A B D January 1 Carrying Interest Expense (6% of January 1 Note Carrying Amount) December 31 Decrease in Year Ending Notes Payable (B – C) $ 4,258 Note Payment (Cash Paid) $ 5,698 Carrying Amount (A – D) December 31 Amount $ 1,440 (6% of $24,000) (6% of $19,742) $24,000 20Y4 $19,742 20Y5 5,698 4,513 19,742 1,185 15,229 (6% of $15,229) 20Υ6 5,698 15,229 914 4,784 10,445 (6% of $10,445) 20Υ7 10,445 5,698 627 5,071 5,374 5,698 $28,490 324* (6% of $5,374) 20Υ8 5,374 5,374 $4,490 $24,000 *Rounded ($5,374 – $5,698).

A B D January 1 Carrying Interest Expense (6% of January 1 Note Carrying Amount) December 31 Decrease in Year Ending Notes Payable (B – C) $ 4,258 Note Payment (Cash Paid) $ 5,698 Carrying Amount (A – D) December 31 Amount $ 1,440 (6% of $24,000) (6% of $19,742) $24,000 20Y4 $19,742 20Y5 5,698 4,513 19,742 1,185 15,229 (6% of $15,229) 20Υ6 5,698 15,229 914 4,784 10,445 (6% of $10,445) 20Υ7 10,445 5,698 627 5,071 5,374 5,698 $28,490 324* (6% of $5,374) 20Υ8 5,374 5,374 $4,490 $24,000 *Rounded ($5,374 – $5,698).

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.1BE: Proceeds from notes payable On January 26, Nyree Co. borrowed cash from Conrad Bank by issuing a...

Related questions

Question

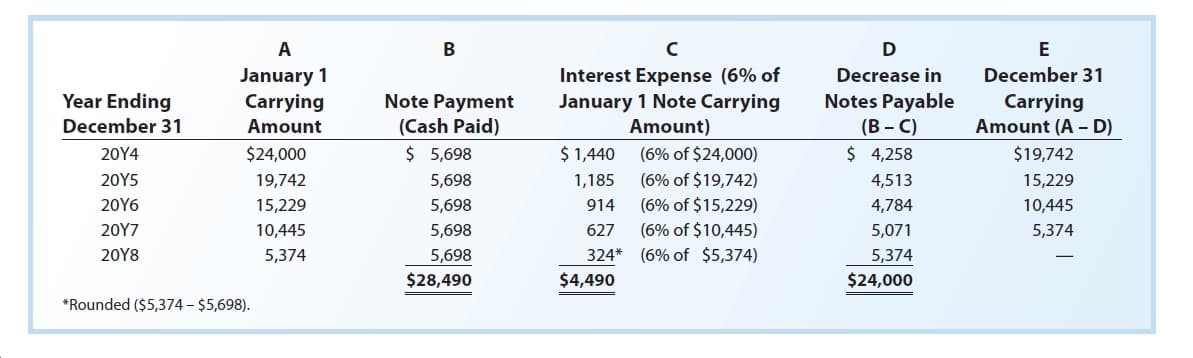

On January 1, Year 1, Bryson Company obtained a $147,750, four-year, 7% installment note from Campbell Bank. The note requires annual payments of $43,620, beginning on December 31, Year 1.

a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4.

b.

c. Describe how the annual note payment would be reported in the Year 1 income statement.

Exhibit 4 Attached

Transcribed Image Text:A

B

D

January 1

Carrying

Interest Expense (6% of

January 1 Note Carrying

Amount)

December 31

Decrease in

Year Ending

Notes Payable

(B – C)

$ 4,258

Note Payment

(Cash Paid)

$ 5,698

Carrying

Amount (A – D)

December 31

Amount

$ 1,440

(6% of $24,000)

(6% of $19,742)

$24,000

20Y4

$19,742

20Y5

5,698

4,513

19,742

1,185

15,229

(6% of $15,229)

20Υ6

5,698

15,229

914

4,784

10,445

(6% of $10,445)

20Υ7

10,445

5,698

627

5,071

5,374

5,698

$28,490

324* (6% of $5,374)

20Υ8

5,374

5,374

$4,490

$24,000

*Rounded ($5,374 – $5,698).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning