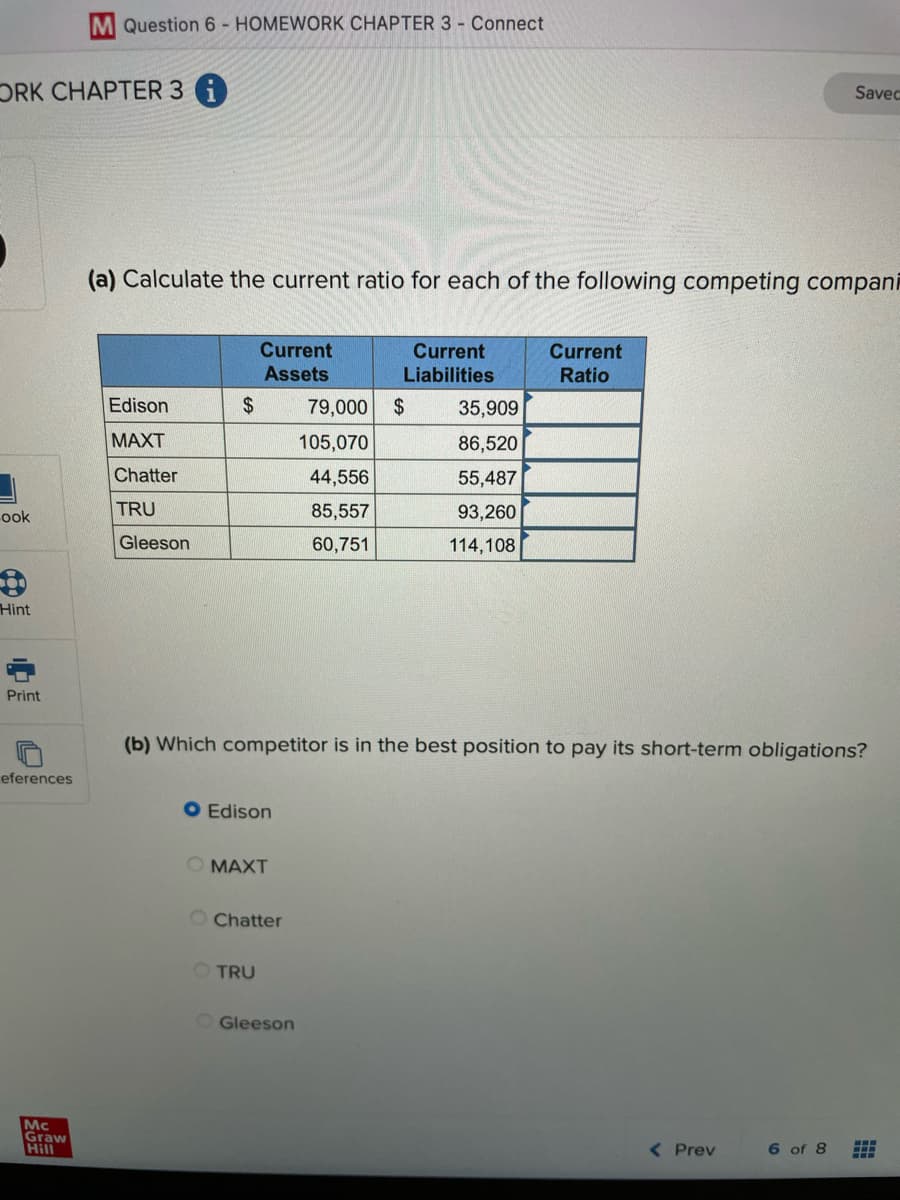

(a) Calculate the current ratio for each of the following competing compan Current Current Liabilities Current Assets Ratio Edison 2$ 79,000 $ 35,909 МАXТ 105,070 86,520 Chatter 44,556 55,487 TRU 85,557 93,260 Gleeson 60,751 114,108 (b) Which competitor is in the best position to pay its short-term obligations? O Edison MAXT Chatter O TRU O Gleeson

(a) Calculate the current ratio for each of the following competing compan Current Current Liabilities Current Assets Ratio Edison 2$ 79,000 $ 35,909 МАXТ 105,070 86,520 Chatter 44,556 55,487 TRU 85,557 93,260 Gleeson 60,751 114,108 (b) Which competitor is in the best position to pay its short-term obligations? O Edison MAXT Chatter O TRU O Gleeson

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 3.3C

Related questions

Question

Practice Pack

Please answer the whole thing

Transcribed Image Text:M Question 6 - HOMEWORK CHAPTER 3 - Connect

DRK CHAPTER 3 i

Savec

(a) Calculate the current ratio for each of the following competing compani

Current

Current

Current

Ratio

Assets

Liabilities

Edison

$

79,000

35,909

MAXT

105,070

86,520

Chatter

44,556

55,487

ook

TRU

85,557

93,260

Gleeson

60,751

114,108

Hint

Print

(b) Which competitor is in the best position to pay its short-term obligations?

eferences

O Edison

O MAXT

O Chatter

O TRU

O Gleeson

Mc

Graw

Hill

( Prev

6 of 8

中

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning