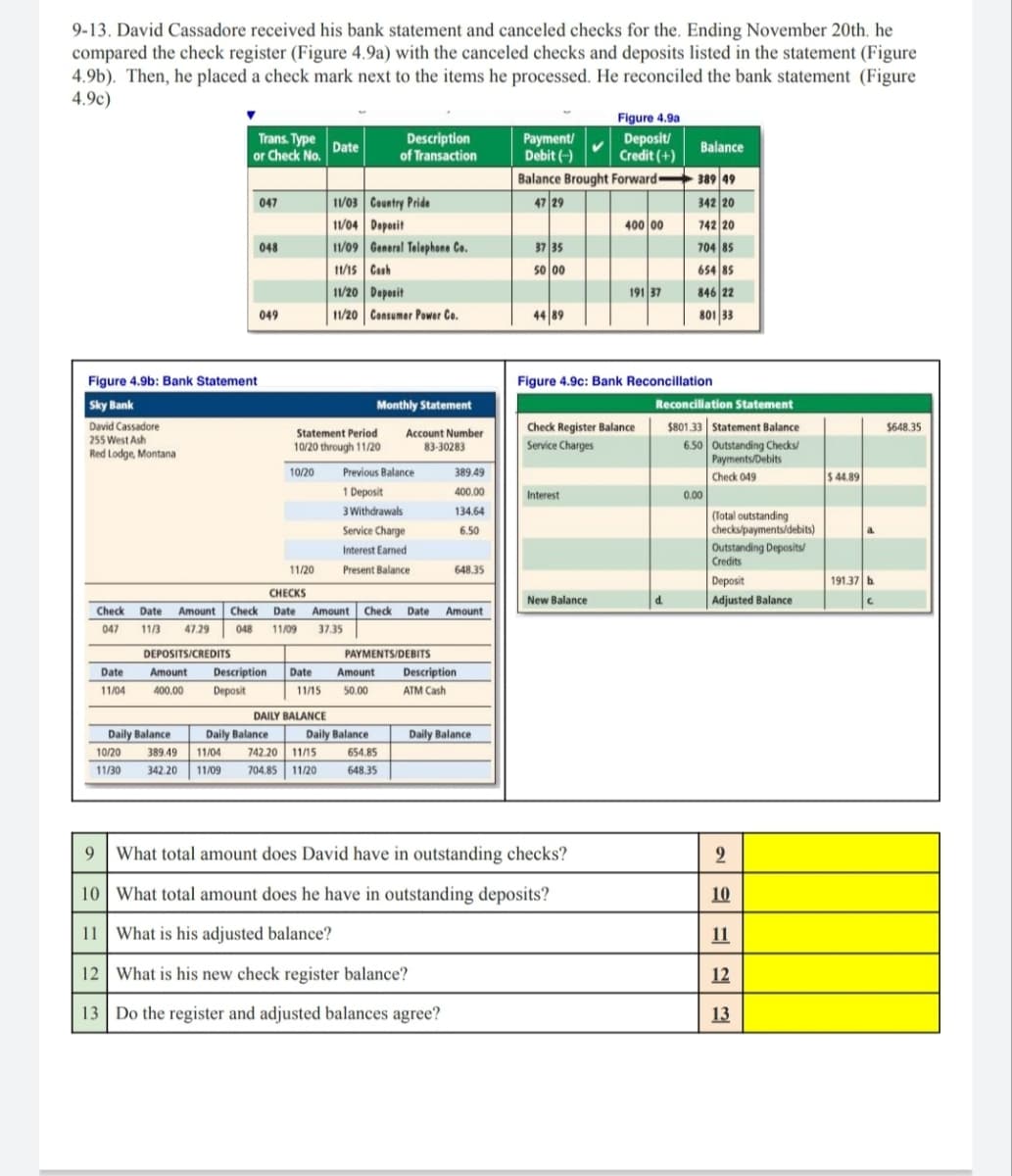

9-13. David Cassadore received his bank statement and canceled checks for the. Ending November 20th. he compared the check register (Figure 4.9a) with the canceled checks and deposits listed in the statement (Figure 4.9b). Then, he placed a check mark next to the items he processed. He reconciled the bank statement (Figure 4.9c) Trans. Type or Check No. 047 Daily Balance 048 Figure 4.9b: Bank Statement. Sky Bank David Cassadore 255 West Ash Red Lodge, Montana 10/20 11/30 049 11/20 DEPOSITS/CREDITS Date Amount Description Date 11/04 400.00 Deposit Date Statement Period 10/20 through 11/20 10/20 DAILY BALANCE Daily Balance 389.49 11/04 742.20 11/15 342.20 11/09 704.85 11/20 11/03 11/04 Deposit 11/09 General Telephone Co. 11/15 Cash Country Pride 11/20 Deposit 11/20 Consumer Power Co. Description of Transaction CHECKS Check Date Amount Check Date Amount Check Date Amount 047 11/3 47.29 048 11/09 37.35 11/15 50.00 Monthly Statement Previous Balance 1 Deposit 3 Withdrawals Service Charge Interest Earned Present Balance Amount Daily Balance Account Number 83-30283 PAYMENTS/DEBITS 654.85 648.35 389,49 400.00 134.64 6.50 648.35 Description ATM Cash Daily Balance Payment/ Debit (-) Balance Brought Forward 47 29 37 35 50 00 44 89 Figure 4.9a Deposit/ Credit (+) Interest New Balance 400 00 Figure 4.9c: Bank Reconcillation Check Register Balance Service Charges 9 What total amount does David have in outstanding checks? 10 What total amount does he have in outstanding deposits? 11 What is his adjusted balance? 12 What is his new check register balance? 13 Do the register and adjusted balances agree? 191 37 Balance 389 49 342 20 742 20 704 85 654 85 846 22 801 33 Reconciliation Statement $801.33 Statement Balance 6.50 Outstanding Checks/ Payments/Debits Check 049 d. 0.00 (Total outstanding checks/payments/debits) Outstanding Deposits/ Credits Deposit Adjusted Balance 2 10 11 12 13 $ 44.89 a 191.37 b $648.35

