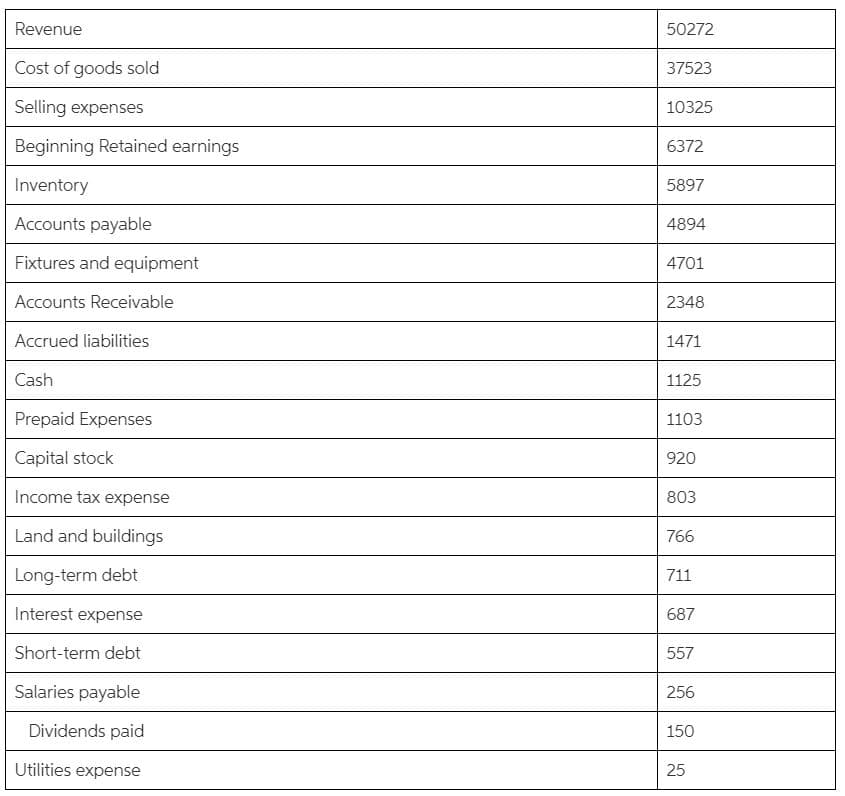

Revenue 50272 Cost of goods sold 37523 Selling expenses 10325 Beginning Retained earnings 6372 Inventory 5897 Accounts payable 4894 Fixtures and equipment 4701 Accounts Receivable 2348 Accrued liabilities 1471 Cash 1125 Prepaid Expenses 1103 Capital stock 920 Income tax expense 803 Land and buildings 766 Long-term debt 711 Interest expense 687 Short-term debt 557 Salaries payable 256 Dividends paid 150 Utilities expense 25

Revenue 50272 Cost of goods sold 37523 Selling expenses 10325 Beginning Retained earnings 6372 Inventory 5897 Accounts payable 4894 Fixtures and equipment 4701 Accounts Receivable 2348 Accrued liabilities 1471 Cash 1125 Prepaid Expenses 1103 Capital stock 920 Income tax expense 803 Land and buildings 766 Long-term debt 711 Interest expense 687 Short-term debt 557 Salaries payable 256 Dividends paid 150 Utilities expense 25

Chapter2: Introduction To Financial Statements

Section: Chapter Questions

Problem 1PB: The following information is taken from the records of Rosebloom Flowers for the year 2019. A....

Related questions

Question

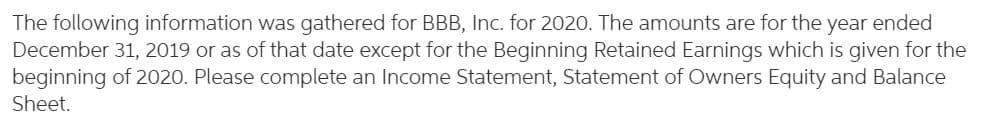

Transcribed Image Text:The following information was gathered for BBB, Inc. for 2020. The amounts are for the year ended

December 31, 2019 or as of that date except for the Beginning Retained Earnings which is given for the

beginning of 2020. Please complete an Income Statement, Statement of Owners Equity and Balance

Sheet.

Transcribed Image Text:Revenue

50272

Cost of goods sold

37523

Selling expenses

10325

Beginning Retained earnings

6372

Inventory

5897

Accounts payable

4894

Fixtures and equipment

4701

Accounts Receivable

2348

Accrued liabilities

1471

Cash

1125

Prepaid Expenses

1103

Capital stock

920

Income tax expense

803

Land and buildings

766

Long-term debt

711

Interest expense

687

Short-term debt

557

Salaries payable

256

Dividends paid

150

Utilities expense

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning