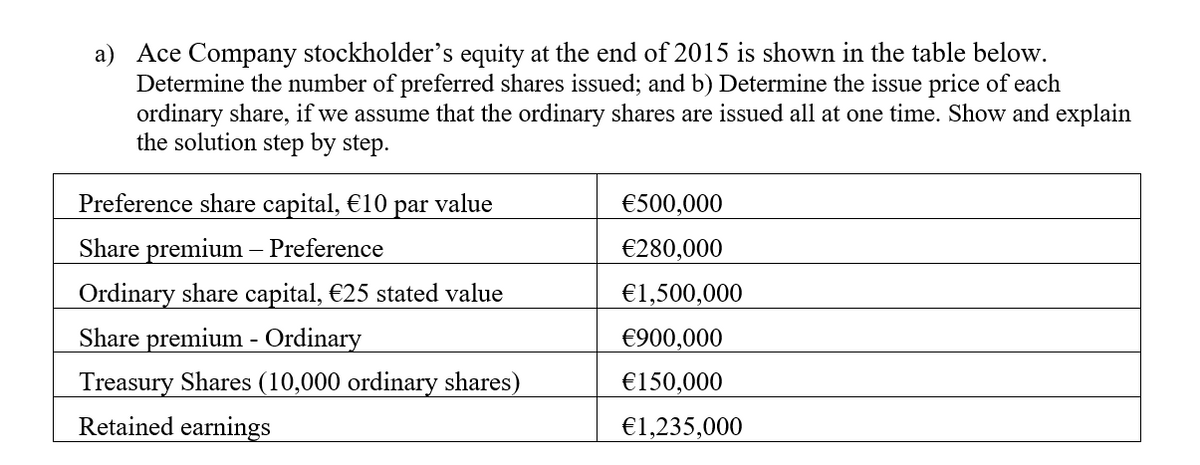

a) Ace Company stockholder's equity at the end of 2015 is shown in the table below. Determine the number of preferred shares issued; and b) Determine the issue price of each ordinary share, if we assume that the ordinary shares are issued all at one time. Show and explain the solution step by step. Preference share capital, €10 par value €500,000 Share premium – Preference Ordinary share capital, €25 stated value Share premium - Ordinary Treasury Shares (10,000 ordinary shares) Retained earnings €280,000 €1,500,000 €900,000 €150,000 €1,235,000

Q: Information concerning a product produced by Ender Company appears here: $4 165 Sales price per unit...

A: Solution.. Selling price per unit = $165 Variable cost per unit = $94 Fixed cost = $482,800

Q: Prepare a horizontal analysis of the balance sheet and explain the analysis made.

A: Balance sheet shows the assets and liabilities of the company and finally, overall financial positio...

Q: Direct Labor Variances Re-Cycle Company manufactures commuter bicycles from recycled materials. T...

A:

Q: 8-27 LO 6 (h) in 8-26, assuming a population size of $8,500,000. Recall that sampling interval = pop...

A: 8-26: Solution

Q: A. B and C are partners with average capital balances during 2020 of P945,000, P477,300 and P324,700...

A: Closing capital of partners is to be calculated as follows = Openin...

Q: has a net payroll amount of $5,064.50. What is the correct journal entry to record this payment on p...

A: Summary of the information provided in the question : Net payroll amount : $ 5,064.50 Requiremen...

Q: How would I solve this question in creating a double entry t-acount in solving the following questio...

A: In double entry system, every entry has two aspects ,that is, debit and credited. If one account is ...

Q: Which of the following sell stock on an organized stock exchange such as the new York stock stock ex...

A: The correct answer for the above question is given in the following steps for your reference.

Q: Use the following information for the Exercises below. [The following information applies to the que...

A: Perpetual inventory valuation is an inventory management method that records when stock is sold or r...

Q: The WGN Company has a bonus arrangement, which grants the financial vice president and other executi...

A: Introduction:- The finance vice president and other executives of the WGN Company are eligible for a...

Q: Recording Standards in Accounts Cioffi Manufacturing Company incorporates standards in its accounts...

A: Direct Materials Price Variance = (Actual price - Standard price) x Actual quantity = (5...

Q: DEL GATO CLINIC Bank Reconciliation June 30 Bank statement balance Book balance Add: Add: Deduct: De...

A: Bank reconciliation statement is prepared where an entry which is found in one book (Cash book or ba...

Q: On January 1, 2013, Pepper Corporation acquired 90 percent of Salt Company's voting common stock for...

A: A Holding company is a company that owns and controls the operations of the other entity. The Subsid...

Q: A, B and C are partners sharing profits and losses in the ratio of 3:2:1 after the bonus (20% of net...

A: A, B ,and C are the partners sharing profits and losses in the ratio of 3:2:1. So, A's Share of pro...

Q: Gross sales, P240,000 Purchases from VAT registered suppliers, P156,980 How much is the percentage ...

A: Percentage tax is the amount of tax which is paid by non VAT registered suppliers. It is indirect ta...

Q: The following information has been obtained for Sheridan Corporation. 1. Prior to 2020, taxable inco...

A: Solution Income statement is a financial statement thats shows you the company's income and expendit...

Q: Which of the following statements is false?A. Noncash activities should be reported in accrual basis...

A: Financial statements are those financial statements which are prepared at the end of accounting peri...

Q: Account Balance Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400...

A: Arenas ,Delay, and Laurent Statement of Liquidation June 30,2019

Q: company, had the following receipts in January 2022: Receipts from passengers, P2,700,000 Receipts ...

A: Calculation of Total Input VAT Available Particulars Amount Input VAT on gasoline P50,000 ...

Q: A client pays cash in advance for a magazine subscription to Living Daily. Living Daily has yet topr...

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is pr...

Q: PROBLEM 8. The Color Company manufactures and sells two products. The selling prices and variable co...

A: Break even point means where there is no profit no loss. Variable cost means the cost which vary w...

Q: Gelato Company manufactures and sells an ice spoon that has seasonal variations in demand, with peak...

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. % ar...

Q: ABC Corporation's board of directors declared a P750,000 cash dividend on September 1, 2021, payable...

A: Dividend: dividend is the portions of profit given to the shareholders by the company There are main...

Q: 16. Under a job order costing system, the dollar amount of the entry involved in the transfer of goo...

A: Note: As per our guidelines, only the first question shall be answered. 16. The correct answer is ...

Q: At the beginning of April, Chickadee Corporation has a balance of $11,500 in the Retained Earnings a...

A: Using the external transactions above, computation of the balance of retained earnings at April 30: ...

Q: The accountant at Fidel Trading has received the November 2010 bank statement. She immediately inves...

A:

Q: Requirement: For each of the following independent income-sharing agreements, prepare an income dist...

A: We are given various scenarios regarding payment of interest on capital, bonus and salaries to partn...

Q: On January 1, 20X8, Ramon Corporation acquired 80 percent of Tester Company's voting common stock fo...

A: Depreciation: It implies to a decrease in fixed asset's value as a result of normal wear & tear,...

Q: X Corporation allows its sales manager to incur expenses subject to reimbursements, as follows: Elec...

A: 1. Amount subject to fringe benefit tax Electricity 70% borne by Company 14000 Water - 70% in ...

Q: A publishing company is planning on developing an SPSS Manual for graduate students in doctoral prog...

A: Formula: Break even point in units = Fixed cost / contribution margin

Q: QUESTION 4 Each of the following is a O an extensive marketin O bonding of employee separation of du...

A: Internal control is a process designed, implemented and maintained by those charged with governance,...

Q: Longo's return on sales was 20% in 2012, is the company's profitability improving or declining?

A: The return on sales is calculated as operating income divided by net sales.

Q: It results not from a deterioration in the asset's ability to serve its intended purpose, but from a...

A: Depreciation is less in the value of asset. depreciation is a natural phenomenon in which the value...

Q: 6. True or False: When two processes are needed, the cost of finished units in Process #1 is transfe...

A: Process costing is costing method followed where one product is manufactured in bulk in a multi-proc...

Q: Ending Work-in-Process Inventory was 2,500 units that were 100% complete as to materials and 25% com...

A: Beginning WIP= 7000 units (100% complete as to materials), Therefore, as per FIFO method, material n...

Q: what is one example of a risk management strategy used by insurance companies to mitigate underwriti...

A: An underwriter's potential loss is known as underwriting risk. Underwriting risk in insurance can re...

Q: Determine the capitalized cost of a resear construction; P100000 at the cost of every y hereafter fo...

A: Original Construction Cost =P5,000,000 Annual Operating Cost from year 1 to 5 = P100,000 Annual Oper...

Q: Consider the following events: 25,000 shares of preferred stock, cumulative, 5%, $40 par was issued ...

A: Cash flow statement means the statement which shows the cash flow in or out of business enterprises ...

Q: JOURNALIZING AND POSTING PAYROLL ENTRIES Cascade Company has fouremployees. All are paid on a monthl...

A: Journal entries refers to recording of business transactions into the books and it is the very initi...

Q: Entries for Stock Investments, Dividends, and Sale of Stock Yerbury Corp. manufactures construction ...

A: Solution A journal is a company's official book in which all business transactions are recorded in c...

Q: Use of company records would be an example of using__________ data

A: Solution Company records means any register ,index , accounting records , agreement , memorandum , m...

Q: Tamarisk Inc is a company that manufactures and sells a single product. Unit sales for each of the ...

A: Profit Margin: To determine the extent to which a corporation or an economic activity produces money...

Q: anary Cawnmowers purchased 300lawnmower parts at $3.50 per part from a supplier on December 4. Terms...

A: In Accounting we follow double entry system. Each transaction is ...

Q: QUESTION 6 During its first month of business in May, On-a-roll, Inc., purchased 100 rolls of wallpa...

A: Closing units (rolls) = Units purchased - units sold Therefore units sold = units purchased - closin...

Q: CUst of göóds sold will be lower under QUESTION 6 Automobile Audio has the following inven Nov. 1 In...

A: Solution.. As per the FIFO method goods comes first also sold first. Hence the oldest purchase wil...

Q: dule C, Transportatio Meals And ertainment, Margaret started her own business in the current year an...

A:

Q: Domingo Company started its business on January 1, 2019. The following transactions occurredduring t...

A: Journal entries recording is the first step of accounting process, under which atleast one account i...

Q: but here are some extra probl- Extra practice problems: 1. On January 1, 2017, you b is 4.00%. The l...

A: Interest Calculation Interest calculation is important for the borrower to given the credit to custo...

Q: How is it possible for a company to suffer a net loss for a given year, yet produce a positive net c...

A: Cash flow statement is the statement showing the flow of cash, there are three main activity from wh...

Q: Treasury stock is generally accounted for by the?

A: The question is based on the concept of cost accounting. Companies occasionally buy their own shares...

Step by step

Solved in 2 steps

- Alert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).According to a company press release, on January 5, 2012, Hansen Natural Corporation changed its name to Monster Beverage Corporation. According to Yahoo Finance, on that day the value of the company stock (symbol: MNST) was $15.64 per share. On January 5, 2018, the stock closed at $63.49 per share. This represents an increase of nearly 306%. A. Discuss the factors that might influence the increase in share price. B. Consider yourself as a potential shareholder. What factors would you consider when deciding whether or not to purchase shares in Monster Beverage Corporation today?Ratio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?

- Stockholders' Equity Terminology A list of terms and a list of definitions or examples are presented below. Make a list of the numbers 1 through 12 and match the letter of the most directly related definition or example with each number Definitions and Examples Capitalizes retained earnings. Shares issued minus treasury shares. Emerson Electric will pay a dividend to all persons holding shares of its common stock on December 15, 2019, even if they just bought the shares and sell them a few days later. The accumulated earnings over the entire life of the corporation that have not been paid out in dividends. Common Stock account balance divided by the number of shares issued. The state of Louisiana set an upper limit of 1,000,000 on the number of shares that Gumps Catch Inc. can issue. Shares that never earn dividends. Any changes to stockholders equity from transactions with no owners. A right to purchase stock at a specified future time and specified price. j. A stock issue that requires no journal entry. k. Shares that may earn guaranteed dividends. 1. On October 15, 2019, General Electric announced its intention to pay a dividend on common stock.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.