9-13. David Cassadore received his bank statement and canceled checks for the. Ending November 20th. he compared the check register (Figure 4.9a) with the canceled checks and deposits listed in the statement (Figure 4.9b). Then, he placed a check mark next to the items he processed. He reconciled the bank statement (Figure 4.9c) Trans. Type or Check No. 047 Daily Balance 048 Figure 4.9b: Bank Statement. Sky Bank David Cassadore 255 West Ash Red Lodge, Montana 10/20 11/30 049 11/20 DEPOSITS/CREDITS Date Amount Description Date 11/04 400.00 Deposit Date Statement Period 10/20 through 11/20 10/20 DAILY BALANCE Daily Balance 389.49 11/04 742.20 11/15 342.20 11/09 704.85 11/20 11/03 11/04 Deposit 11/09 General Telephone Co. 11/15 Cash Country Pride 11/20 Deposit 11/20 Consumer Power Co. Description of Transaction CHECKS Check Date Amount Check Date Amount Check Date Amount 047 11/3 47.29 048 11/09 37.35 11/15 50.00 Monthly Statement Previous Balance 1 Deposit 3 Withdrawals Service Charge Interest Earned Present Balance Amount Daily Balance Account Number 83-30283 PAYMENTS/DEBITS 654.85 648.35 389,49 400.00 134.64 6.50 648.35 Description ATM Cash Daily Balance Payment/ Debit (-) Balance Brought Forward 47 29 37 35 50 00 44 89 Figure 4.9a Deposit/ Credit (+) Interest New Balance 400 00 Figure 4.9c: Bank Reconcillation Check Register Balance Service Charges 9 What total amount does David have in outstanding checks? 10 What total amount does he have in outstanding deposits? 11 What is his adjusted balance? 12 What is his new check register balance? 13 Do the register and adjusted balances agree? 191 37 Balance 389 49 342 20 742 20 704 85 654 85 846 22 801 33 Reconciliation Statement $801.33 Statement Balance 6.50 Outstanding Checks/ Payments/Debits Check 049 d. 0.00 (Total outstanding checks/payments/debits) Outstanding Deposits/ Credits Deposit Adjusted Balance 2 10 11 12 13 $ 44.89 a 191.37 b $648.35

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 1CP

Related questions

Question

100%

Transcribed Image Text:9-13. David Cassadore received his bank statement and canceled checks for the. Ending November 20th. he

compared the check register (Figure 4.9a) with the canceled checks and deposits listed in the statement (Figure

4.9b). Then, he placed a check mark next to the items he processed. He reconciled the bank statement (Figure

4.9c)

Figure 4.9b: Bank Statement

Sky Bank

David Cassadore

255 West Ash

Red Lodge, Montana

Trans. Type

or Check No.

9

Date

11/04

047

048

049

Check Date Amount Check

047 11/3 47.29

10/20

11/20

Date

Statement Period

10/20 through 11/20

11/03

11/04 Deposit

11/09 General Telephone Co.

11/15 Cash

11/20 Deposit

11/20 Consumer Power Co.

DAILY BALANCE

Daily Balance Daily Balance

10/20 389.49 11/04 742.20 11/15

11/30 342.20 11/09 704.85 11/20

Country Pride

048 11/09 37.35

Description

of Transaction

DEPOSITS/CREDITS

Amount Description Date Amount

400.00 Deposit

11/15 50.00

Monthly Statement

Previous Balance

1 Deposit

3 Withdrawals

Service Charge

Interest Earned

Present Balance

Daily Balance

CHECKS

Date Amount Check Date Amount

Account Number

83-30283

PAYMENTS/DEBITS

654.85

648.35

389.49

400.00

134.64

6.50

648.35

Description

ATM Cash

Daily Balance

Payment/

Debit (-)

Balance Brought Forward

47 29

37 35

50 00

44 89

Figure 4.9a

Deposit/

Credit (+)

Interest

New Balance

What total amount does David have in outstanding checks?

10 What total amount does he have in outstanding deposits?

11 What is his adjusted balance?

12 What is his new check register balance?

13 Do the register and adjusted balances agree?

400 00

Figure 4.9c: Bank Reconcillation

Check Register Balance

Service Charges

191 37

Balance

389 49

342 20

742 20

704 85

654 85

846 22

801 33

Reconciliation Statement

$801.33 Statement Balance

6.50 Outstanding Checks/

Payments/Debits

Check 049

d.

0.00

(Total outstanding

checks/payments/debits)

Outstanding Deposits/

Credits

Deposit

Adjusted Balance

2

10

11

12

13

$ 44.89

a

191.37 b

$648.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning