9. Yellow Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2014, at a cost of $148,000. Over its 4-year useful life, the bus is expected to be driven 100,000 miles. Salvage value is expected to be $8,000 after the useful life. a) Compute the depreciable cost per unit. b) Prepare a depreciation schedule assuming actual mileage was: 2014, 26,000 miles; 2015, 32,000 miles; 2016, 25,000 miles; and 2017, 17,000 miles...

9. Yellow Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2014, at a cost of $148,000. Over its 4-year useful life, the bus is expected to be driven 100,000 miles. Salvage value is expected to be $8,000 after the useful life. a) Compute the depreciable cost per unit. b) Prepare a depreciation schedule assuming actual mileage was: 2014, 26,000 miles; 2015, 32,000 miles; 2016, 25,000 miles; and 2017, 17,000 miles...

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 7EA: Alfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last...

Related questions

Question

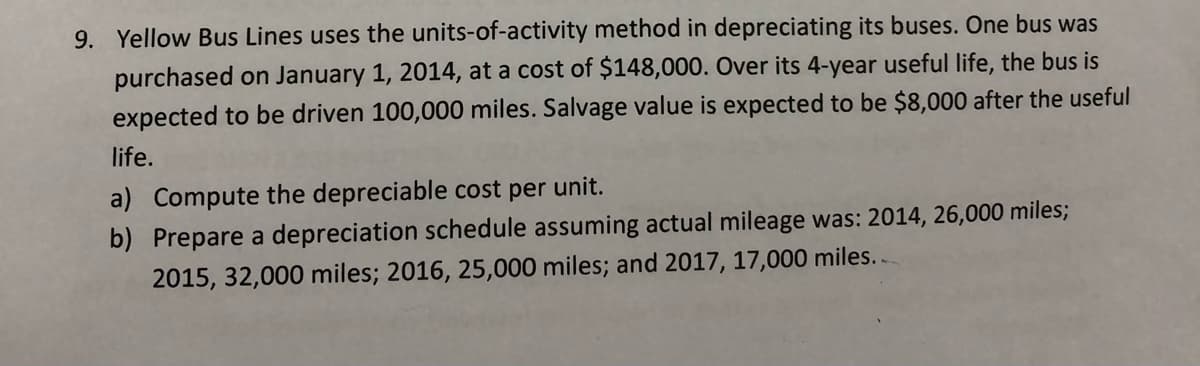

Transcribed Image Text:9. Yellow Bus Lines uses the units-of-activity method in depreciating its buses. One bus was

purchased on January 1, 2014, at a cost of $148,000. Over its 4-year useful life, the bus is

expected to be driven 100,000 miles. Salvage value is expected to be $8,000 after the useful

life.

a) Compute the depreciable cost per unit.

b) Prepare a depreciation schedule assuming actual mileage was: 2014, 26,000 miles;

2015, 32,000 miles; 2016, 25,000 miles; and 2017, 17,000 miles..

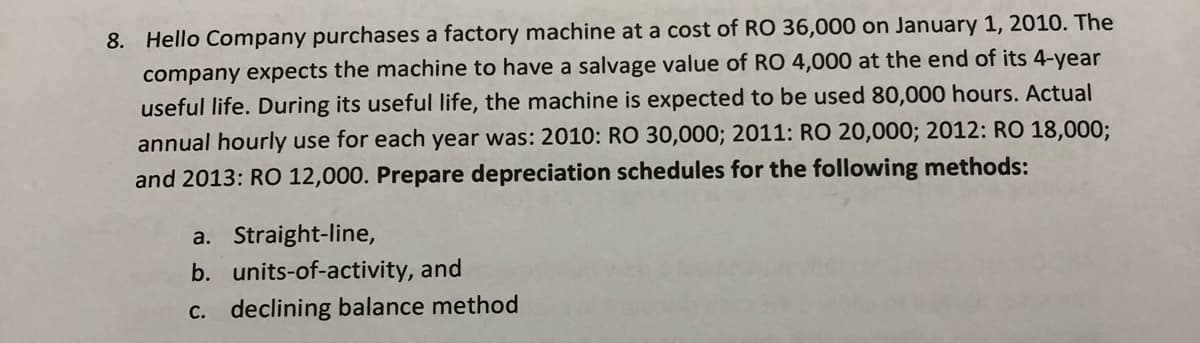

Transcribed Image Text:8. Hello Company purchases a factory machine at a cost of RO 36,000 on January 1, 2010. The

company expects the machine to have a salvage value of RO 4,000 at the end of its 4-year

useful life. During its useful life, the machine is expected to be used 80,000 hours. Actual

annual hourly use for each year was: 2010: RO 30,000; 2011: RO 20,000; 2012: RO 18,000;

and 2013: RO 12,000. Prepare depreciation schedules for the following methods:

a. Straight-line,

b. units-of-activity, and

c. declining balance method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT