Required a) Using the above information, calculate the following ratios to one (1) decimal place: (i) (ii) (ii) Current ratio Acid test ratio Gross profit margin

Required a) Using the above information, calculate the following ratios to one (1) decimal place: (i) (ii) (ii) Current ratio Acid test ratio Gross profit margin

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 76E: Ratio Analysis The following information was taken from Nash Inc.s trial balances as of December 31,...

Related questions

Question

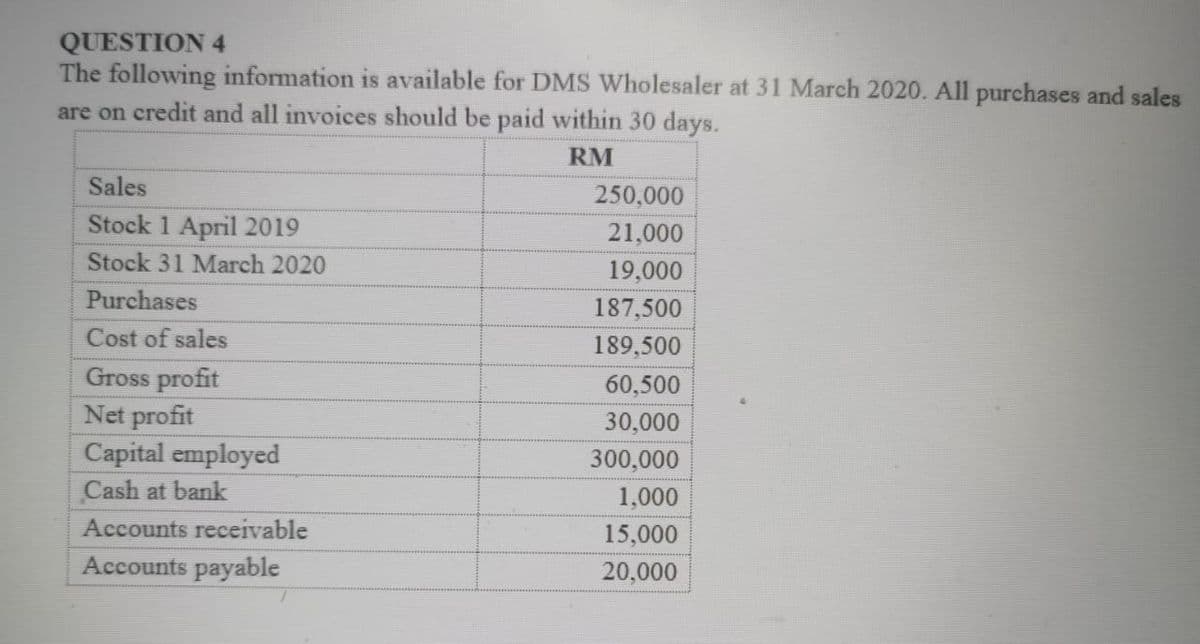

Transcribed Image Text:QUESTION 4

The following information is available for DMS Wholesaler at 31 March 2020. All purchases and sales

are on credit and all invoices should be paid within 30 days.

