1. Following the depreciation example on page 7-5 of the VLN, determine Straight line depreciation expense year 2?____________ 2. Following the depreciation example on page 7-5 of the VLN, determine Straight line accumulated depreciation year 2?_____________

1. Following the depreciation example on page 7-5 of the VLN, determine Straight line depreciation expense year 2?____________ 2. Following the depreciation example on page 7-5 of the VLN, determine Straight line accumulated depreciation year 2?_____________

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 29BE

Related questions

Question

1. Following the depreciation example on page 7-5 of the VLN, determine Straight line depreciation expense year 2?____________

2. Following the depreciation example on page 7-5 of the VLN, determine Straight line accumulated depreciation year 2?_____________

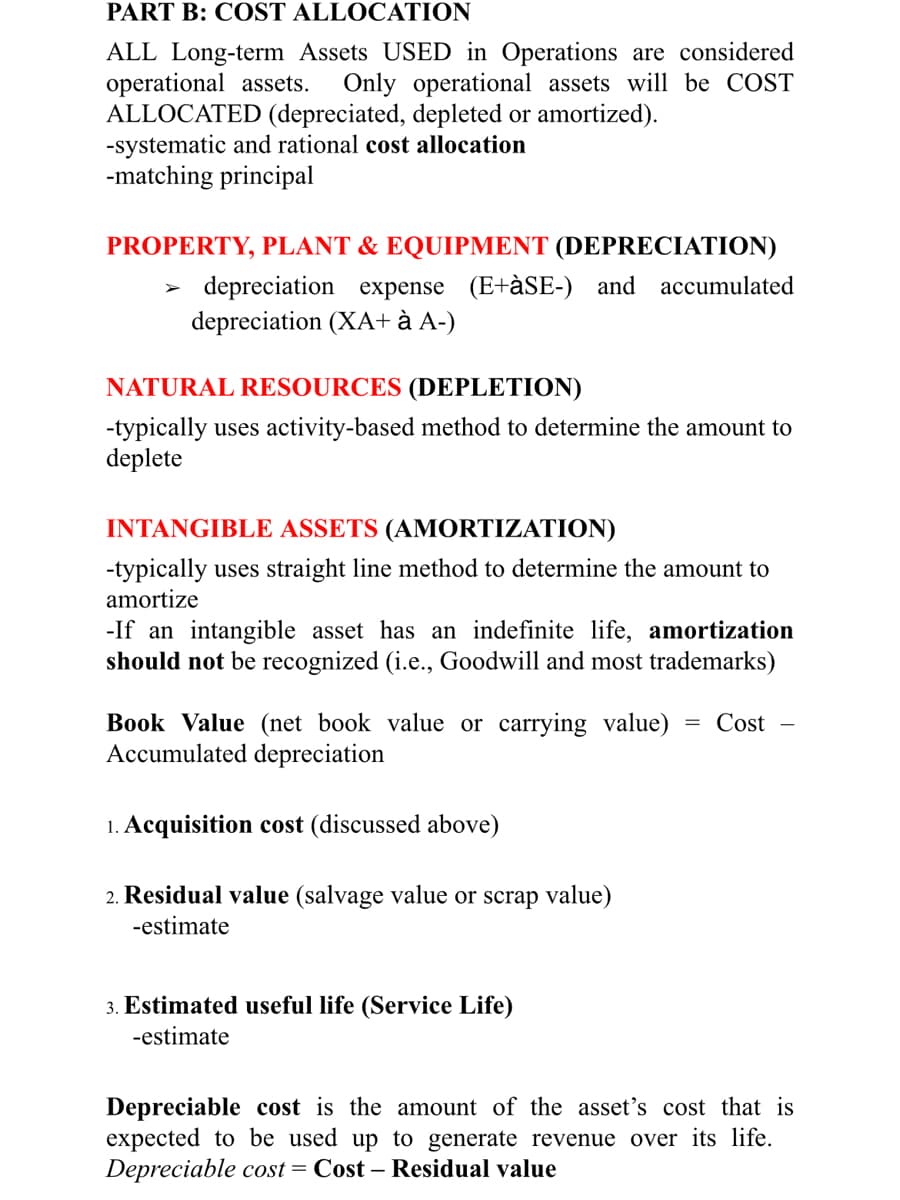

Transcribed Image Text:PART B: COST ALLOCATION

ALL Long-term Assets USED in Operations are considered

operational assets.

ALLOCATED (depreciated, depleted or amortized).

-systematic and rational cost allocation

-matching principal

Only operational assets will be COST

PROPERTY, PLANT & EQUIPMENT (DEPRECIATION)

depreciation expense (E+àSE-) and accumulated

depreciation (XA+ à A-)

NATURAL RESOURCES (DEPLETION)

-typically uses activity-based method to determine the amount to

deplete

INTANGIBLE ASSETS (AMORTIZATION)

-typically uses straight line method to determine the amount to

amortize

-If an intangible asset has an indefinite life, amortization

should not be recognized (i.e., Goodwill and most trademarks)

Book Value (net book value or carrying value)

Accumulated depreciation

= Cost

1. Acquisition cost (discussed above)

2. Residual value (salvage value or scrap value)

-estimate

3. Estimated useful life (Service Life)

-estimate

Depreciable cost is the amount of the asset's cost that is

expected to be used up to generate revenue over its life.

Depreciable cost = Cost – Residual value

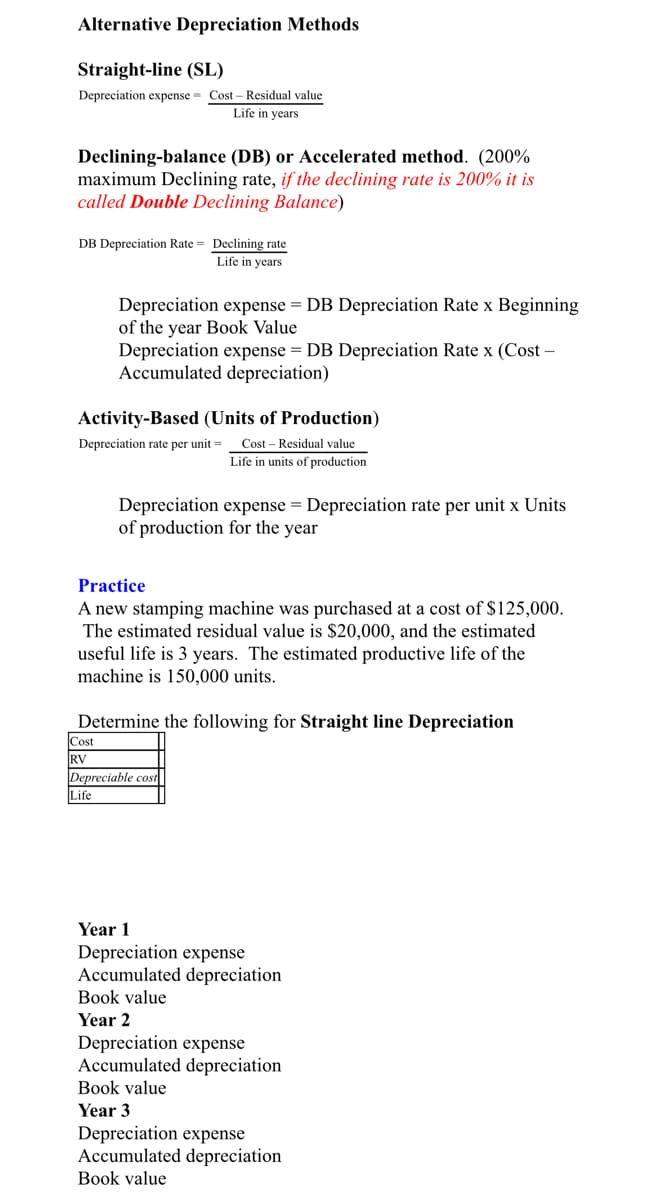

Transcribed Image Text:Alternative Depreciation Methods

Straight-line (SL)

Depreciation expense = Cost – Residual value

Life in years

Declining-balance (DB) or Accelerated method. (200%

maximum Declining rate, if the declining rate is 200% it is

called Double Declining Balance)

DB Depreciation Rate = Declining rate

Life in years

Depreciation expense = DB Depreciation Rate x Beginning

of the year Book Value

Depreciation expense

Accumulated depreciation)

DB Depreciation Rate x (Cost -

Activity-Based (Units of Production)

Cost - Residual value

Life in units

Depreciation rate per unit =

production

Depreciation expense = Depreciation rate per unit x Units

of production for the year

Practice

A new stamping machine was purchased at a cost of $125,000.

The estimated residual value is $20,000, and the estimated

useful life is 3 years. The estimated productive life of the

machine is 150,000 units.

Determine the following for Straight line Depreciation

Cost

RV

Depreciable cost

Life

Year 1

Depreciation expense

Accumulated depreciation

Book value

Year 2

Depreciation expense

Accumulated depreciation

Book value

Year 3

Depreciation expense

Accumulated depreciation

Book value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning