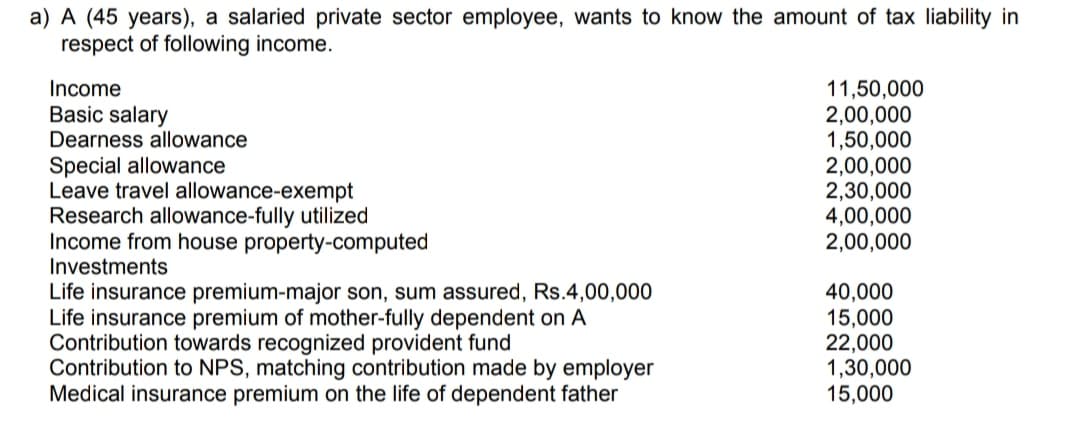

a) A (45 years), a salaried private sector employee, wants to know the amount of tax liability in respect of following income. 11,50,000 2,00,000 1,50,000 2,00,000 2,30,000 4,00,000 2,00,000 Income Basic salary Dearness allowance Special allowance Leave travel allowance-exempt Research allowance-fully utilized Income from house property-computed Investments Life insurance premium-major son, sum assured, Rs.4,00,000 40,000

a) A (45 years), a salaried private sector employee, wants to know the amount of tax liability in respect of following income. 11,50,000 2,00,000 1,50,000 2,00,000 2,30,000 4,00,000 2,00,000 Income Basic salary Dearness allowance Special allowance Leave travel allowance-exempt Research allowance-fully utilized Income from house property-computed Investments Life insurance premium-major son, sum assured, Rs.4,00,000 40,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 47P: How do the all events and economic performance requirements apply to the following transactions by...

Related questions

Question

100%

Assessment year 2021-22

Full detailed solution

Transcribed Image Text:a) A (45 years), a salaried private sector employee, wants to know the amount of tax liability in

respect of following income.

11,50,000

2,00,000

1,50,000

2,00,000

2,30,000

4,00,000

2,00,000

Income

Basic salary

Dearness allowance

Special allowance

Leave travel allowance-exempt

Research allowance-fully utilized

Income from house property-computed

Investments

Life insurance premium-major son, sum assured, Rs.4,00,000

Life insurance premium of mother-fully dependent on A

Contribution towards recognized provident fund

Contribution to NPS, matching contribution made by employer

Medical insurance premium on the life of dependent father

40,000

15,000

22,000

1,30,000

15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT