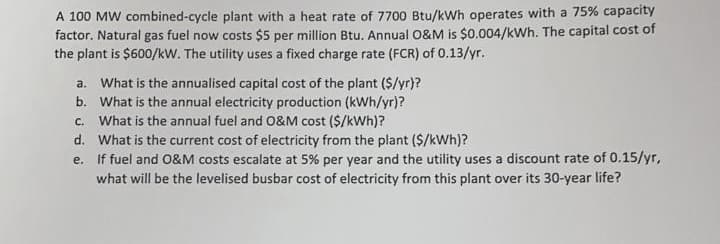

A 100 MW combined-cycle plant with a heat rate of 7700 Btu/kWh operates with a 75% capacity factor. Natural gas fuel now costs $5 per million Btu. Annual 0&M is $0.004/kWh. The capital cost of the plant is $600/kW. The utility uses a fixed charge rate (FCR) of 0.13/yr. What is the annualised capital cost of the plant ($/yr)? b. What is the annual electricity production (kWh/yr)? c. What is the annual fuel and O&M cost ($/kWh)? d. What is the current cost of electricity from the plant ($/kWh)? If fuel and O&M costs escalate at 5% per year and the utility uses a discount rate of 0.15/yr, what will be the levelised busbar cost of electricity from this plant over its 30-year life? a. е.

A 100 MW combined-cycle plant with a heat rate of 7700 Btu/kWh operates with a 75% capacity factor. Natural gas fuel now costs $5 per million Btu. Annual 0&M is $0.004/kWh. The capital cost of the plant is $600/kW. The utility uses a fixed charge rate (FCR) of 0.13/yr. What is the annualised capital cost of the plant ($/yr)? b. What is the annual electricity production (kWh/yr)? c. What is the annual fuel and O&M cost ($/kWh)? d. What is the current cost of electricity from the plant ($/kWh)? If fuel and O&M costs escalate at 5% per year and the utility uses a discount rate of 0.15/yr, what will be the levelised busbar cost of electricity from this plant over its 30-year life? a. е.

Introductory Circuit Analysis (13th Edition)

13th Edition

ISBN:9780133923605

Author:Robert L. Boylestad

Publisher:Robert L. Boylestad

Chapter1: Introduction

Section: Chapter Questions

Problem 1P: Visit your local library (at school or home) and describe the extent to which it provides literature...

Related questions

Question

Transcribed Image Text:A 100 MW combined-cycle plant with a heat rate of 7700 Btu/kWh operates with a 75% capacity

factor. Natural gas fuel now costs $5 per million Btu. Annual 0&M is $0.004/kWh. The capital cost of

the plant is $600/kw. The utility uses a fixed charge rate (FCR) of 0.13/yr.

What is the annualised capital cost of the plant ($/yr)?

b. What is the annual electricity production (kWh/yr)?

c. What is the annual fuel and 0&M cost ($/kWh)?

d. What is the current cost of electricity from the plant ($/kWh)?

If fuel and 0&M costs escalate at 5% per year and the utility uses a discount rate of 0.15/yr,

what will be the levelised busbar cost of electricity from this plant over its 30-year life?

a.

e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, electrical-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Introductory Circuit Analysis (13th Edition)

Electrical Engineering

ISBN:

9780133923605

Author:

Robert L. Boylestad

Publisher:

PEARSON

Delmar's Standard Textbook Of Electricity

Electrical Engineering

ISBN:

9781337900348

Author:

Stephen L. Herman

Publisher:

Cengage Learning

Programmable Logic Controllers

Electrical Engineering

ISBN:

9780073373843

Author:

Frank D. Petruzella

Publisher:

McGraw-Hill Education

Introductory Circuit Analysis (13th Edition)

Electrical Engineering

ISBN:

9780133923605

Author:

Robert L. Boylestad

Publisher:

PEARSON

Delmar's Standard Textbook Of Electricity

Electrical Engineering

ISBN:

9781337900348

Author:

Stephen L. Herman

Publisher:

Cengage Learning

Programmable Logic Controllers

Electrical Engineering

ISBN:

9780073373843

Author:

Frank D. Petruzella

Publisher:

McGraw-Hill Education

Fundamentals of Electric Circuits

Electrical Engineering

ISBN:

9780078028229

Author:

Charles K Alexander, Matthew Sadiku

Publisher:

McGraw-Hill Education

Electric Circuits. (11th Edition)

Electrical Engineering

ISBN:

9780134746968

Author:

James W. Nilsson, Susan Riedel

Publisher:

PEARSON

Engineering Electromagnetics

Electrical Engineering

ISBN:

9780078028151

Author:

Hayt, William H. (william Hart), Jr, BUCK, John A.

Publisher:

Mcgraw-hill Education,