Details of Notes Receivatle and Related Ertries Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the fallowing notes: Date Face Amount Interest Rate Term 1. Apr. 10 $69,000 4% 60 days 2. June 24 13,200 30 days 3. y 1 45,000 6. 120 days 4. Oct. 31 45,000 60 days 5. Nov. 15 54,000 60 days 6. Dec. 27 180,000 30 days Required: Assume 360 days in a year. 1. Determine for cach note (a) the due date and (b) the armournt of interest due at maturity, idertilying each note by number. (a) (b) Note Due Date Interest Due at Maturity (1) June 10 460 (2) June 24 66 (3) July 1 900 (4) Oct. 31 675 (5) June 15 540 (6) Jan. 27 600 2. Joumalize the entry to record the dishonor of Note (3) on its due date. If an amount box does not require an entry, leave it blark or enter "0". Jul. 1 - Accounts Receivable Notes Receivable Interest Revenue 45650 45.000 50 3. Joumalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Dec. 31 Interest Receivable Interest Revenue 414 920 4. Joumalize the entries to record the receipt of the amourts due on Notes (5) and (6) in January. If an amourt box does not require an entry, leave it blank or erter "0". Jan. 14 Cash Notes Receivable Interest Receivable Interest Revenue S4,000 Jan. 26 Cash Notes Receivable Interest Receivable 180,000 Interest Revenue

Details of Notes Receivatle and Related Ertries Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the fallowing notes: Date Face Amount Interest Rate Term 1. Apr. 10 $69,000 4% 60 days 2. June 24 13,200 30 days 3. y 1 45,000 6. 120 days 4. Oct. 31 45,000 60 days 5. Nov. 15 54,000 60 days 6. Dec. 27 180,000 30 days Required: Assume 360 days in a year. 1. Determine for cach note (a) the due date and (b) the armournt of interest due at maturity, idertilying each note by number. (a) (b) Note Due Date Interest Due at Maturity (1) June 10 460 (2) June 24 66 (3) July 1 900 (4) Oct. 31 675 (5) June 15 540 (6) Jan. 27 600 2. Joumalize the entry to record the dishonor of Note (3) on its due date. If an amount box does not require an entry, leave it blark or enter "0". Jul. 1 - Accounts Receivable Notes Receivable Interest Revenue 45650 45.000 50 3. Joumalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Dec. 31 Interest Receivable Interest Revenue 414 920 4. Joumalize the entries to record the receipt of the amourts due on Notes (5) and (6) in January. If an amourt box does not require an entry, leave it blank or erter "0". Jan. 14 Cash Notes Receivable Interest Receivable Interest Revenue S4,000 Jan. 26 Cash Notes Receivable Interest Receivable 180,000 Interest Revenue

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter8: Receivables

Section: Chapter Questions

Problem 4PB

Related questions

Question

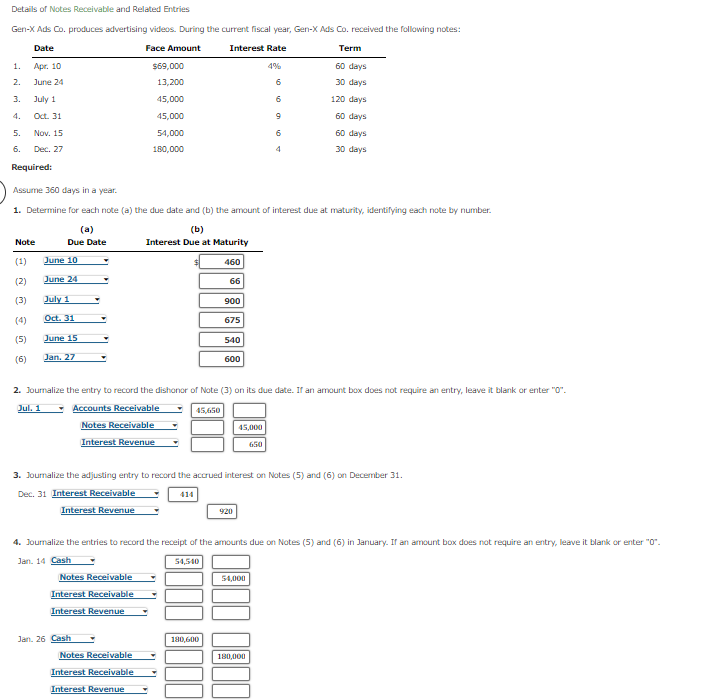

Transcribed Image Text:Details of Notes Receivable and Related Entries

Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the following notes:

Date

Face Amount

Interest Rate

Term

1.

Apr. 10

$69,000

4%

60 days

2.

June 24

13,200

6

30 days

3.

July 1

45,000

6

120 days

4.

Oct. 31

45,000

60 days

5.

Nov. 15

54,000

6.

60 days

6.

Dec. 27

180,000

4

30 days

Required:

Assume 360 days in a year.

1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number.

(a)

(b)

Note

Due Date

Interest Due at Maturity

(1)

June 10

460

(2)

June 24

66

(3)

July 1

900

(4)

Oct. 31

675

(5)

June 15

540

(6)

Jan, 27

600

2. Journalize the entry to record the dishonor of Note (3) on its due date. If an amount box does not require an entry, leave it blank or enter "O".

Jul. 1

- Accounts Receivable

45,650

Notes Receivable

45,000

Interest Revenue

650

3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31.

Dec. 31 Interest Receivable

414

Interest Revenue

920

4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January. If an amount box does not require an entry, leave it blank or enter "0".

Jan. 14 Cash

54,540

Notes Receivable

54,000

Interest Receivable

Interest Revenue

Jan. 26 Cash

180,600

Notes Receivable

180,000

Interest Receivable

Interest Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage