Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=185.

Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=185.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter5: Financial Options

Section: Chapter Questions

Problem 3MC: Consider Triple Play’s call option with a $25 strike price. The following table contains historical...

Related questions

Question

100%

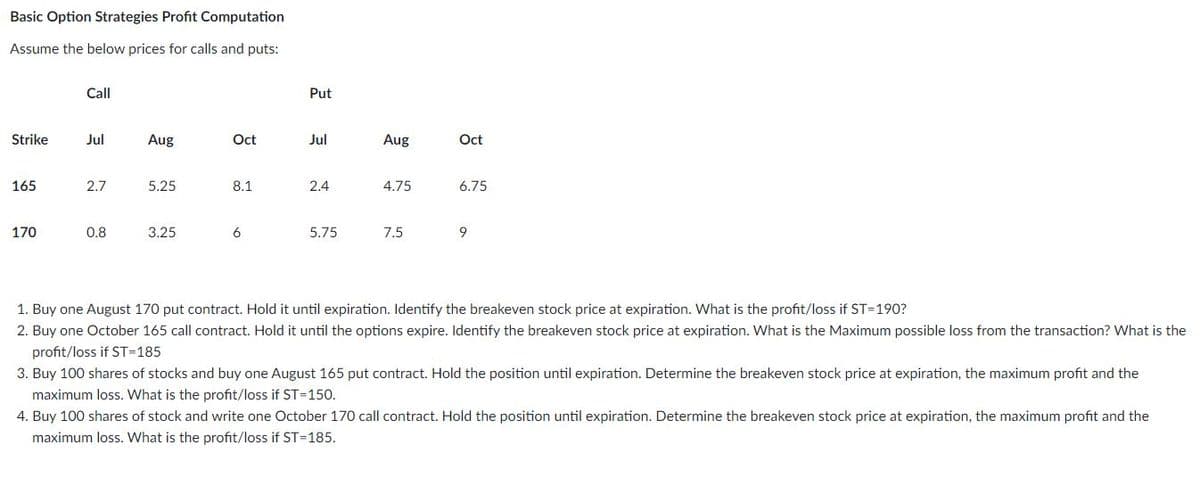

Basic Option Strategies Profit Computation

Assume the below prices for calls and puts:

|

|

Call |

Call |

Call | Put | Put | Put |

|

Strike |

Jul |

Aug |

Oct |

Jul |

Aug |

Oct |

|

165 |

2.7 |

5.25 |

8.1 |

2.4 |

4.75 |

6.75 |

|

170 |

0.8 |

3.25 |

6 |

5.75 |

7.5 |

9 |

- Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the

profit/loss if ST=190? - Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185

- Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150.

- Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=185.

Transcribed Image Text:Basic Option Strategies Profit Computation

Assume the below prices for calls and puts:

Call

Put

Strike

Jul

Aug

Oct

Jul

Aug

Oct

165

2.7

5.25

8.1

2.4

4.75

6.75

170

0.8

3.25

6

5.75

7.5

9

1. Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190?

2. Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the

profit/loss if ST=185

3. Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the

maximum loss. What is the profit/loss if ST=150.

4. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the

maximum loss. What is the profit/loss if ST=185.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning