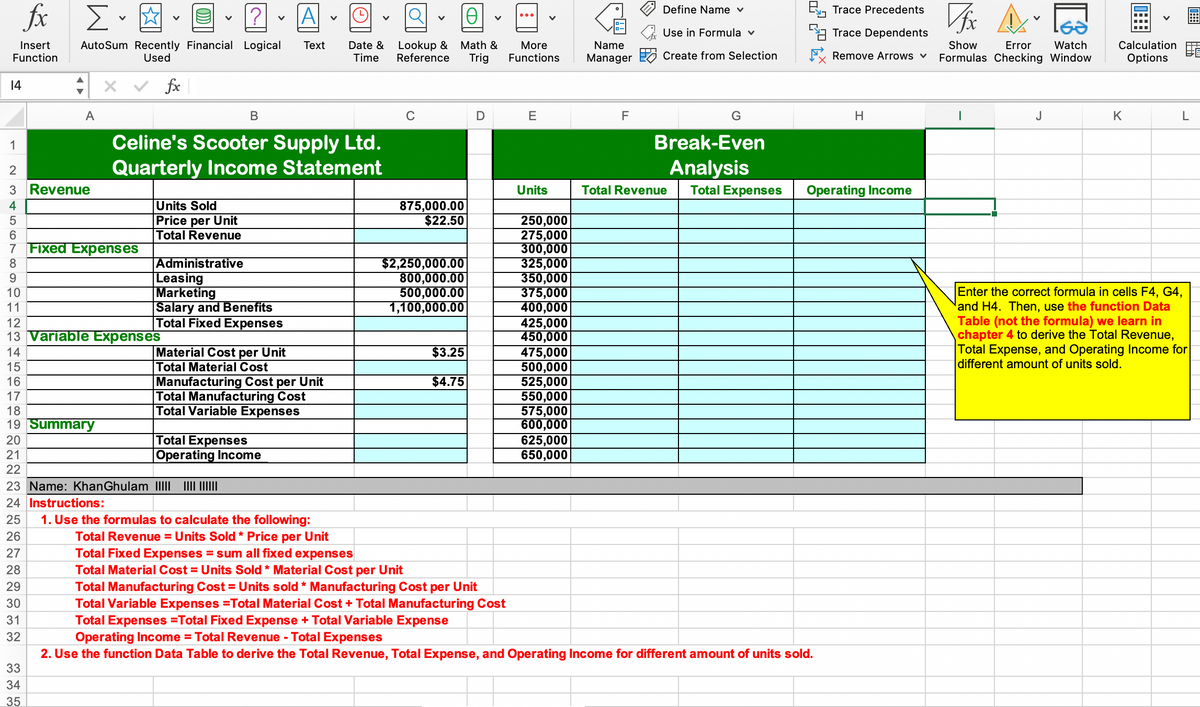

A B Celine's Scooter Supply Ltd. Quarterly Income Statement Units Sold Price per Unit Total Revenue Administrative Leasing Marketing Salary and Benefits Total Fixed Expenses Material Cost per Unit Total Material Cost Manufacturing Cost per Unit Total Manufacturing Cost Total Variable Expenses Total Expenses Operating Income 1. Use the formulas to calculate the following: Total Revenue = Units Sold* Price per Unit Total Fixed Expenses = sum all fixed expenses Total Material Cost = Units Sold * Material Cost per Unit C 1 2 3 Revenue 4 5 6 7 Fixed Expenses 8 9 10 11 12 13 Variable Expenses 14 15 16 17 18 19 Summary 20 21 22 23 Name: KhanGhulam ||| ||||||||||| 24 Instructions: 25 26 27 28 875,000.00 $22.50 $2,250,000.00 800,000.00 500,000.00 1,100,000.00 $3.25 $4.75 DE Units 250,000 275,000 300,000 325,000 350,000 375,000 400,000 425.000 450,000 475.000 500,000 525,000 550,000 575,000 600,000 625,000 650,000 F Total Revenue G Break-Even Analysis Total Expenses H Operating Income I J K L Enter the correct formula in cells F4, G4, and H4. Then, use the function Data Table (not the formula) we learn in chapter 4 to derive the Total Revenue, Total Expense, and Operating Income for different amount of units sold.

A B Celine's Scooter Supply Ltd. Quarterly Income Statement Units Sold Price per Unit Total Revenue Administrative Leasing Marketing Salary and Benefits Total Fixed Expenses Material Cost per Unit Total Material Cost Manufacturing Cost per Unit Total Manufacturing Cost Total Variable Expenses Total Expenses Operating Income 1. Use the formulas to calculate the following: Total Revenue = Units Sold* Price per Unit Total Fixed Expenses = sum all fixed expenses Total Material Cost = Units Sold * Material Cost per Unit C 1 2 3 Revenue 4 5 6 7 Fixed Expenses 8 9 10 11 12 13 Variable Expenses 14 15 16 17 18 19 Summary 20 21 22 23 Name: KhanGhulam ||| ||||||||||| 24 Instructions: 25 26 27 28 875,000.00 $22.50 $2,250,000.00 800,000.00 500,000.00 1,100,000.00 $3.25 $4.75 DE Units 250,000 275,000 300,000 325,000 350,000 375,000 400,000 425.000 450,000 475.000 500,000 525,000 550,000 575,000 600,000 625,000 650,000 F Total Revenue G Break-Even Analysis Total Expenses H Operating Income I J K L Enter the correct formula in cells F4, G4, and H4. Then, use the function Data Table (not the formula) we learn in chapter 4 to derive the Total Revenue, Total Expense, and Operating Income for different amount of units sold.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter2: Choice In A World Of Scarcity

Section: Chapter Questions

Problem 22CTQ: What assumptions about the economy must he true for the invisible hand to work? To what extent are...

Related questions

Question

Transcribed Image Text:fox

B, Trace Precedents

Σ.

A

Define Name v

Use in Formula v

Trace Dependents

Lookup &

Reference

Watch

AutoSum Recently Financial Logical

Used

Math &

More

Functions

Insert

Тext

Date &

Name

Show

Error

Calculation

Function

Manager Create from Selection

Remove Arrows v

Time

Trig

Formulas Checking Window

Options

: x v fx

14

A

В

C

D E

F

J

K

Celine's Scooter Supply Ltd.

Quarterly Income Statement

1

Break-Even

Analysis

Total Expenses

3 Revenue

Units

Total Revenue

Operating Income

Units Sold

Price per Unit

Total Revenue

875,000.00

$22.50

250,000

275,000

300,000

325,000

350,000

375,000

400,000

425,000

450,000

475,000

500,000

525,000

550,000

575,000

600,000

625,000

650,000

6

7 Fixed Expenses

Administrative

|Leasing

Marketing

Salary and Benefits

Total Fixed Expenses

$2,250,000.00

800,000.00

500,000.00

1,100,000.00

8

9.

Enter the correct formula

and H4. Then, use the function Data

Table (not the formula) we learn in

chapter 4 to derive the Total Revenue,

Total Expense, and Operating Income for

different amount of units sold.

10

cells F4, G4,

11

12

13 Variable Expenses

$3.25

Material Cost per Unit

Total Material Cost

Manufacturing Cost per Unit

Total Manufacturing Cost

Total Variable Expenses

14

15

$4.75

17

18

19 Summary

Total Expenses

|Operating Income

20

21

22

23 Name: KhanGhulam III II ||

24 Instructions:

25

1. Use the formulas to calculate the following:

Total Revenue = Units Sold * Price per Unit

Total Fixed Expenses = sum all fixed expenses

Total Material Cost = Units Sold * Material Cost per Unit

Total Manufacturing Cost = Units sold * Manufacturing Cost per Unit

Total Variable Expenses =Total Material Cost + Total Manufacturing Cost

Total Expenses =Total Fixed Expense + Total Variable Expense

Operating Income = Total Revenue - Total Expenses

2. Use the function Data Table to derive the Total Revenue, Total Expense, and Operating Income for different amount of units sold.

26

27

28

29

30

31

32

33

34

35

画

LO CO N C O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax