On 10 November 2021, Circle plc was taken over by Square plc. Shareholders in Circle plc received three £1 ordinary shares in Square pic for every two £1 ordinary shares in Circle plc. Immediately after the takeover, Square plc's £1 ordinary shares were quoted at £5. Identify, by clicking on the relevant boxes in the table, the total number and base cost of Maria's holding of £1 ordinary shares in Square plc immediately after the takeover for cas gains tax purposes. Number of shares 9,000 4,000 6,000 18,000 Base cost after takeover £20,000 £36,000 £45,000 £54,000

On 10 November 2021, Circle plc was taken over by Square plc. Shareholders in Circle plc received three £1 ordinary shares in Square pic for every two £1 ordinary shares in Circle plc. Immediately after the takeover, Square plc's £1 ordinary shares were quoted at £5. Identify, by clicking on the relevant boxes in the table, the total number and base cost of Maria's holding of £1 ordinary shares in Square plc immediately after the takeover for cas gains tax purposes. Number of shares 9,000 4,000 6,000 18,000 Base cost after takeover £20,000 £36,000 £45,000 £54,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 28E

Related questions

Question

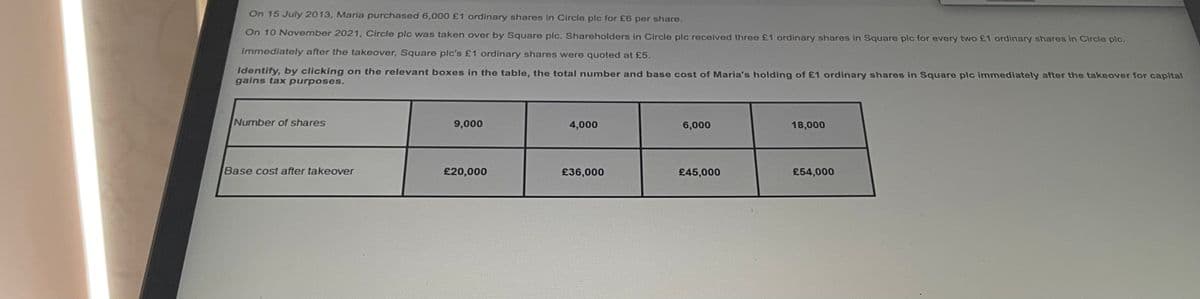

Transcribed Image Text:On 15 July 2013, Maria purchased 6,000 £1 ordinary shares in Circle plc for £6 per share.

On 10 November 2021, Circle plc was taken over by Square plc. Shareholders in Circle plc received three £1 ordinary shares in Square plc for every two £1 ordinary shares in Circle pic.

Immediately after the takeover, Square plc's £1 ordinary shares were quoted at £5.

Identify, by clicking on the relevant boxes in the table, the total number and base cost of Maria's holding of £1 ordinary shares in Square plc immediately after the takeover for capital

gains tax purposes.

Number of shares

9,000

4,000

6,000

18,000

Base cost after takeover

£20,000

£36,000

£45,000

£54,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning