A bridge is to be constructed now as part of a new road. Engineers have determined that current traffic volume on the new road will justify a two-lane road and a bridge at the present time. Because of the uncertainty regarding future traffic, the time at which the additional two lanes will be required currently being studied. Two alternatives are being considered. Alternative 1 - One-stage construction: Build a four lane bridge right now for $454,000. Alternative 2 - Two-stage construction: Start with a two-lane bridge now for $200,000 and widen to four lanes later when traffic justifies. The future cost of widening the bridge to four-lanes at that time will be $200,000 plus an extra $28,000 for every year that widening is delayed. For example, if future widening is done at the end of year 5, the cost of widening at that time will be equal to $200,000 + 5x(S28,000) = $340,000. The following estimates have been made of when widening to a four-lane bridge will be required: Pessimistic estimate Most likely estimate Optimistic estimate End of year 2 End of year 5 End of year 6 In view of these estimates, which alternative would you recommend? The MARR used by the highway department is 6% per year (a) Calculate the PW of costs for the different scenarios of Alternative 2 PWpessimistic (6%) $ thousand (Round to one decimal place.) PWmost likely (6%) = S thousand (Round to one decimal place.) PWoptimistic (6%) = $ thousand (Round one decimal place.)

A bridge is to be constructed now as part of a new road. Engineers have determined that current traffic volume on the new road will justify a two-lane road and a bridge at the present time. Because of the uncertainty regarding future traffic, the time at which the additional two lanes will be required currently being studied. Two alternatives are being considered. Alternative 1 - One-stage construction: Build a four lane bridge right now for $454,000. Alternative 2 - Two-stage construction: Start with a two-lane bridge now for $200,000 and widen to four lanes later when traffic justifies. The future cost of widening the bridge to four-lanes at that time will be $200,000 plus an extra $28,000 for every year that widening is delayed. For example, if future widening is done at the end of year 5, the cost of widening at that time will be equal to $200,000 + 5x(S28,000) = $340,000. The following estimates have been made of when widening to a four-lane bridge will be required: Pessimistic estimate Most likely estimate Optimistic estimate End of year 2 End of year 5 End of year 6 In view of these estimates, which alternative would you recommend? The MARR used by the highway department is 6% per year (a) Calculate the PW of costs for the different scenarios of Alternative 2 PWpessimistic (6%) $ thousand (Round to one decimal place.) PWmost likely (6%) = S thousand (Round to one decimal place.) PWoptimistic (6%) = $ thousand (Round one decimal place.)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

6

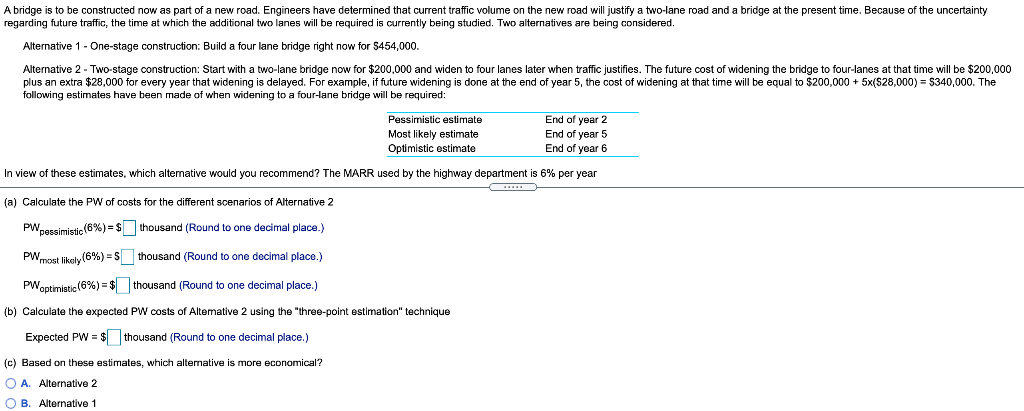

Transcribed Image Text:A bridge is to be constructed now as part of a new road. Engineers have determined that current traffic volume on the new road will justify a two-lane road and a bridge at the present time. Because of the uncertainty

regarding future traffic, the time at which the additional two lanes will be required is currently being studied. Two alternatives are being considered.

Alternative 1 - One-stage construction: Build a four lane bridge right now for $454,000.

Alternative 2 - Two-stage construction: Start with a two-lane bridge now for $200,000 and widen to four lanes later when traffic justifies. The future cost of widening the bridge to four-lanes at that time will be $200,000

plus an extra $28,000 for every year that widening is delayed. For example, if future widening

following estimates have been made of when widening to a four-lane bridge will be required:

sdone at the end of year 5, the cost of widening

that time will be equal to $200,000 + 5x($28,000) = $340,000. The

End of year 2

End of year 5

End of year 6

Pessimistic estimate

Most likely estimate

Optimistic estimate

In view of these estimates, which altemative would you recommend? The MARR used by the highway department is 6% per year

(a) Calculate the PW of costs for the different scenarios of Alternative 2

PWpessimistic (6%) = $ thousand (Round to one decimal place.)

PWmost likely (6%) = S thousand (Round to one decimal place.)

iatie(6%) = $ thousand (Round to one decimal place.)

PWoptimistic

(b) Calculate the expected PW costs of Altemative 2 using the "three-point estimation" technique

Expected PW = $ thousand (Round to one decimal place.)

(c) Based on these estimates, which alternative is more economical?

O A. Alternative 2

O B. Alternative 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning