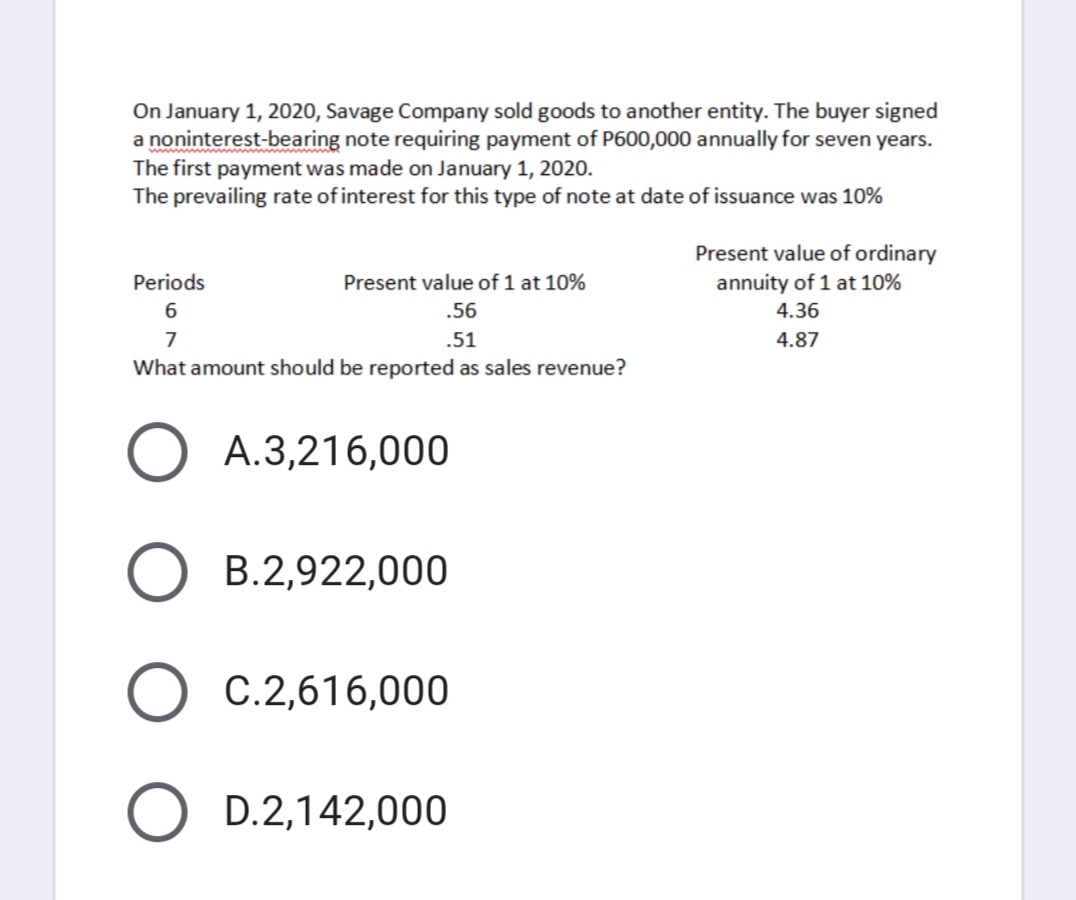

On January 1, 2020, Savage Company sold goods to another entity. The buyer signed a noninterest-bearing note requiring payment of P600,000 annually for seven years. The first payment was made on January 1, 2020. The prevailing rate of interest for this type of note at date of issuance was 10% Present value of ordinary annuity of 1 at 10% Periods Present value of 1 at 10% 6 .56 4.36 7 .51 4.87 What amount should be reported as sales revenue? A.3,216,000 O B.2,922,000 O C.2,616,000 O D.2,142,000

On January 1, 2020, Savage Company sold goods to another entity. The buyer signed a noninterest-bearing note requiring payment of P600,000 annually for seven years. The first payment was made on January 1, 2020. The prevailing rate of interest for this type of note at date of issuance was 10% Present value of ordinary annuity of 1 at 10% Periods Present value of 1 at 10% 6 .56 4.36 7 .51 4.87 What amount should be reported as sales revenue? A.3,216,000 O B.2,922,000 O C.2,616,000 O D.2,142,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 14RE: On January 1, 2019, Boater Company issues a 20,000 non-interest-bearing, 5-year note for equipment....

Related questions

Question

Transcribed Image Text:On January 1, 2020, Savage Company sold goods to another entity. The buyer signed

a noninterest-bearing note requiring payment of P600,000 annually for seven years.

The first payment was made on January 1, 2020.

The prevailing rate of interest for this type of note at date of issuance was 10%

Present value of ordinary

annuity of 1 at 10%

Periods

Present value of 1 at 10%

.56

4.36

7

.51

4.87

What amount should be reported as sales revenue?

A.3,216,000

B.2,922,000

C.2,616,000

D.2,142,000

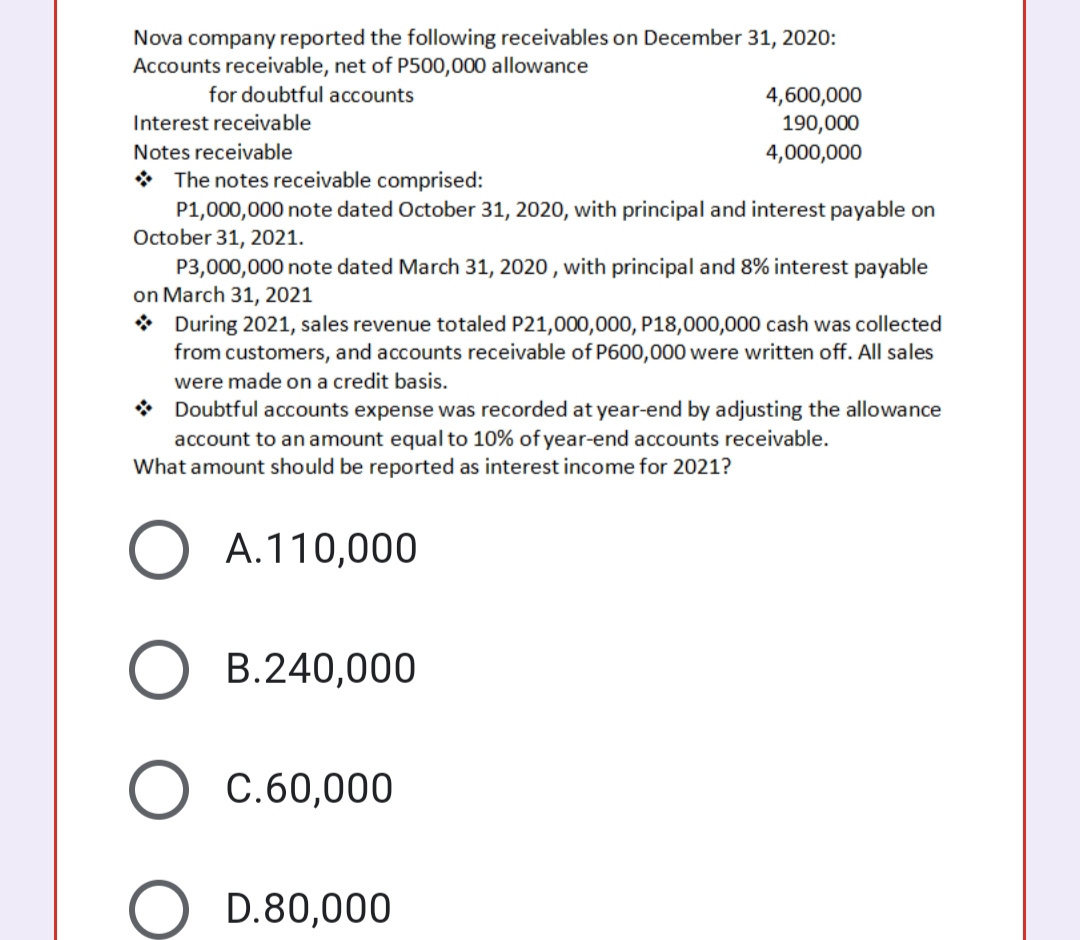

Transcribed Image Text:Nova company reported the following receivables on December 31, 2020:

Accounts receivable, net of P500,000 allowance

for doubtful accounts

4,600,000

190,000

Interest receivable

Notes receivable

4,000,000

* The notes receivable comprised:

P1,000,000 note dated October 31, 2020, with principal and interest payable on

October 31, 2021.

P3,000,000 note dated March 31, 2020 , with principal and 8% interest payable

on March 31, 2021

* During 2021, sales revenue totaled P21,000,000, P18,000,000 cash was collected

from customers, and accounts receivable of P600,000 were written off. All sales

were made on a credit basis.

* Doubtful accounts expense was recorded at year-end by adjusting the allowance

account to an amount equal to 10% of year-end accounts receivable.

What amount should be reported as interest income for 2021?

A.110,000

B.240,000

C.60,000

D.80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College