RM

Sales

250,000

Stock 1 April 2019

21,000

Stock 31 March 2020

19,000

Purchases

187,500

Cost of sales

189,500

Gross profit

Net profit

Capital employed

60,500

30,000

300,000

Cash at bank

1,000

Accounts receivable

15,000

Accounts payable

20,000

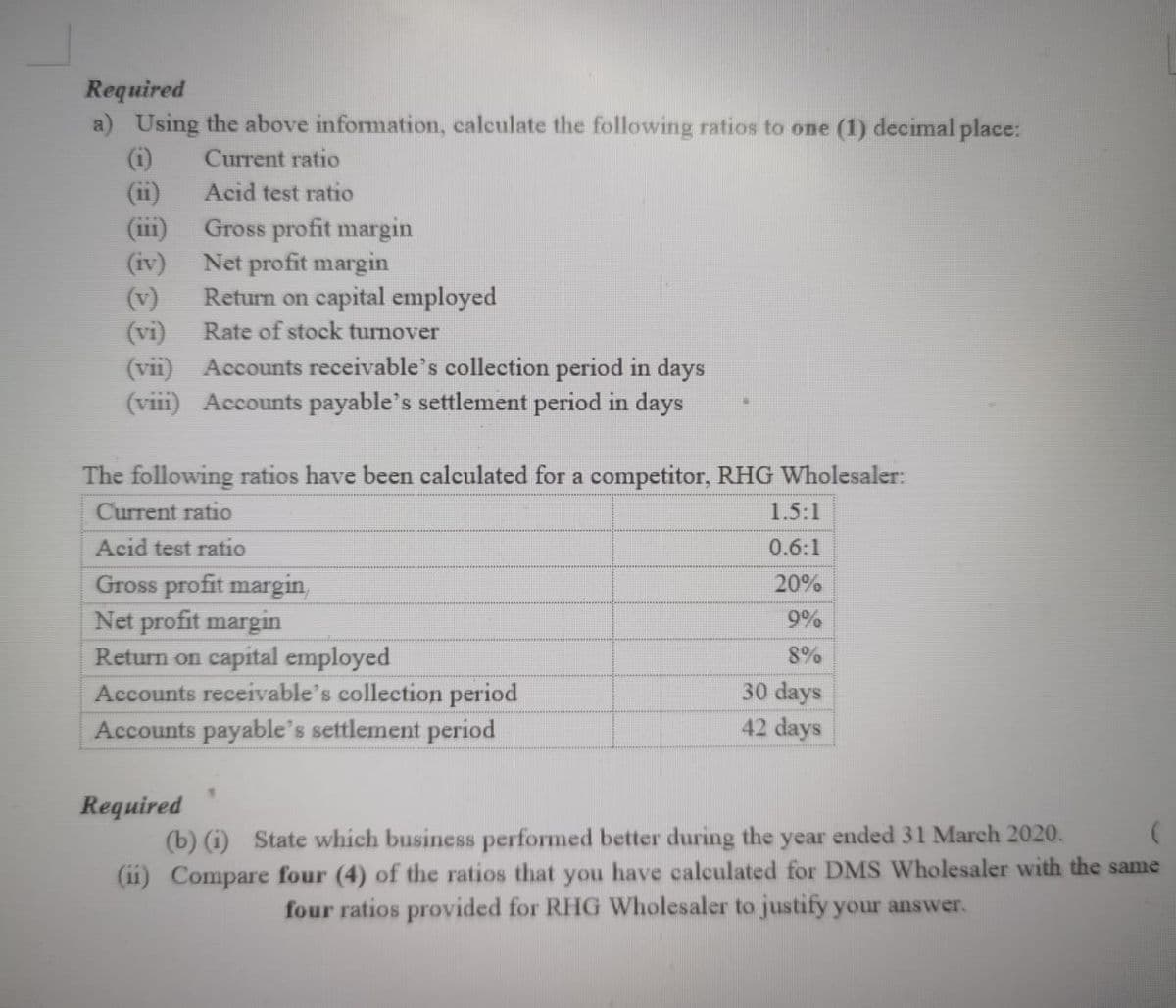

Transcribed Image Text:Required

a) Using the above information, calculate the following ratios to one (1) decimal place:

(i)

(ii)

(ii1)

(iv) Net profit margin

(v)

(vi)

(vii) Accounts receivable's collection period in days

(viii) Accounts payable's settlement period in days

Current ratio

Acid test ratio

Gross profit margin

Return on capital employed

Rate of stock turnover

The following ratios have been calculated for a competitor, RHG Wholesaler:

Current ratio

1.5:1

Acid test ratio

0.6:1

Gross profit margin,

Net profit margin

Return on capital employed

Accounts receivable's collection period

Accounts payable's settlement period

20%

9%

8%

30 days

42 days

Required

(b) (i) State which business performed better during the year ended 31 March 2020.

(1i) Compare four (4) of the ratios that you have calculated for DMS Wholesaler with the same

four ratios provided for RHG Wholesaler to justify your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning