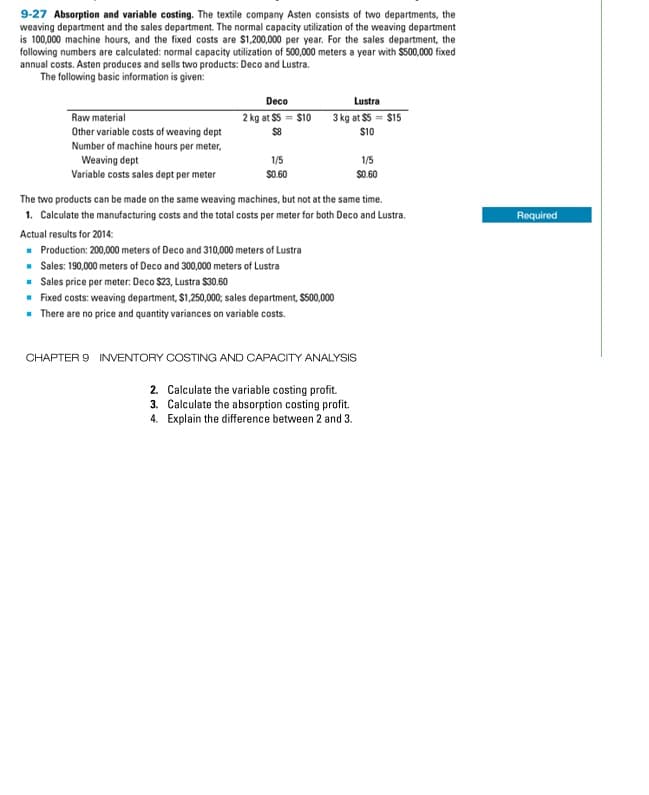

9-27 Absorption and variable costing. The textile company Asten consists of two departments, the weaving department and the sales department. The normal capacity utilization of the weaving department is 100,000 machine hours, and the fixed costs are $1,200,000 per year. For the sales department, the following numbers are calculated: normal capacity utilization of 500,000 meters a year with $500,000 fixed annual costs. Asten produces and sells two products: Deco and Lustra. The following basic information is given: Raw material Other variable costs of weaving dept Number of machine hours per meter, Weaving dept Variable costs sales dept per meter Deco Lustra 2 kg at $5= $10 3 kg at $5 - $15 $8 $10 1/5 $0.60 1/5 $0.60 The two products can be made on the same weaving machines, but not at the same time. 1. Calculate the manufacturing costs and the total costs per meter for both Deco and Lustra. Actual results for 2014: ■ Production: 200,000 meters of Deco and 310,000 meters of Lustra ■ Sales: 190,000 meters of Deco and 300,000 meters of Lustra ▪ Sales price per meter: Deco $23, Lustra $30.60 . Fixed costs: weaving department, $1,250,000; sales department, $500,000 . There are no price and quantity variances on variable costs. CHAPTER 9 INVENTORY COSTING AND CAPACITY ANALYSIS 2. Calculate the variable costing profit. 3. Calculate the absorption costing profit. Required

9-27 Absorption and variable costing. The textile company Asten consists of two departments, the weaving department and the sales department. The normal capacity utilization of the weaving department is 100,000 machine hours, and the fixed costs are $1,200,000 per year. For the sales department, the following numbers are calculated: normal capacity utilization of 500,000 meters a year with $500,000 fixed annual costs. Asten produces and sells two products: Deco and Lustra. The following basic information is given: Raw material Other variable costs of weaving dept Number of machine hours per meter, Weaving dept Variable costs sales dept per meter Deco Lustra 2 kg at $5= $10 3 kg at $5 - $15 $8 $10 1/5 $0.60 1/5 $0.60 The two products can be made on the same weaving machines, but not at the same time. 1. Calculate the manufacturing costs and the total costs per meter for both Deco and Lustra. Actual results for 2014: ■ Production: 200,000 meters of Deco and 310,000 meters of Lustra ■ Sales: 190,000 meters of Deco and 300,000 meters of Lustra ▪ Sales price per meter: Deco $23, Lustra $30.60 . Fixed costs: weaving department, $1,250,000; sales department, $500,000 . There are no price and quantity variances on variable costs. CHAPTER 9 INVENTORY COSTING AND CAPACITY ANALYSIS 2. Calculate the variable costing profit. 3. Calculate the absorption costing profit. Required

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 28E: Minor Co. has a job order cost system and applies overhead based on departmental rates. Service...

Related questions

Question

Transcribed Image Text:9-27 Absorption and variable costing. The textile company Asten consists of two departments, the

weaving department and the sales department. The normal capacity utilization of the weaving department

is 100,000 machine hours, and the fixed costs are $1,200,000 per year. For the sales department, the

following numbers are calculated: normal capacity utilization of 500,000 meters a year with $500,000 fixed

annual costs. Asten produces and sells two products: Deco and Lustra.

The following basic information is given:

Raw material

Other variable costs of weaving dept

Number of machine hours per meter,

Weaving dept

Variable costs sales dept per meter

Deco

2 kg at $5= $10

$8

1/5

$0.60

Lustra

3 kg at $5= $15

$10

■ Sales: 190,000 meters of Deco and 300,000 meters of Lustra

■

Sales price per meter: Deco $23, Lustra $30.60

The two products can be made on the same weaving machines, but not at the same time.

1. Calculate the manufacturing costs and the total costs per meter for both Deco and Lustra.

Actual results for 2014:

■ Production: 200,000 meters of Deco and 310,000 meters of Lustra

Fixed costs: weaving department, $1,250,000; sales department, $500,000

■ There are no price and quantity variances on variable costs.

1/5

$0.60

CHAPTER 9 INVENTORY COSTING AND CAPACITY ANALYSIS

2. Calculate the variable costing profit.

3. Calculate the absorption costing profit.

4. Explain the difference between 2 and 3.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College