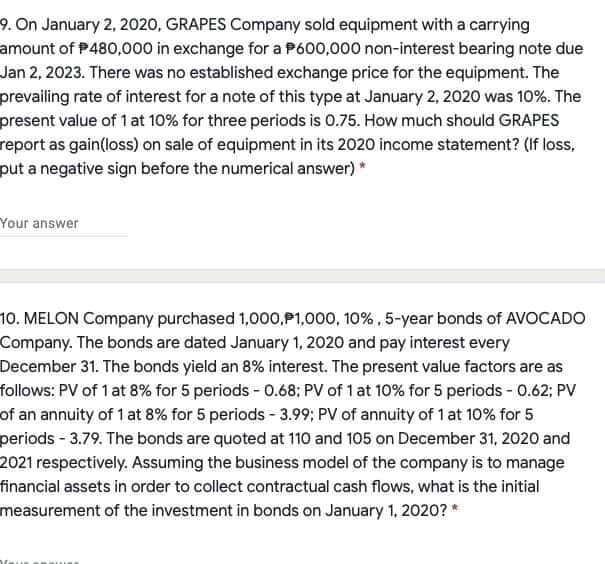

9. On January 2, 2020, GRAPES Company sold equipment with a carrying amount of P480,000 in exchange for a P600,000 non-interest bearing note due Jan 2, 2023. There was no established exchange price for the equipment. The prevailing rate of interest for a note of this type at January 2, 2020 was 10%. The present value of 1 at 10% for three periods is 0.75. How much should GRAPES report as gain(loss) on sale of equipment in its 2020 income statement? (If loss, put a negative sign before the numerical answer)* Your answer

9. On January 2, 2020, GRAPES Company sold equipment with a carrying amount of P480,000 in exchange for a P600,000 non-interest bearing note due Jan 2, 2023. There was no established exchange price for the equipment. The prevailing rate of interest for a note of this type at January 2, 2020 was 10%. The present value of 1 at 10% for three periods is 0.75. How much should GRAPES report as gain(loss) on sale of equipment in its 2020 income statement? (If loss, put a negative sign before the numerical answer)* Your answer

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 10MC: On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major...

Related questions

Question

Please provide complete solutions. Thank you

Transcribed Image Text:9. On January 2, 2020, GRAPES Company sold equipment with a carrying

amount of P480,000 in exchange for a P600,000 non-interest bearing note due

Jan 2, 2023. There was no established exchange price for the equipment. The

prevailing rate of interest for a note of this type at January 2, 2020 was 10%. The

present value of 1 at 10% for three periods is 0.75. How much should GRAPES

report as gain(loss) on sale of equipment in its 2020 income statement? (If loss,

put a negative sign before the numerical answer) *

Your answer

10. MELON Company purchased 1,000,P1,000, 10%, 5-year bonds of AVOCADO

Company. The bonds are dated January 1, 2020 and pay interest every

December 31. The bonds yield an 8% interest. The present value factors are as

follows: PV of 1 at 8% for 5 periods - 0.68; PV of 1 at 10% for 5 periods - 0.62; PV

of an annuity of 1 at 8% for 5 periods - 3.99; PV of annuity of 1 at 10% for 5

periods - 3.79. The bonds are quoted at 110 and 105 on December 31, 2020 and

2021 respectively. Assuming the business model of the company is to manage

financial assets in order to collect contractual cash flows, what is the initial

measurement of the investment in bonds on January 1, 2020? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning