(a) (b) (c) Describe fully an appropriate dummy variable regression model to analyse the time series. Specify the assumptions involved in fitting the model and discuss how they can be checked graphically. Analyse the data fully by fitting your model (using Minitab) and interpret the results. Obtain the profit forecast for each quarter of 2023 and their 95% prediction intervals. Interpret your prediction intervals. Attach your Minitab output (at most 2 pages!) with your coursework. Explain the reasons behind autocorrelated errors in fitting regression models for time series data and the problems caused by them. Describe how they can be dealt with.

(a) (b) (c) Describe fully an appropriate dummy variable regression model to analyse the time series. Specify the assumptions involved in fitting the model and discuss how they can be checked graphically. Analyse the data fully by fitting your model (using Minitab) and interpret the results. Obtain the profit forecast for each quarter of 2023 and their 95% prediction intervals. Interpret your prediction intervals. Attach your Minitab output (at most 2 pages!) with your coursework. Explain the reasons behind autocorrelated errors in fitting regression models for time series data and the problems caused by them. Describe how they can be dealt with.

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

Y1 is 35 Y20 is 55

Transcribed Image Text:(a)

(b)

(c)

(d)

(e)

(f)

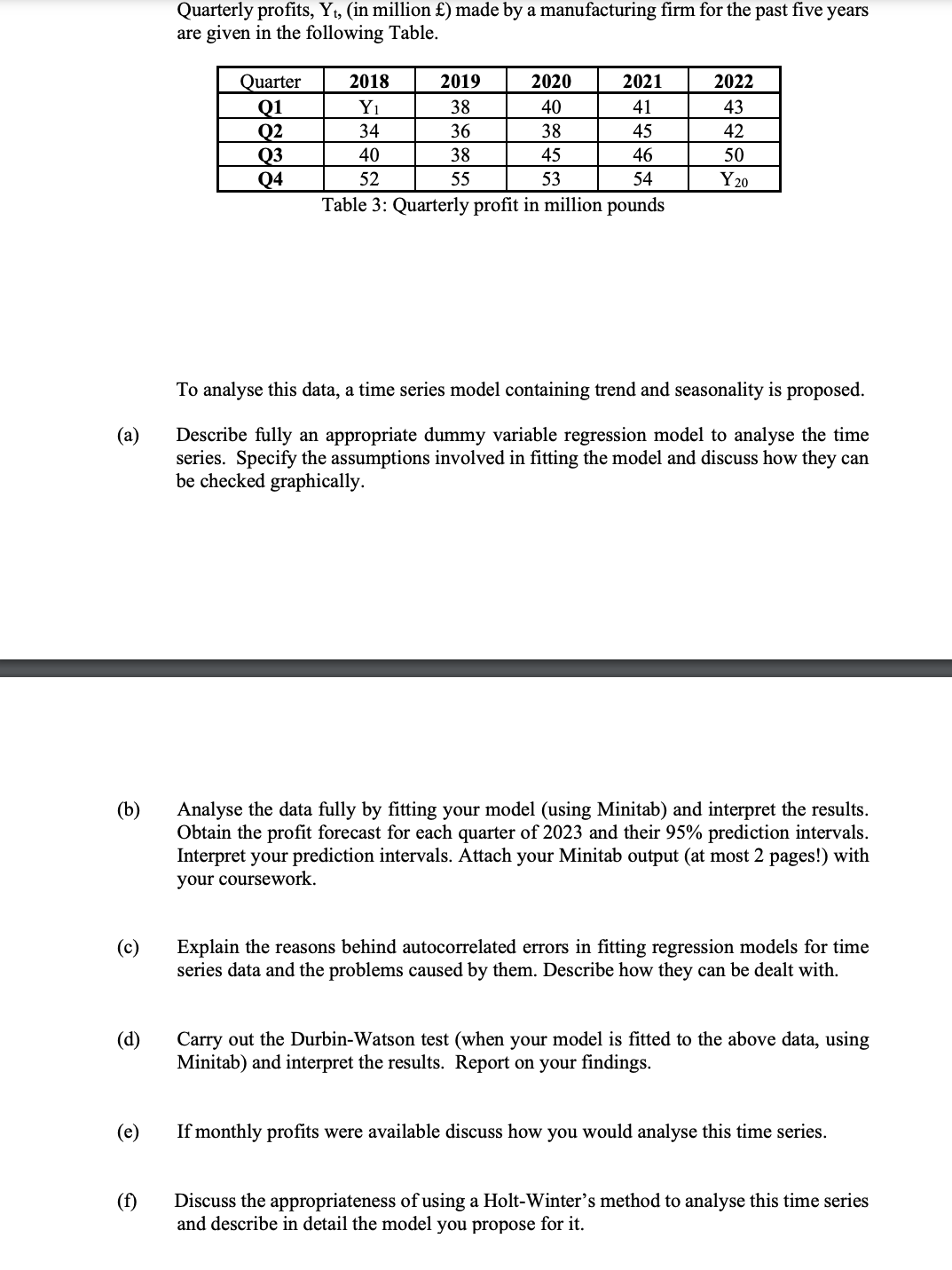

Quarterly profits, Yt, (in million £) made by a manufacturing firm for the past five years

are given in the following Table.

2019

38

INTIN

34

36

38

55

Quarter 2018

Q1

Q2

Q3

Q4

Y₁

40

2020

40

38

45

2021

41

45

46

52

53

54

Table 3: Quarterly profit in million pounds

2022

43

42

50

Y20

To analyse this data, a time series model containing trend and seasonality is proposed.

Describe fully an appropriate dummy variable regression model to analyse the time

series. Specify the assumptions involved in fitting the model and discuss how they can

be checked graphically.

Analyse the data fully by fitting your model (using Minitab) and interpret the results.

Obtain the profit forecast for each quarter of 2023 and their 95% prediction intervals.

Interpret your prediction intervals. Attach your Minitab output (at most 2 pages!) with

your coursework.

Explain the reasons behind autocorrelated errors in fitting regression models for time

series data and the problems caused by them. Describe how they can be dealt with.

Carry out the Durbin-Watson test (when your model is fitted to the above data, using

Minitab) and interpret the results. Report on your findings.

If monthly profits were available discuss how you would analyse this time series.

Discuss the appropriateness of using a Holt-Winter's method to analyse this time series

and describe in detail the model you propose for it.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,