a) Calculate the product cost using a Traditional and ABC approach. b) Discuss and analyse alternative methods available to businesses of allocating costs.

a) Calculate the product cost using a Traditional and ABC approach. b) Discuss and analyse alternative methods available to businesses of allocating costs.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter26: Cost Allocation And Activity-Based Costing

Section: Chapter Questions

Problem 26.8EX: Identifying activity bases in an activity-based cost system Select Foods Inc. uses activity-based...

Related questions

Question

Can you please help me with question B

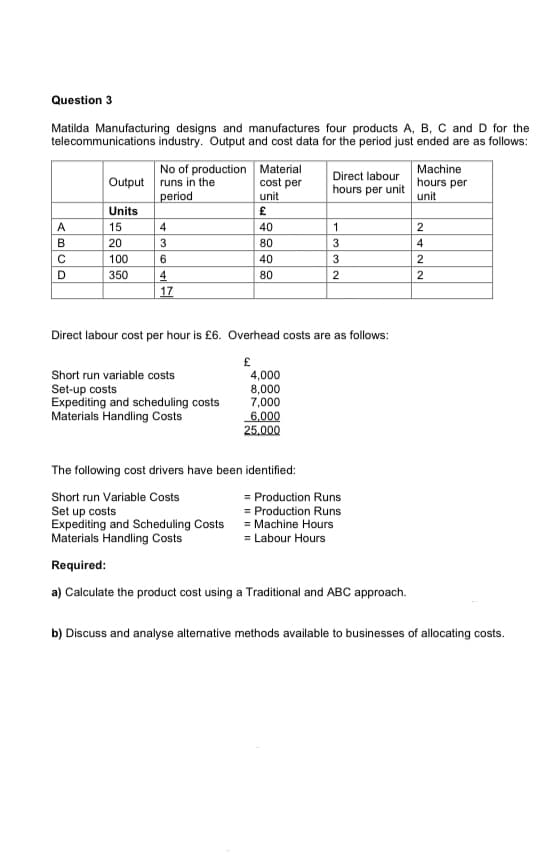

Transcribed Image Text:Question 3

Matilda Manufacturing designs and manufactures four products A, B, C and D for the

telecommunications industry. Output and cost data for the period just ended are as follows:

ABCD

No of production Material

Output runs in the

cost per

unit

period

£

40

80

40

80

Units

15

20

100

350

4

3

6

4

17

Short run variable costs

Set-up costs

Expediting and scheduling costs

Materials Handling Costs

Direct labour

hours per unit

4,000

8,000

7,000

6,000

25,000

1

Direct labour cost per hour is £6. Overhead costs are as follows:

£

Nww.

2

The following cost drivers have been identified:

Short run Variable Costs

Set up costs

Expediting and Scheduling Costs

Materials Handling Costs

Required:

a) Calculate the product cost using a Traditional and ABC approach.

= Production Runs

= Production Runs

= Machine Hours

= Labour Hours

Machine

hours per

unit

~4~~

2

2

2

b) Discuss and analyse alternative methods available to businesses of allocating costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning