A call option gives the option holder the right to sell an asset at a fixed price during a particular period. The fixed price that the asset may be sold at is called the exercise price. The following table shows the options quotation in U.S. dollars for Parrot Transport Corp. for June 30 of this year. Call - Last Quote Put - Last Quote Option Closing Price Strike Price September September 1 $48.50 $52.50 $5.00 $5.50 2 $48.50 $43.50 $7.50 $3.00 3 $48.50 $54.50 $4.00 $6.50 If you could exercise the options listed anytime on or before the expiration date (the third Friday of September), then these options would be European options. Assume that the options listed in the table are American options. Which of the put options for Parrot Transport Corp. listed in the table are in-the-money on June 30? O Option 1 and option 3 Only option 2 All of the options None of the options The Parrot Transport Corp. stock was selling at $50 per share on the first day of this month. • If you had a call option on the first of the month • If you had a put option on the first of the month with an exercise price of $45 and if the option with an exercise price of $45 and if the option

A call option gives the option holder the right to sell an asset at a fixed price during a particular period. The fixed price that the asset may be sold at is called the exercise price. The following table shows the options quotation in U.S. dollars for Parrot Transport Corp. for June 30 of this year. Call - Last Quote Put - Last Quote Option Closing Price Strike Price September September 1 $48.50 $52.50 $5.00 $5.50 2 $48.50 $43.50 $7.50 $3.00 3 $48.50 $54.50 $4.00 $6.50 If you could exercise the options listed anytime on or before the expiration date (the third Friday of September), then these options would be European options. Assume that the options listed in the table are American options. Which of the put options for Parrot Transport Corp. listed in the table are in-the-money on June 30? O Option 1 and option 3 Only option 2 All of the options None of the options The Parrot Transport Corp. stock was selling at $50 per share on the first day of this month. • If you had a call option on the first of the month • If you had a put option on the first of the month with an exercise price of $45 and if the option with an exercise price of $45 and if the option

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 1BIC

Related questions

Question

100%

Please answer all questions

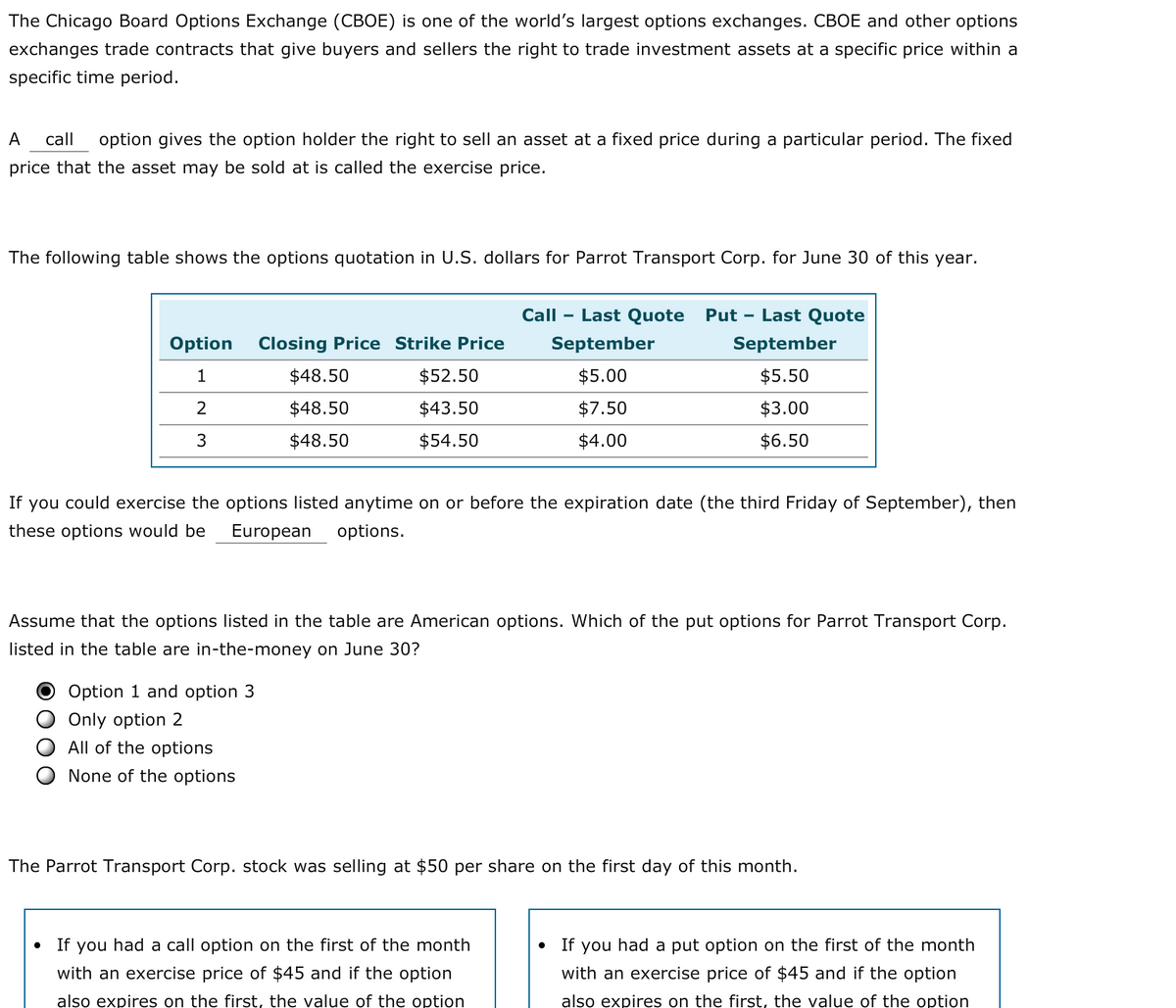

Transcribed Image Text:The Chicago Board Options Exchange (CBOE) is one of the world's largest options exchanges. CBOE and other options

exchanges trade contracts that give buyers and sellers the right to trade investment assets at a specific price within a

specific time period.

А

call

option gives the option holder the right to sell an asset at a fixed price during a particular period. The fixed

price that the asset may be sold at is called the exercise price.

The following table shows the options quotation in U.S. dollars for Parrot Transport Corp. for June 30 of this year.

Call

Last Quote

Put - Last Quote

Option

Closing Price Strike Price

September

September

1

$48.50

$52.50

$5.00

$5.50

$48.50

$43.50

$7.50

$3.00

3

$48.50

$54.50

$4.00

$6.50

If

you could exercise the options listed anytime on or before the expiration date (the third Friday of September), then

these options would be

European

options.

Assume that the options listed in the table are American options. Which of the put options for Parrot Transport Corp.

listed in the table are in-the-money on June 30?

Option 1 and option 3

Only option 2

All of the options

None of the options

The Parrot Transport Corp. stock was selling at $50 per share on the first day of this month.

If you had a call option on the first of the month

If you had a put option on the first of the month

with an exercise price of $45 and if the option

with an exercise price of $45 and if the option

also expires on the first, the value of the option

also expires on the first, the value of the option

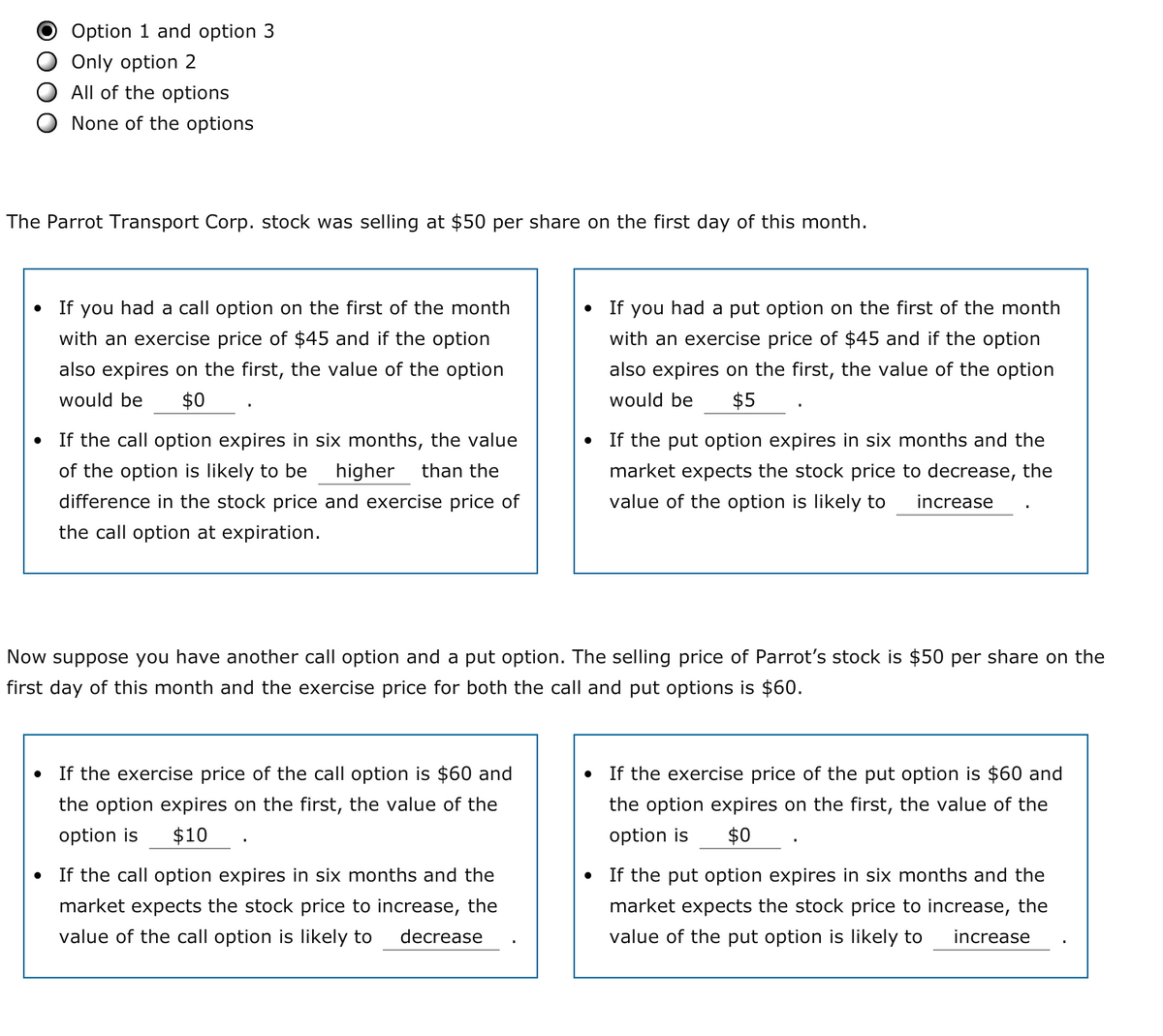

Transcribed Image Text:Option 1 and option 3

Only option 2

All of the options

None of the options

The Parrot Transport Corp. stock was selling at $50 per share on the first day of this month.

If

you had a call option on the first of the month

If you had a put option on the first of the month

with an exercise price of $45 and if the option

with an exercise price of $45 and if the option

also expires on the first, the value of the option

also expires on the first, the value of the option

would be

$0

would be

$5

• If the call option expires in six months, the value

If the put option expires in six months and the

of the option is likely to be

higher

than the

market expects the stock price to decrease, the

difference in the stock price and exercise price of

value of the option is likely to

increase

the call option at expiration.

Now suppose you have another call option and a put option. The selling price of Parrot's stock is $50 per share on the

first day of this month and the exercise price for both the call and put options is $60.

If the exercise price of the call option is $60 and

If the exercise price of the put option is $60 and

the option expires on the first, the value of the

the option expires on the first, the value of the

option is

$10

option is

$0

• If the call option expires in six months and the

• If the put option expires in six months and the

market expects the stock price to increase, the

market expects the stock price to increase, the

value of the call option is likely to

decrease

value of the put option is likely to

increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you