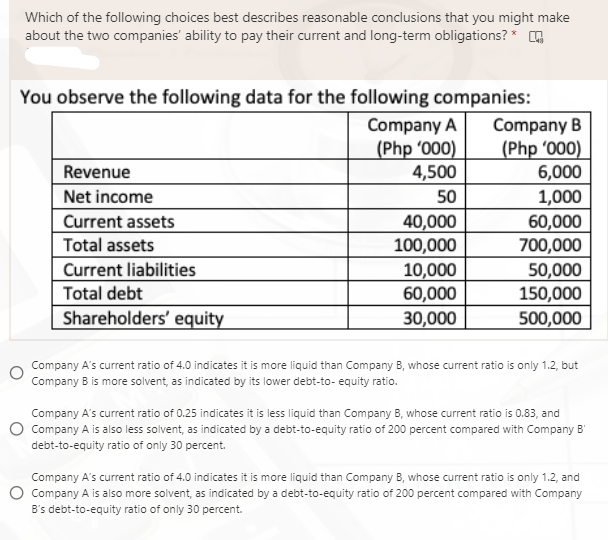

Which of the following choices best describes reasonable conclusions that you might make about the two companies' ability to pay their current and long-term obligations? * Q You observe the following data for the following companies: Company A (Php '000) 4,500 Company B (Php '000) 6,000 1,000 Revenue Net income 50 40,000 100,000 60,000 700,000 Current assets Total assets Current liabilities 10,000 60,000 50,000 150,000 Total debt Shareholders' equity 30,000 500,000 Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, but Company B is more solvent, as indicated by its lower debt-to- equity ratio. Company A's current ratio of 0.25 indicates it is less liquid than Company B, whose current ratio is 0.83, and O Company A is also less solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B' debt-to-equity ratio of only 30 percent. Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, and O Company A is also more solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B's debt-to-equity ratio of only 30 percent.

Which of the following choices best describes reasonable conclusions that you might make about the two companies' ability to pay their current and long-term obligations? * Q You observe the following data for the following companies: Company A (Php '000) 4,500 Company B (Php '000) 6,000 1,000 Revenue Net income 50 40,000 100,000 60,000 700,000 Current assets Total assets Current liabilities 10,000 60,000 50,000 150,000 Total debt Shareholders' equity 30,000 500,000 Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, but Company B is more solvent, as indicated by its lower debt-to- equity ratio. Company A's current ratio of 0.25 indicates it is less liquid than Company B, whose current ratio is 0.83, and O Company A is also less solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B' debt-to-equity ratio of only 30 percent. Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, and O Company A is also more solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B's debt-to-equity ratio of only 30 percent.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4TP: You are considering two possible companies for investment purposes. The following data is available...

Related questions

Question

23

Transcribed Image Text:Which of the following choices best describes reasonable conclusions that you might make

about the two companies' ability to pay their current and long-term obligations?*

You observe the following data for the following companies:

Company A

|(Php '000)

4,500

Company B

(Php '000)

6,000

1,000

Revenue

Net income

50

Current assets

40,000

100,000

60,000

700,000

Total assets

Current liabilities

10,000

60,000

50,000

150,000

Total debt

Shareholders' equity

30,000

500,000

Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, but

Company B is more solvent, as indicated by its lower debt-to- equity ratio.

Company A's current ratio of 0.25 indicates it is less liquid than Company B, whose current ratio is 0.83, and

Company A is also less solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B'

debt-to-equity ratio of only 30 percent.

Company A's current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, and

Company A is also more solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company

B's debt-to-equity ratio of only 30 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning