,484,000

120,000

Accounts receivable

Retained earnings

b. Sales discount

2018

Loan receivable

b. Loan receivable

paid

end

uncollectible

P4,200,000

Unearned interest income

a. P2,720,000

b. P2,750,000

P300,000

Additional information:

A. The beginning balance of the accounts receivable on January 1,2018 was net

of the allowance for doubtful accounts in 2017 amounting to P20,000.

One of the credits in the accounts receivable was made as a result of cash

collections. When receivables were collected, the bookkeeper credited

accounts receivable for the cash collected. Collections of P700,000 accounts

receivable did not avail of the cash discount while the rest took advantage of

the 2% cash discount. The other credit was an adjustment for estimated

uncollectible in 2018. In 2018, Kaya Co. Recorded credit sales of P4,000,000

and interim provision fpor doubtful accounts at 3% of credit sales. You have

agreed that this provision for bad debts is correct. During the year, accounts

of P300,000 were subsequently recovered. This amount was credited to

miscellaneous income.

P300,000

received January

B. On January 1,2018, Kaya Co. Granted a loan to a borrower, in the amount

of P4,000,000. The interest rate on the loan is 10% payable annually starting

December 31,2018. The loan matures in 5 years. Kaya Co. Incurred and paid

P11,520 of direct origination cost which was debited to unearned ineterest

income. Kaya Co. Charged P300,000 nonrefundable origination fees which

were credited to unearned intyerest income.

Questions:

Based on the above data, answer the following: (Round off present value factors to

four decimal places)

1. Which one of the following is a correct adjusting entry for the accounts

receivable at the end of 2018?

c. P4,390, 195

d. P4,070,000

P20,000

P20,000

P16,000

P16,000

Balance end

collections

Accounts receivable

c. Bad debts expense P100,000

Allowance for bad debts

d. Miscellaneous income

Allowance for bad debts

2. Which one of the following is a correct adjusting entry for the loan receivable

at the end of 2018?

a. Unearned interest income P11,520

P100,000

P20,000

P20,000

c. Loan receivable

Interest income

d. Unearned interest income P470,000

e. Interest income

Balance end

Collections in 2018

c. P2,520,000

d. P2,550,000

4. The adjusted interest income in 2018 is

a. P400,000

b. P470,000

1,2018

P300,000

P300,000

P400,000

Estimated

Direct orig.fees

P11,520

P400,000

P470,000

3. The adjusted net realizable value of the accounts receivable in 2018 is

c. P513,235

d. P445,382

5. The carrying amount of the loan receivable at the end of 2018 is

a. P3,756,902

b. P3,807,731

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning