a) Calculate the return on assets. (Enter your answer as a percent rounded to 2 decimal places.) b) Calculate the operating profit margin. (Enter your answer as a percent rounded to 2 decimal places.) c) Calculate the sales-to-assets ratio. (Round your answer to 2 decimal places.)

a) Calculate the return on assets. (Enter your answer as a percent rounded to 2 decimal places.) b) Calculate the operating profit margin. (Enter your answer as a percent rounded to 2 decimal places.) c) Calculate the sales-to-assets ratio. (Round your answer to 2 decimal places.)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.3MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

Q A B and C please

Transcribed Image Text:Exercise n°3.

Gil Corporation has current assets of $90,000 and current liabilities of

$180,000.

Required:

The following table gives abbreviated balance sheets and income

statements for Walmart.

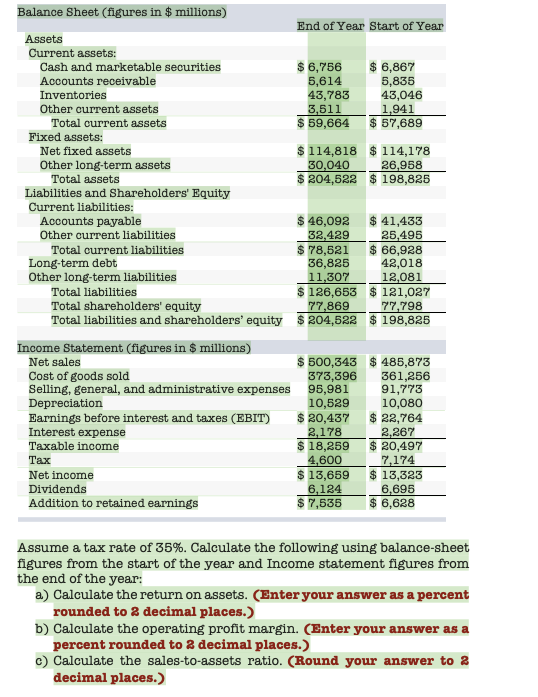

Transcribed Image Text:Balance Sheet (figures in $ millions)

End of Year Start of Year

Assets

Current assets:

$ 6,756

5,614

43,783

3,511

$ 59,664

$ 6,867

5,835

43,046

1,941

$ 57,689

Cash and marketable securities

Accounts receivable

Inventories

Other current assets

Total current assets

Fixed assets:

$ 114,818 $ 114,178

30,040

$ 204,522 $ 198,825

Net fixed assets

Other long-term assets

26,958

Total assets

Liabilities and Shareholders' Equity

Current liabilities:

$ 41,433

25,495

$ 66,928

42,018

12,081

$ 126,653 $ 121,027

77,798

Total liabilities and shareholders' equity $ 204,522 $ 198,825

$ 46,092

32,429

$ 78,521

36,825

11,307

Accounts payable

Other current liabilities

Total current liabilities

Long-term debt

Other long-term liabilities

Total liabilities

Total shareholders' equity

77,869

Income Statement (figures in $ millions)

$ 500,343 $ 485,873

373,396

95,981

10,529

$ 20,437

2,178

$ 18,259

4,600

$ 13,659

6,124

$ 7,535

Net sales

361,256

91,773

10,080

$ 22,764

2,267

$ 20,497

7,174

$ 13,323

6,695

$ 6,628

Cost of goods sold

Selling, general, and administrative expenses

Depreciation

Earnings before interest and taxes (EBIT)

Interest expense

Taxable income

Тах

Net income

Dividends

Addition to retained earnings

Assume a tax rate of 35%. Calculate the following using balance-sheet

figures from the start of the year and Income statement figures from

the end of the year:

a) Calculate the return on assets. (Enter your answer as a percent

rounded to 2 decimal places.)

b) Calculate the operating profit margin. (Enter your answer as a

percent rounded to 2 decimal places.)

c) Calculate the sales-to-assets ratio. (Round your answer to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning