Company further seeks your assistance to select the appropriate method of depreciation either to go for reducing balance method or straight-line balance method. Which method you recommend the company and on what bases?

Company further seeks your assistance to select the appropriate method of depreciation either to go for reducing balance method or straight-line balance method. Which method you recommend the company and on what bases?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 7RE: Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of...

Related questions

Question

100%

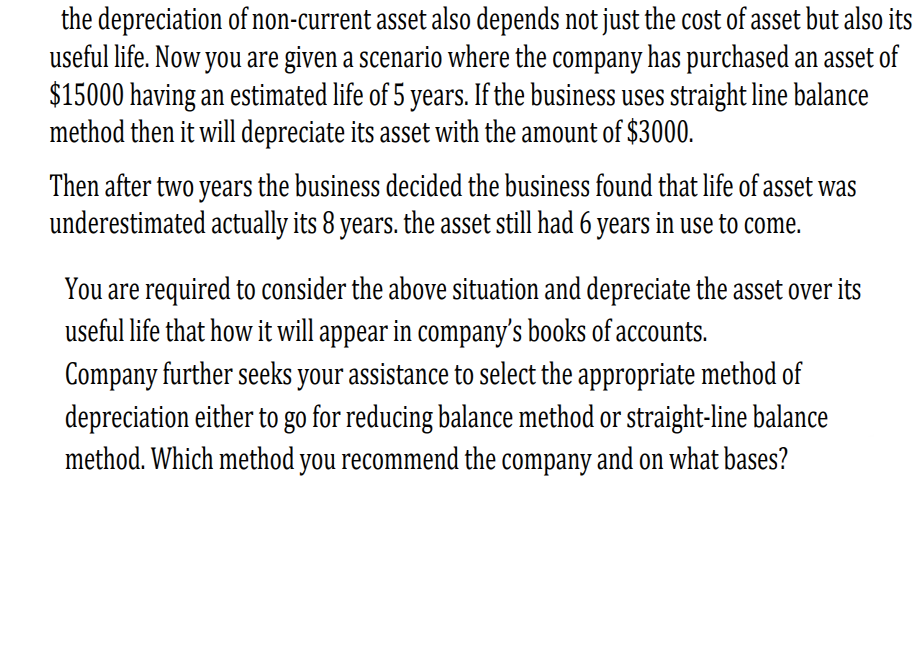

Transcribed Image Text:the depreciation of non-current asset also depends not just the cost of asset but also its

useful life. Now you are given a scenario where the company has purchased an asset of

$15000 having an estimated life of 5 years. If the business uses straight line balance

method then it will depreciate its asset with the amount of $3000.

Then after two years the business decided the business found that life of asset was

underestimated actually its 8 years. the asset still had 6 years in use to come.

You are required to consider the above situation and depreciate the asset over its

useful life that how it will appear in company's books of accounts.

Company further seeks your assistance to select the appropriate method of

depreciation either to go for reducing balance method or straight-line balance

method. Which method you recommend the company and on what bases?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage