A 72-year-old customer asks his registered representative (RR) to begin required minimum distributions (RMDS) from a qualified annuity. The withdrawals will be taxed in which of the following ways?

A 72-year-old customer asks his registered representative (RR) to begin required minimum distributions (RMDS) from a qualified annuity. The withdrawals will be taxed in which of the following ways?

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 34P

Related questions

Question

A6)

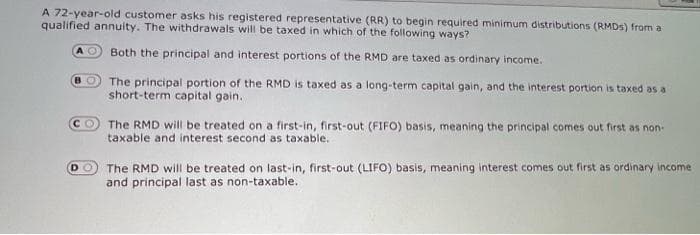

Transcribed Image Text:A 72-year-old customer asks his registered representative (RR) to begin required minimum distributions (RMDS) from a

qualified annuity. The withdrawals will be taxed in which of the following ways?

AO Both the principal and interest portions of the RMD are taxed as ordinary income.

BO The principal portion of the RMD is taxed as a long-term capital gain, and the interest portion is taxed as a

short-term capital gain.

CO The RMD will be treated on a first-in, first-out (FIFO) basis, meaning the principal comes out first as non-

taxable and interest second as taxable.

DO

The RMD will be treated on last-in, first-out (LIFO) basis, meaning interest comes out first as ordinary income

and principal last as non-taxable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT