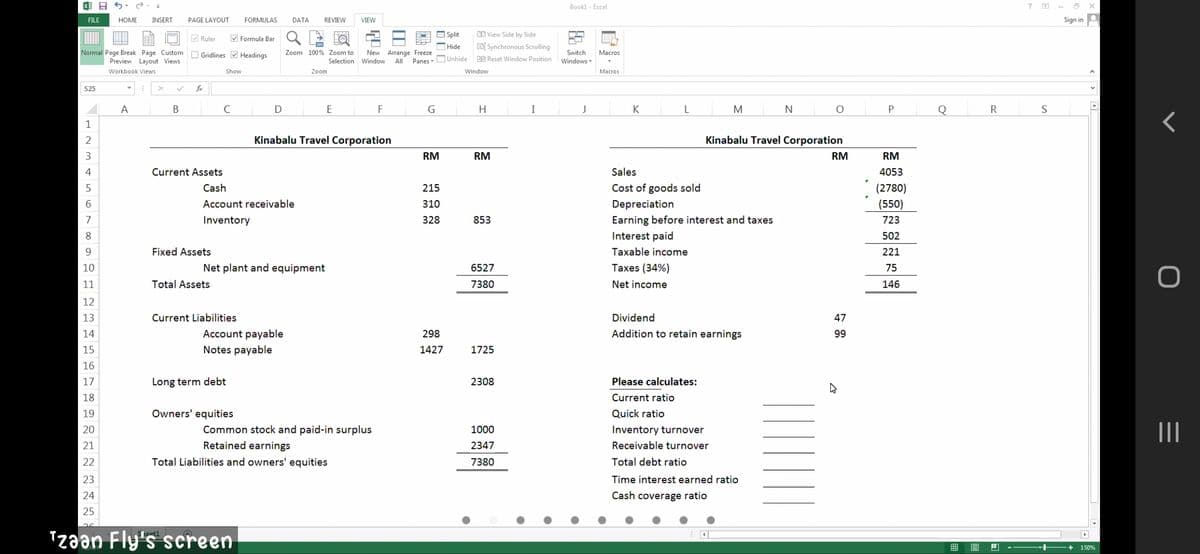

A B D K M P. Kinabalu Travel Corporation Kinabalu Travel Corporation RM RM RM RM Current Assets Sales 4053 Cash 215 Cost of goods sold (2780) Account receivable 310 Depreciation (550) Inventory 328 853 Earning before interest and taxes 723 Interest paid 502 Fixed Assets Taxable income 221 Net plant and equipment 6527 Taxes (34%) 75 Total Assets 7380 Net income 146 Current Liabilities Dividend 47 Account payable Notes payable 298 Addition to retain earnings 99 1427 1725 Long term debt 2308 Please calculates: Current ratio Owners' equities Quick ratio Common stock and paid-in surplus 1000 Inventory turnover Retained earnings Total Liabilities and owners' equities 2347 Receivable turnover 7380 Total debt ratio Time interest earned ratio Cash coverage ratio

A B D K M P. Kinabalu Travel Corporation Kinabalu Travel Corporation RM RM RM RM Current Assets Sales 4053 Cash 215 Cost of goods sold (2780) Account receivable 310 Depreciation (550) Inventory 328 853 Earning before interest and taxes 723 Interest paid 502 Fixed Assets Taxable income 221 Net plant and equipment 6527 Taxes (34%) 75 Total Assets 7380 Net income 146 Current Liabilities Dividend 47 Account payable Notes payable 298 Addition to retain earnings 99 1427 1725 Long term debt 2308 Please calculates: Current ratio Owners' equities Quick ratio Common stock and paid-in surplus 1000 Inventory turnover Retained earnings Total Liabilities and owners' equities 2347 Receivable turnover 7380 Total debt ratio Time interest earned ratio Cash coverage ratio

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 2.7C

Related questions

Question

Answer only for question

Receivable turnover, total debt ratio, time interest earned ratio and cash coverage ratio

Transcribed Image Text:Bookl - Excel

?

FILE

HOME

INSERT

PAGE LAYOUT

FORMULAS

DATA

REVIEW

VIEW

Sign in

V Ruler

M Formula Bar

- Split

O View Side by Side

FO

Hide

EBİ Synchronous Scrolling

Normal Page Break Page Custom O Gridlines V Headings

Zoom 100% Zoom to

New Arrange Freeze

Switch

Macros

BB Reset Window Position

Preview Layout Views

Panes - OUnhide

Selection Window

All

Windows -

Workbook Views

Show

Zoom

Window

Маcros

S25

fx

A

C

E

H.

I

J

K

N

Q

R

1

2

Kinabalu Travel Corporation

Kinabalu Travel Corporation

3

RM

RM

RM

RM

Current Assets

Sales

4053

Cash

215

Cost of goods sold

(2780)

6.

Account receivable

310

Depreciation

(550)

Earning before interest and taxes

Interest paid

7

Inventory

328

853

723

8.

502

Fixed Assets

Taxable income

221

10

Net plant and equipment

6527

Taxes (34%)

75

11

Total Assets

7380

Net income

146

12

13

Current Liabilities

Dividend

47

14

Account payable

298

Addition to retain earnings

99

15

Notes payable

1427

1725

16

17

Long term debt

2308

Please calculates:

18

Current ratio

19

Owners' equities

Quick ratio

Common stock and paid-in surplus

II

20

1000

Inventory turnover

21

Retained earnings

2347

Receivable turnover

22

Total Liabilities and owners' equities

7380

Total debt ratio

23

Time interest earned ratio

24

Cash coverage ratio

25

Tzaan Fly's screen

150%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you