8ption plan, National Corporation granted 12 million options on January 1, 2021, that permit executives to urchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2023 (the vesting ate). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated an appropriate option pricing model, is $5 per option. Suppose that unexpected turnover during 2022 caused the forfeiture of 5% the stock options. empute the amaunt of compensation expense for 2022 and 2023. (Enter your answers in millons (Le., 10,000,000 should be tered as 10).) Compensation expense (S in millions) 22 23

8ption plan, National Corporation granted 12 million options on January 1, 2021, that permit executives to urchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2023 (the vesting ate). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated an appropriate option pricing model, is $5 per option. Suppose that unexpected turnover during 2022 caused the forfeiture of 5% the stock options. empute the amaunt of compensation expense for 2022 and 2023. (Enter your answers in millons (Le., 10,000,000 should be tered as 10).) Compensation expense (S in millions) 22 23

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 7RE: On January 1, 2019, Phoenix Corporation adopts a performance-based share option plan for 25...

Related questions

Question

Please help me

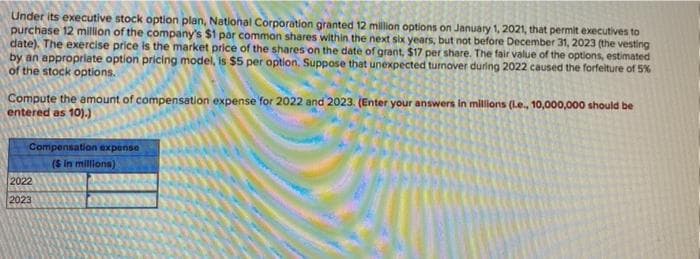

Transcribed Image Text:Under its executive stock option plan, Natilonal Corporation granted 12 million options on January 1, 2021, that permit executives to

purchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2023 (the vesting

date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated

by an appropriate option pricing model, is $5 per option. Suppose that unexpected tumover during 2022 caused the forfelture of 5%

of the stock options.

Compute the amount of compensation expense for 2022 and 2023. (Enter your answers in millions (L.e., 10,000,000 should be

entered as 10).)

Compensation expense

(S in millions)

2022

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT