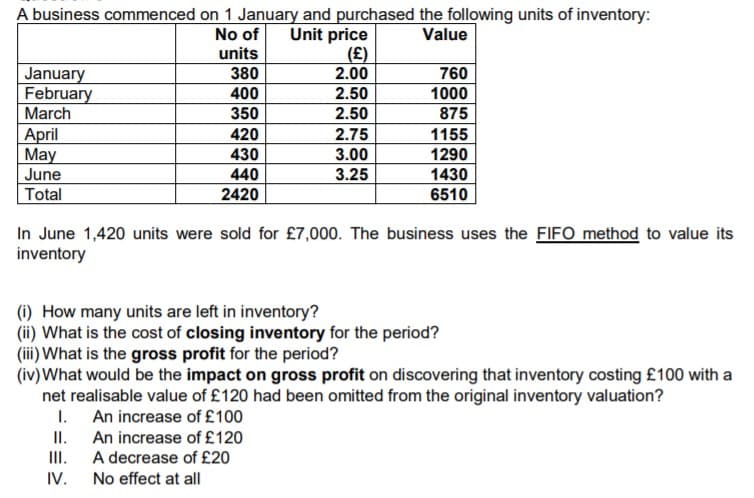

A business commenced on 1 January and purchased the following units of inventory: Unit price (£) 2.00 Value No of units 380 January February March 760 1000 400 2.50 2.50 350 875 April May June 420 2.75 3.00 1155 430 1290 440 3.25 1430 6510 Total 2420 In June 1,420 units were sold for £7,000. The business uses the FIFO method to value its inventory (i) How many units are left in inventory? (ii) What is the cost of closing inventory for the period? (iii) What is the gross profit for the period?

A business commenced on 1 January and purchased the following units of inventory: Unit price (£) 2.00 Value No of units 380 January February March 760 1000 400 2.50 2.50 350 875 April May June 420 2.75 3.00 1155 430 1290 440 3.25 1430 6510 Total 2420 In June 1,420 units were sold for £7,000. The business uses the FIFO method to value its inventory (i) How many units are left in inventory? (ii) What is the cost of closing inventory for the period? (iii) What is the gross profit for the period?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 14RE: On January 1 of Year 1, Dorso Company adopted the dollar-value LIFO method of inventory costing....

Related questions

Question

(i) How many units are left in inventory?

(ii) What is the cost of closing inventory for the period?

(iii)What is the gross profit for the period?

(iv)What would be the impact on gross profit on discovering that inventory costing £100 with a

net realisable value of £120 had been omitted from the original

I. An increase of £100

II. An increase of £120

III. A decrease of £20

IV. No effect at all

Transcribed Image Text:A business commenced on 1 January and purchased the following units of inventory:

Unit price

(£)

2.00

No of

Value

units

760

January

February

March

380

400

2.50

1000

350

2.50

875

1155

April

May

June

420

2.75

430

3.00

1290

1430

440

3.25

Total

2420

6510

In June 1,420 units were sold for £7,000. The business uses the FIFO method to value its

inventory

(1) How many units are left in inventory?

(ii) What is the cost of closing inventory for the period?

(ii) What is the gross profit for the period?

(iv)What would be the impact on gross profit on discovering that inventory costing £100 with a

net realisable value of £120 had been omitted from the original inventory valuation?

1. An increase of £100

II.

III.

An increase of £120

A decrease of £20

IV.

No effect at all

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College