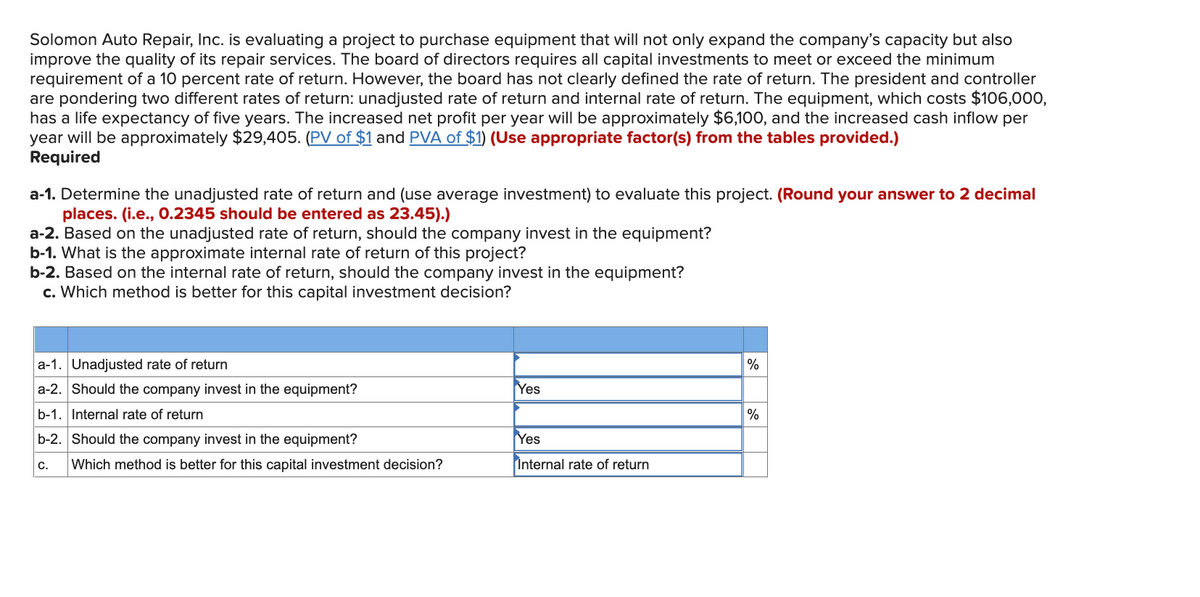

a-1. Determine the unadjusted rate of return and (use ave places. (i.e., 0.2345 should be entered as 23.45).) a-2. Based on the unadjusted rate of return, should the ce b-1. What is the approximate internal rate of return of this

Q: How much is the net cash flows from operating activities?

A: Answer:

Q: orrection of Errors Grace’s trial balance did not balance, the debits exceeded the credits by $1…

A: There are various errors that take place while recording, posting, and balancing accounts. These…

Q: Assume a parent company acquired its subsidiary on January 1, 2016. On January 1, 2016, the…

A: When a company holds shares in another company then the income needs to be consolidated. The holder…

Q: Prepare a budget report based on flexible budget data to help Joe -хpenses.)

A: In this question, we have to calculate the budget report for the swift company clothing department.…

Q: Create a Statement of Cash Flows using the information provided.

A: The cash flow statement is the statement that depicts the inflows and outflow of cash and cash…

Q: Reuben's Deli currently makes rolls for deli sandwiches it produces. It uses 31,000 rolls annually…

A: In make or buy decision making, that option should be adopted which is less costly.

Q: nd equipment which has a fair market value of mer made an additional investment of P150,00 of the…

A: Owners capital is the owners personal assets invested by him in the business . It could be cash or…

Q: the company marks up its manufacturing costs by 10% then the selling price for Job A319 would be…

A: Calculation of overhead rates Fixed manufacturing overhead rate (Milling department) = Fixed…

Q: A 1000 par value 10-year bond with 6.0% semiannual coupons was convertible semiannually. bought to…

A: It is the amount liable to the bondholders by the issuer of bonds. These bonds payable will be…

Q: QUESTION 1 Which of the following is a for AGI deduction? O Traditional IRA contribution Property…

A: Home mortgage interest expense is for AGI deduction.

Q: January 3 Purchased equipment for $55000, paying $45000 in cash and signing a 10000, 4-month, 10%…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: 1. On June 10, Krabby burger Shack purchased $6,000 of merchandise from Chum Bucket FOB shipping…

A: Journal Entries - Journal Entries are the entries recorded as debit and credit in the journal…

Q: True or false Total net cash provided from the three major activities less total net cash used…

A: Net increase or decrease in cash or cash equivalents = Net cash provided from the three major…

Q: Gross profit method - GPR based on sales - - On Nov. 29, 20x1, a meteorite struck the warehouse of…

A: Inventory means the goods in which business deals. Inventory can be calculated by preparing the…

Q: Question #2 - Post the transactions to the Ledger PLEASEE HELP ME HURRU.I AM IN DESK Wanda, the…

A:

Q: A company produced 500 units of a product and incurred the following costs. Direct materials,…

A: Contribution margin: The balance when the sales are deducted by the variable costs is known as…

Q: The assets and liabilities of Global Travel Agency on December 31, 20Y5, and its revenue and…

A: Disclaimer: ''Since you have posted a question with multiple parts, we will solve the first three…

Q: $1,000 in exp e depreciatie

A: Part A Initial Cost of Equipment +Overhead= $20000 Initial cost of equipment after tax= $25600…

Q: During the month of March 2022, the following inventory transactions occurred: March 1…

A: The periodic inventory system is a method of ascertaining inventory by taking an actual physical…

Q: Explain the Advantage and Disadvantage of Debt

A: In this question, we will Explain the Advantage and Disadvantage of Debt .

Q: The budget director of Gourmet Grill Company requests estimates of sales, production, and other…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Arona Corporation manufactures canoes in two departments, Fabrication and Waterproofing. In the…

A: An equivalent unit of production is an expression of the work done by a manufacturer on partially…

Q: Accounting includes activities such as identifying, measuring, and communicating financial…

A: Accounting includes identifying, measuring, recording, posting, summarising and communicating…

Q: Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products,…

A: 1. Standard quantity of kilograms allowed = No. of helmets x Standard quantity required to make 1…

Q: The following account balances were taken from the books of ABC Company for the month of March.…

A: Salaries payable is current liability which should be reported under liabilities section of balance…

Q: On December 31, a partnership has total partnership capital as follows: Partner #1,…

A: Introduction Partnership is the association of two or more persons who have agreed to share profit…

Q: For each of the following support departments, identify a cost driver that could be used for…

A: A cost driver seems to be the source of a cost that has an impact on the overall cost. For instance,…

Q: At the start of the period, ABC Company has total assets of P500,000 and total liabilities of…

A: Beginning equity = Total assets at the beginning - Total liabilities at the beginning Total equity…

Q: At the end of the first year of operations, Majestic Company had accounts receivable of P6,000,000,…

A: The allowance for doubtful accounts represents the uncollectible amount of sales made to customers…

Q: Viktor Hovland purchases land with natural gas reserves for $500,000. He expects to extract 2,000…

A:

Q: Transactions of Laguna Company during January follows: Pag-IBIG cont 1100.00 Income tax w/held…

A:

Q: Assume that in the first step of the reorganization, Auto Corp. will exchange $6,190,273 worth of…

A: When one company acquires another company the acquiring company is a parent and another is a…

Q: SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the…

A: Labor spending variance = Standard Labor cost - Actual Labor cost Labor rate variance = (standard…

Q: The following transactions of MORALES Accounting Firm during the first month of Operations: April 1…

A: The journal is prepared to record the transactions of the business on daily basis. The ledger…

Q: In correction of combined errors, you need to be careful with counterbalancing and non-…

A: Counter Balancing Errors If the effect of an error in one account is cancelled by the effect of one…

Q: Current Attempt in Progress In its first month of operation, Metlock Company purchased 86 units of…

A: Solution:- step2 in the solution.

Q: On June 1, 2021, Demer Consulting provides services to a customer for $150,000. To pay for the…

A: The journal entries are prepared to record the day to day transactions of the business during the…

Q: þ. Post the journal entries in the ledger accounts on the next page for Sheila McFarlane, a lawyer,…

A: Introduction:- A trial balance is a list of all of a company's general ledger accounts (including…

Q: Omega Company prepared an aging of accounts receivable on December 31, 2018 and determined that the…

A: Ending Allowance for uncollectible accounts balance = Ending accounts receivable - ending net…

Q: tables. The owne y their male chet e Becker's meas ide chould include

A: Given: pay their male chefs $45/hr Female chef $35/hr.

Q: Rooney Electronics is considering investing in manufacturing equipment expected to cost $330,000.…

A: The question is based on the concept of Financial Management. As per the Bartleby guidelines we are…

Q: A firm operated at 80% of capacity for the past year, during which fixed costs were $201,000,…

A: Marginal costing is the one widely used by the management to determine the impact of increase and…

Q: January 25 Received $1150 cash for laundry services provided in January 2022. JOUonal eny xy

A: Cash receipts of any kind are counted as accounting transactions. This is true whether a cash basis…

Q: ABC Company, a computer repair shop provided the following information at the end of its first month…

A: Income Statement Amount Revenues: Computer Repair Services Rendered 160,000…

Q: An automobile repair shop renders various car repair services for P25,000 on April 12. The shop sent…

A: Solution: under accrual method of accounting, revenues and expenses are recognized as and when they…

Q: Johnson Company bought a light general purpose truck for $20,000. Calculate the yearly depreciation…

A: MACRS is a method of depreciating the assets. Under this method, the rates at which the asset is to…

Q: haz Corporation has taxable income in 2021 of $312,000 for purposes of computing the §179 expense…

A: Capitalized Cost: A capitalized cost is a cost added to the expense premise of a proper resource on…

Q: Nighthawk Company's Income Statement for the Year Ended December 31, 2021 Sales (200,000 units)…

A: Sales (200,000 units) $1,200,000 Cost of goods sold 700,000 Gross profit 500,000 Operating expenses…

Q: The following are the selected ledger balances taken from the books of ABC Company for the year…

A: Total Assets:- Total assets are the all the assets either current or non-current owned by a company…

Q: erest Receivable Bond Carrying Or Interest Discount Amount of Cash Received Revenue Amortization…

A: >Bonds Payable are the source of finance for the companies. >The bondholders are…

Step by step

Solved in 2 steps with 1 images

- During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana’s cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: The firm’s tax rate is 40%. The current price of Jana’s 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Jana would incur flotation costs equal to 5% of the proceeds on a new issue. Jana’s common stock is currently selling at $50 per share. Its last dividend (D0) was $3.12, and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. Jana’s beta is 1.2, the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-judgmental-risk-premium approach, the firm uses a 3.2% risk premium. Jana’s target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity. To help you structure the task, Leigh Jones has asked you to answer the following questions: (1) What sources of capital should be included when you estimate Jana’s weighted average cost of capital? (2) Should the component costs be figured on a before-tax or an after-tax basis? (3) Should the costs be historical (embedded) costs or new (marginal) costs?Manny Carson, certified management accountant and controller of Wakeman Enterprises, has been given permission to acquire a new computer and software for the companys accounting system. The capital investment analysis showed an NPV of 100,000. However, the initial estimates of acquisition and installation costs were made on the basis of tentative costs without any formal bids. Manny now has two formal bids, one that would allow the firm to meet or beat the original projected NPV and one that would reduce the projected NPV by 50,000. The second bid involves a system that would increase both the initial cost and the operating cost. Normally, Manny would take the first bid without hesitation. However, Todd Downing, the owner of the firm presenting the second bid, is a close friend. Manny called Todd and explained the situation, offering Todd an opportunity to alter his bid and win the job. Todd thanked Manny and then made a counteroffer. Todd: Listen, Manny, this job at the original price is the key to a successful year for me. The revenues will help me gain approval for the loan I need for renovation and expansion. If I dont get that loan, I see hard times ahead. The financial stats for loan approval are so marginal that reducing the bid price may blow my chances. Manny: Losing the bid altogether would be even worse, dont you think? Todd: True. However, if you award me the job, Ill be able to add personnel. I know that your son is looking for a job, and I can offer him a good salary and a promising future. Additionally, Ill be able to take you and your wife on that vacation to Hawaii that weve been talking about. Manny: Well, you have a point. My son is having an awful time finding a job, and he has a wife and three kids to support. My wife is tired of having them live with us. She and I could use a vacation. I doubt that the other bidder would make any fuss if we turned it down. Its offices are out of state, after all. Todd: Out of state? All the more reason to turn it down. Given the states economy, it seems almost criminal to take business outside. Those are the kind of business decisions that cause problems for people like your son. Required: Evaluate the ethical behavior of Manny. Should Manny have called Todd in the first place? Would there have been any problems if Todd had agreed to meet the lower bid price? Identify the parts of the Statement of Ethical Professional Practice (Chapter 1) that Manny may be violating, if any.Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.

- Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Develop and solve an integer programming model for maximizing the net present value. Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). Suppose that if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation from part (b) to reflect this new situation.Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows: The companys capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals. Instructions 1. Compute the cash payback period for each of the four proposals. 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. Round to one decimal place. 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected. 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value table appearing in Exhibit 2 of this chapter. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).

- The senior VP in charge has asked that you make a recommendation for the purchase of new equipment.Ideally, the company wants to limit its capital investment to $500,000. However, if an asset meritsspending more, an investment exceeding this limit may be considered. You assemble a team to helpyou. Your goal is to determine which option will result in the best investment for the company. Toencourage capital investments, the government has exempted taxes on profits from new investments.This legislation is to be in effect for the foreseeable future.The average reported operating income for the company is $1,430,500.The company uses an 11% discount rate in evaluating capital investments.The team is considering the following optionsOption 1:The asset cost is $300,000.The asset is expected to have an 8-year useful life with no salvage value.Straight-line depreciation is used.The net cash inflow is expected to be $62,000 each year for 8 years.A significant portion of this asset is made from…Dalrymple Inc. is considering production of a new product. In evaluating whether to go ahead with the project, which of the following items should be considered when cash flows are estimated? If the item should not be included, explain why not.A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.B) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.C) The company has spent for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.D) The new product will cut into sales of some of the firm's other products.E) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million…During the last few years, Harry Davis Industries has been too constrained by the high cost of capital to makemany capital investments. Recently, though, capital costs have been declining, and the company has decidedto look seriously at a major expansion program proposed by the marketing department. Assume that you arean assistant to Leigh Jones, the financial vice president. Your first task is to estimate Harry Davis’s cost ofcapital. Jones has provided you with the following data, which she believes may be relevant to your task:(1) The firm’s tax rate is 40%.(2) The current price of Harry Davis’s 12% coupon, semi-annual payment, noncallable bonds with 15 yearsremaining to maturity is $1,225.72. Harry Davis does not use short-term interest-bearing debt on a permanentbasis. New bonds would be privately placed with no flotation cost.(3) The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $117.Harry Davis would incur flotation costs equal…

- During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana’s cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: The firm's tax rate is 25%. The current price of Jana’s 12% coupon, semiannual payment, noncallable bonds with 15 years training to maturity is $1,153.72. There are 70,000 bonds. Jana does not use short-term interest bearing debt on a permanent basis. new bonds would be privately placed with no flotation cost. The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. There are 200,000 outstanding shares. Jana would…During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana's cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: The firm's tax rate is 40%. The current price of Jana's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Jana would incur flotation costs equal to 5% of the proceeds on a new…During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana’s cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: The firm’s tax rate is 40%. The current price of Jana’s 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Jana would incur flotation costs equal to 5% of the proceeds on a new…