a) Calculate total accumulative depreciation of each asset until the sold Hint: Review Class 15 material b) Calculate the Adjusted basis for each asset c) Calculate the Gain/Loss Recognized for each asset.

a) Calculate total accumulative depreciation of each asset until the sold Hint: Review Class 15 material b) Calculate the Adjusted basis for each asset c) Calculate the Gain/Loss Recognized for each asset.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.2.2MBA

Related questions

Question

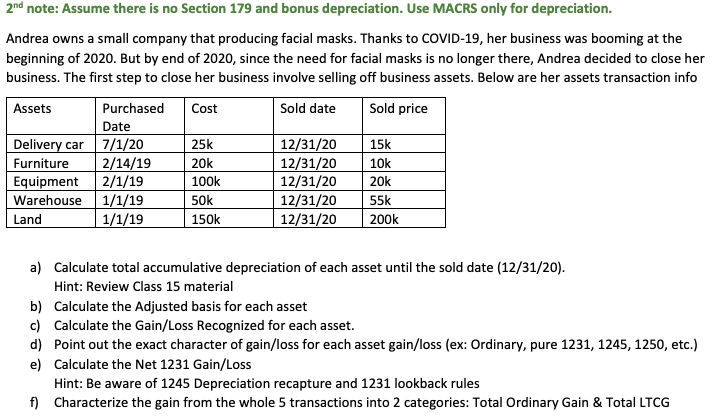

Transcribed Image Text:2nd note: Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation.

Andrea owns a small company that producing facial masks. Thanks to COVID-19, her business was booming at the

beginning of 2020. But by end of 2020, since the need for facial masks is no longer there, Andrea decided to close her

business. The first step to close her business involve selling off business assets. Below are her assets transaction info

Assets

Purchased

Cost

Sold date

Sold price

Date

Delivery car 7/1/20

2/14/19

12/31/20

12/31/20

12/31/20

25k

15k

Furniture

Equipment

20k

10k

2/1/19

Warehouse 1/1/19

1/1/19

100k

20k

12/31/20

12/31/20

50k

55k

Land

150k

200k

a) Calculate total accumulative depreciation of each asset until the sold date (12/31/20).

Hint: Review Class 15 material

b) Calculate the Adjusted basis for each asset

c) Calculate the Gain/Loss Recognized for each asset.

d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.)

e) Calculate the Net 1231 Gain/Loss

Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules

f) Characterize the gain from the whole 5 transactions into 2 categories: Total Ordinary Gain & Total LTCG

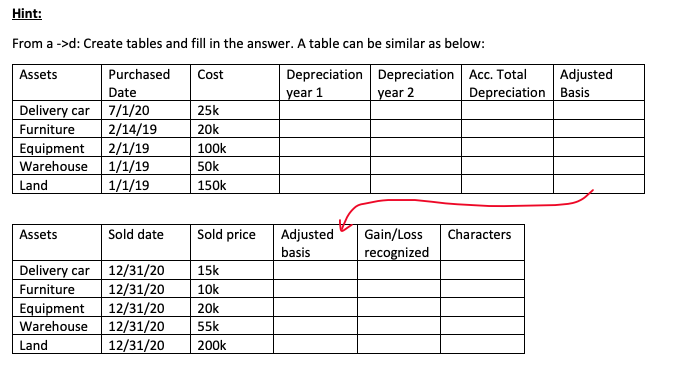

Transcribed Image Text:Hint:

From a ->d: Create tables and fill in the answer. A table can be similar as below:

Depreciation Depreciation Acc. Total

year 1

Adjusted

Depreciation Basis

Assets

Purchased

Cost

Date

year 2

Delivery car 7/1/20

2/14/19

2/1/19

1/1/19

1/1/19

25k

Furniture

Equipment

20k

100k

Warehouse

50k

Land

150k

Assets

Sold date

Sold price

Adjusted

Gain/Loss

Characters

basis

recognized

Delivery car 12/31/20

Furniture

Equipment

Warehouse

Land

15k

12/31/20

12/31/20

12/31/20

12/31/20

10k

20k

55k

200k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning